VdA advises Greenvolt on IPO

Vieira de Almeida & Associados has advised GreenVolt – Energias Renováveis on the successful IPO of its ordinary shares completed on Euronext Lisbon on July 14, 2021

VdA has advised GreenVolt on this transaction, enabling a successful IPO, while the firm at the same time also assisted this client in completing a relevant M&A transaction by successfully acquiring a biomass energy generation company in Tilbury, United Kingdom and assisting the company in seeking an ESG rating, awarded by Sustainalytics.

VdA has advised GreenVolt on this transaction, enabling a successful IPO, while the firm at the same time also assisted this client in completing a relevant M&A transaction by successfully acquiring a biomass energy generation company in Tilbury, United Kingdom and assisting the company in seeking an ESG rating, awarded by Sustainalytics.

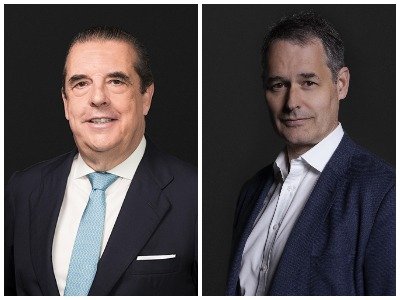

The VdA team was led by partners (pictured from top left to botom right) Hugo Moredo Santos and Pedro Cassiano Santos (Banking & Finance), Ana Luís de Sousa (Energy & Natural Resources), Vanda Cascão (Energy & Natural Resources), Paulo Trindade Costa (M&A) and Isabel Gião de Andrade (Corporate Governance).

The partners were supported by a team of lawyers from all these departments, comprising in total more than 30 other associates, including Sofia Bobone (Corporate Governance), Ricardo Seabra Moura (Tax), Inês Perez Sanchez, Soraia Ussene and José Miguel Carracho (Banking & Finance), Maria Gorjão Henriques (Energy & Natural Resources) and Pedro Sassetti Coimbra (M&A).

The Offering Price for the IPO was set at €4.25 per share, implying a pre-money market capitalisation of approximately €319 million, following a successful and comfortably over-subscribed book-building with high quality investors.

The Offering consisted entirely of a primary offering of new ordinary shares issued by the Company to qualified investors and certain institutional investors, corresponding to an approximately €130 million capital increase (30,588,235 Shares).

The Prospectus as approved by the Portuguese Securities Market Commission (Comissão do Mercado de Valores Mobiliários, the “CMVM”), and the supplement, are available On the CMVM’s website (www.cmvm.pt).

PLMJ advised the Joint Global Coordinators – the banks BNP Paribas and CaixaBank – on the context of the IPO launched by GreenVolt. To monitor this transaction, PLMJ created a multidisciplinary team coordinated by Raquel Azevedo, (partner in the Banking and Finance and Capital Markets area), and João Marques Mendes (co-coordinating partner in the Energy area). The team also included André Figueiredo, coordinating partner of the Banking and Finance and Capital Markets area, and the associates Rui Vasconcelos Pinto (Public Law), Alexandre Norinho de Oliveira (Capital Markets), Sara Asseiceiro (Capital Markets), Dinis Tracana (Tax) and Francisca Resende Gomes (Capital Markets).