United front

At a global and local level, Baker McKenzie is making significant changes to its structure and working environment in an effort to encourage more teamwork and cross-selling

At a global and local level, Baker McKenzie is making significant changes to its structure and working environment in an effort to encourage more teamwork and cross-selling

With the legal services sector experiencing severe downward pressure on fees, Baker McKenzie, like many law firms, knows it is in a battle. Consequently, the firm is readying itself for the fight by taking steps to unite its lawyers both at a global and local level. From an international perspective, earlier this year it emerged that its offices in Europe, the Middle East and Africa (EMEA) would be incorporated into a single profit pool, a move that is intended to bring a greater level of financial integration to the firm. This change of direction is a clear indication that Baker McKenzie has acknowledged that its current set-up, consisting of separate independent offices with segregated financial structures, is no longer working.

With regard to the issue of the firm’s EMEA offices being integrated into a single profit pool (a process that began on 1 July this year), Baker McKenzie’s Madrid managing partner Rodrigo Ogea says that, from the perspective of Baker McKenzie’s practice in Spain, this will mean that the firm’s Madrid and Barcelona practices will be “joining together”. Some would say that closer ties between the firm’s Madrid and Barcelona offices is much needed – there has been a perception in the market that the two offices have been separate firms that are sometimes competing with each other, with stories of Barcelona partners trying to win clients in Madrid and vice-versa. Meanwhile, sources close to the firm say that under the previous structure (which existed prior to the creation of the EMEA profit pool), though Baker McKenzie offered incentives encouraging its network of offices to refer work to each other, the system was “too complex”. It is understood that the way the firm remunerates its partners – that is a system that is 60 per cent lockstep and 40 per cent merit-based – will stay the same under the new structure.

Need for cross-selling

Meanwhile, Baker McKenzie’s office in Madrid is also making efforts to ensure its lawyers work more as a team. A key part of this strategy involved moving the firm to new offices in Madrid’s Calle de José Ortega y Gasset. While ostensibly the reason for the move was that the firm’s former office in Paseo de la Castellana was becoming overcrowded (for example, the firm’s IT team was located in a different building), the firm also saw an opportunity to design an office that helped to better integrate its lawyers in Madrid as well as potentially make them more productive.

Ogea says the office move was the most significant development for the firm’s Madrid practice in the last year. “We wanted to create one of the most modern legal environments,” says Ogea. Consequently, the newly designed office space does not include separate offices, but is instead ‘open plan’, while in addition, areas with informal seating have been incorporated with the aim of encouraging teams of lawyers to congregate together. “We previously had no rooms for teams of lawyers, they tended to sit in their places and did not encounter each other spontaneously, so it was difficult to create cross-selling – the idea was also to give younger lawyers different areas in which to work; ‘millennials’ are very hard-working, but they have zero tolerance for spending 12 hours in the same place,” says Ogea. He adds that Baker McKenzie’s new Madrid office – which is 6,200 square-metres in size (the previous offices were 5,000 square metres) – is now considered one of the firm’s most modern European offices. Teams from other Baker McKenzie offices have come to Madrid to use the new premises for meetings and recruitment events.

Better working environment

Ogea argues that the firm’s new Madrid office has been good for business. In addition to giving lawyers more opportunities to cross-sell, he claims productivity has increased by 10 per cent (measured by billable hours) as a result, while internal calls are down by 50 per cent (suggesting that lawyers are speaking to each other in person more), and paper consumption is down 40 per cent. The new working environment in Madrid will also boost the firm’s practice in the longer term in that it will help Baker McKenzie to recruit the best young lawyers, according to Ogea. “Attracting the best talent will help the firm to perform in the best way,” he says. “We operate in a very competitive market, every day people are trying get our clients, we can only protect ourselves through business innovation.”

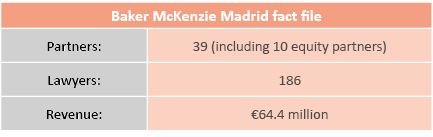

With regard to Baker McKenzie’s practice in Spain, revenues remained largely flat, increasing 0.6 per cent to €64.4 million in 2017 – the majority of major law firms in Spain reported more significant increases in revenue in the last year. However, Ogea says that the longer-term trend is one of more substantial growth, adding that the firm’s revenue grew 14 per cent in the last three years. He adds that an increasing amount of legal work is being generated by Spanish companies that are expanding their operations overseas. Ogea says Spanish companies – from small and medium-sized enterprises (SMEs) to Blue Chip companies – have, in recent years, targeted foreign markets and as a result, 40 per cent of the revenue of Baker McKenzie’s Spain offices is generated outside of the country.

Technology is a major potential growth area for law firms, according to Ogea. “There is a huge opportunity in digital transformation, there is a lot of attention on artificial intelligence, smart contracts and machine learning,” he explains. “We are advising many Spanish clients on their digital transformation strategies.”

Meanwhile, there are also opportunities for new types of legal work related to the real estate sector. “The real estate market is not only driven by price per square metre, but also consumer behaviour,” Ogea explains. He adds that the data that is available on footfall in shopping centres, for example, can influence the cost of commercial real estate.

Fierce competition

Ogea expects further consolidation in the legal market given the fierce competition, and the pressure on fees. “These are the ingredients for consolidation, Spain is a super competitive market, it’s very mature, you have all the international firms, strong Spanish firms and the ‘Big Four,’” he adds. Meanwhile, the last year has seen considerable political upheaval in Spain with the political crisis in Catalonia and a new Spanish government [Pedro Sánchez of the PSOE became Prime Minister of Spain earlier this year]. However, Ogea says the economic impact of the political uncertainty has been limited.

With regard to the outlook for the rest of 2018, Ogea expects law firms’ revenues to be boosted by opportunities in tax and employment. Meanwhile, Latin American businesses are increasingly investing in Spain. “Family-owned multinationals from Latin American are diversifying – there is a lot of cross-border investment in Spain in the real estate, finance and construction sectors.”

The future is looking bright for law firms in Spain that are able to help clients tackle issues such as digitalisation as well as expand their operations in foreign jurisdictions. Baker McKenzie’s lawyers in Madrid will be hoping that the creation of a single profit pool for EMEA – as well as the move to an office that aims to encourage lawyers to increasingly work together and cross-sell their services – will unite what has often been perceived, at a global level, as a fragmented firm, and better prepare them for the fight they face in what is an extremely competitive market.