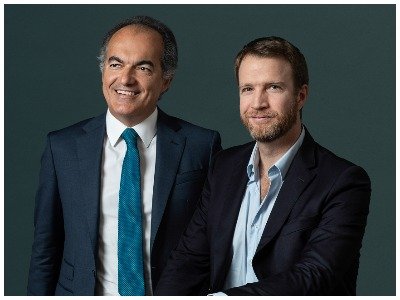

Portugal’s Rainmakers

PLMJ ended 2021 at the top of the M&A rankings, with an astounding 43 deals and a total value of €6 billion*. Despite Diogo Perestrelo’s and Duarte Schmidt Lino’s high visibility in the market and the focus of this interview, they were quick to point out they make up just one third of the firm’s six partner strong contingent. It is a team that was restructured two years ago, to include the Porto based fee earners, and focus on high value deals. As this article uncovers, it appears to be a strategy that is paying off.

2021 was a great year for PLMJ regarding M&A work, was it better than you were both expecting?

2021 was a great year for PLMJ regarding M&A work, was it better than you were both expecting?

Diogo Perestrelo:

I think we are always very positive and optimistic but we did not expect such a good year for 2021. It was a record for us in terms of deal values, and the volume of transactions. We were always betting, myself and Duarte, on what we thought would be the outcome of 2021, at the start of the year. But both of us were very happy with the outcome. We used to have four separate teams at PLMJ for Corporate/M&A work, but two years ago, we made some internal changes and consolidated everyone into one team. We are six partners in this team including our Porto office. This has been very positive in terms of our efficiency and sharing knowledge. So, I think we were prepared for the interesting and successful year we had last year, because of the strong group we put in place two years ago.

Duarte Schmidt Lino:

2021 was a great year and a record year but we have also been more diligent and transparent with reporting our transactional work in real-time to the market. So it may seem that there was a big jump in 2021 compared to the year before, but we can also attribute our increased reporting on deals as a determining factor. One of our bigger challenges has been to maximise the use of our team’s resources. This is with regards to the type of work and the choice of opportunities we are faced with. When the market is hot and you are faced with many avenues, there is a cost of opportunity to consider when deciding on which work to move forward with. What we have now, since the restructuring of the team, are six partners that all trust each other and that choose the work together. Decisions are made on what we think the team is best suited to. This is a big difference compared to how we used to previously operate. Also, by treating Porto and our team there, as part of one single unit, we can allocate work more efficiently. Typically Portuguese law firms see their Porto office as local in terms of geography and focus on the market in the north of the country. Our strategy doesn’t follow this route, as our Porto lawyers, just like our Lisbon team, are global and advise on deals outside of their local market.

DP:

The big changes we made at PLMJ in recent years have included moving from an ‘eat what you kill’ model of remuneration for the partners to ‘Lockstep’. This has contributed towards increasing the cake as a whole, as supposed to just increasing one’s (partners) slice of the cake. Our M&A team is a great example of this change in our culture, where we work towards the same goal.

What was the main reason behind restructuring the M&A team at PLMJ? Was it to focus more on high value work?

DP:

Yes, I think so. The legal sector cannot stay static, the world is constantly moving forward, and we have to adapt. Sometimes law firms and lawyers have many difficulties in making these adjustments. Some just assume that everything will stay with no change, but we need to change. This train of thought is consensual among our partnership now. Apart from a deep knowledge of the law, we have to have more than just this. We need to have all the skills required such as financial, capacity of negotiation, corporate finance and a second language: German, Italian and French as well as English, but more than that, the strength of communication is key. Sometimes lawyers don’t communicate well. Our transactions are complex and we need to be able to explain this in simple terms to our clients. The environment is so different now, and we need to share our knowledge with our clients in an easy way.

DSL:

When we merged the teams it was evident there were different cultures within the firm. This was something we addressed immediately. We made sure everyone was focused on this idea of simple communication. Our clients have very limited time and don’t want us to teach them what we know or don’t need to know, rather give them our view and conclusions as succinctly as possible. We are not compliance officers. Our job is not to create legally flawless transactions. We deliver the work at the level of risk that the client wants. We work a lot with Private Equity and Hedge Funds and those entities really don’t want us to waste their time. They hate solutions imposed on them because it is the normal way of doing things.

DP:

As you know, we like to use the expression the Portuguese magic triangle (PLMJ, VdA & Morais Leitão) and we all work a lot with big US and UK law firms. Most of our good referrals come from them. If we didn’t have this culture of how we manage M&A work, it would be very difficult to survive and have a different approach for each of the deals we advise on.

Which are the most satisfying deals to work on and why?

DSL:

The most interesting work I do, is when there is a component of restructuring, with hostile creditors and we need to work with the promoter to save the company and save jobs and turn something that is not working into a thriving project. Those are the types of transactions where you have to think strategically and tactically.

Where do you see the opportunities during the next 12 months?

DSL:

We are still living with the effects of the pandemic and now the war in Ukraine. Energy costs were already going up and the slope has become steeper. This will have a lot of consequences, there were deals that have been suspended but this also brings opportunities in hardship situations. We see some of our clients trying to understand what they can do. The energy sector will continue to move a lot and the deeper trend towards renewables. The war has accelerated this shift towards renewables. We will see di-vestments by traditional players in the Oi & Gas industry, which is already happening.

DP:

The health sector is continuing to grow and will be a big opportunity in 2022. Technology and digital has clients excited. Real Estate is still strong but not so much for Tourism. Infrastructure and Transport will continue to present opportunities. Sellers will want to deaccelerate their exits and buyers will be more cautious.

By Michael Heron

To read the full interview on issue number 113 click here.

*Data sourced from TTR