Deal flow in Spain decreases by 26 per cent in 2020

According to TTR, in the first nine months of 2020, 1,387 transactions amounting to €66 billion were recorded in the Spanish transactional market

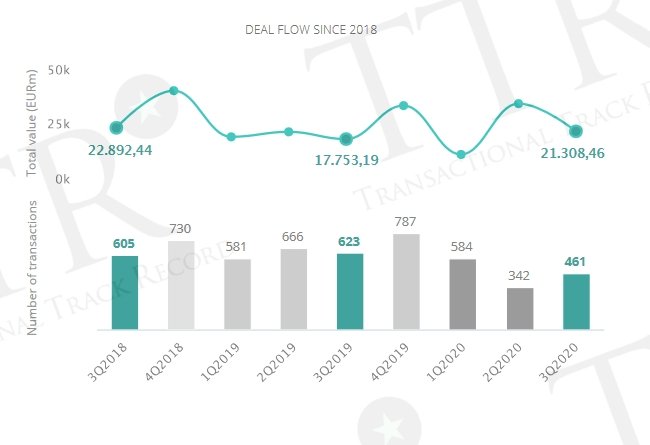

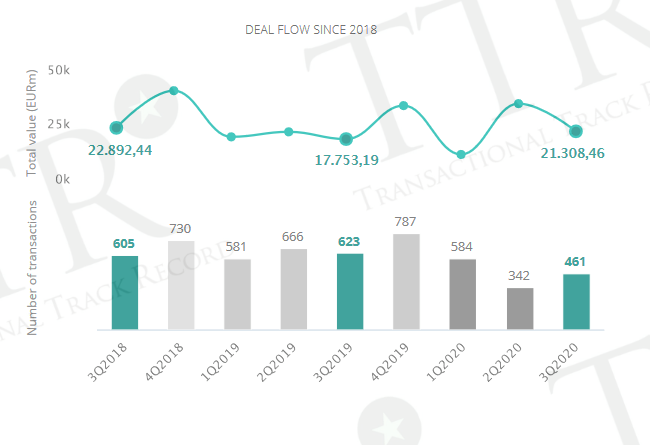

The Spanish transaction market has recorded a total of 1,387 transactions, including both announced and closed deals, for an aggregate amount of €66,043 million in the first nine months of the year, according to the quarterly report of TTR in collaboration with Intralinks. These deals include M&A, Private Equity, Venture Capital and Asset Acquisitions. These figures represent a decrease of 25.83% in the number of transactions and an increase of 14.62% in the value of transactions, compared to the same period in 2019.

Specifically, in the third quarter of 2020, a total of 461 transactions were recorded with an aggregate amount of €21.3 billion.

In terms of sectors, Real Estate is the most active in the year, with a total of 312 transactions, followed by the Technology sector, with 238, and the Financial and Insurance sector, with 98 transactions. However, in year-on-year terms, the Real Estate sector recorded a 34% decrease, while the Technology sector reduced its activity by 13%, and the Financial and Insurance sector by 26%.

Mergers & Acquisitions

Mergers & Acquisitions account for 39% of the total deals, with 546 transactions YTD with a value of €44.5 billion (66.6% of the total YTD amount).

Cross-Border deals

Regarding the cross-border market, in the third quarter of the year, Spanish companies chose Portugal as the main destination for their investments, with 27 operations.

On the other hand, the United States (86), the United Kingdom (78) and France (65) are the countries which have made the largest number of investments in Spain. The United States stands out for its amount, with an aggregate of €4.63 billion.

Private Equity and Venture Capital

A total of 113 Private Equity transactions were booked in the first nine months of 2020, of which 34 had an aggregate non-confidential amount of €10 billion. This represents a 42.64% decrease in the number of transactions and a 58.82% decrease in the value of transactions, compared to the same period last year.

In the Venture Capital market, 315 transactions have been carried out, of which 262 have an aggregate non-confidential amount of €3.59 billion. In this case, there has been a decrease with respect to the same period in 2019 of 14.86% in the number of operations, and an increase of 126.45% in the capital mobilised.

Asset Acquisitions

In the Asset Acquisition market, 414 transactions were recorded for an amount of €10.5 billion, representing a decrease of 28% in the number of transactions and a decrease of 19.82% in their value compared to the same period in 2019.

Deal of the quarter

In the third quarter of 2020, TTR has selected as a major transaction the acquisition by Oaktree Capital Management of the Spanish company SDIN Residencial from Banco Sabadell.

The transaction, valued at €882 million, was advised on the Legal side by Allen & Overy Spain, PwC Tax & Legal Spain, and Dentons Spain. On the Financial side, Mediobanca, Colliers International Spain, Deloitte España and PwC Spain acted as advisers. PwC Tax & Legal España and PwC España advised on Due Diligence matters.