Lisbon-headquartered law firm Miranda has recruited senior associate Maria Ataíde Cordeiro from PLMJ.

Freshfields Bruckhaus Deringer’s Madrid office has promoted Bosco Montejo to partner.

More than 300 members of the Spanish and Portuguese legal profession attended last night’s event in Madrid to mark the re-launch of Iberian Lawyer magazine.

PLMJ has appointed the former managing director of the Portuguese Automobile Club, João Mendes Dias, as its new chief operating officer.

Spanish law firm Amat & Vidal-Quadras (AVQ) – which is present in Barcelona and Madrid – has joined the Grimaldi Alliance, which has been launched by Italian law firm Grimaldi Studio Legale.

PLMJ and Uría Menénedez advised Vidatel in relation to the ICC International Court of Arbitration dispute involving PT Ventures and Unitel.

Cuatrecasas has elected Rafael Fontana as chairman and Jorge Badía as the firm’s new chief executive officer (CEO).

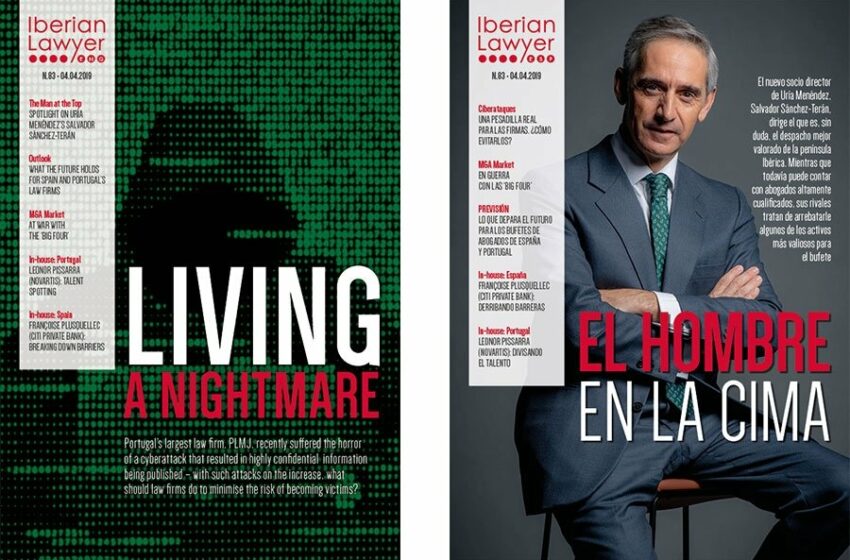

Iberian Lawyer magazine has been re-launched as a free digital monthly magazine, with the first issue published today (4 April).

Miguel Bajo Fernández, founding partner of the firm Bajo & Trallero Abogados, has died aged 74 after a long illness.

Uría Menéndez advised Bankia on the sale of 51 per cent of insurance companies Caja Granada Vida and Cajamurcia Vida y Pensiones to Mapfre for €110.3 million.