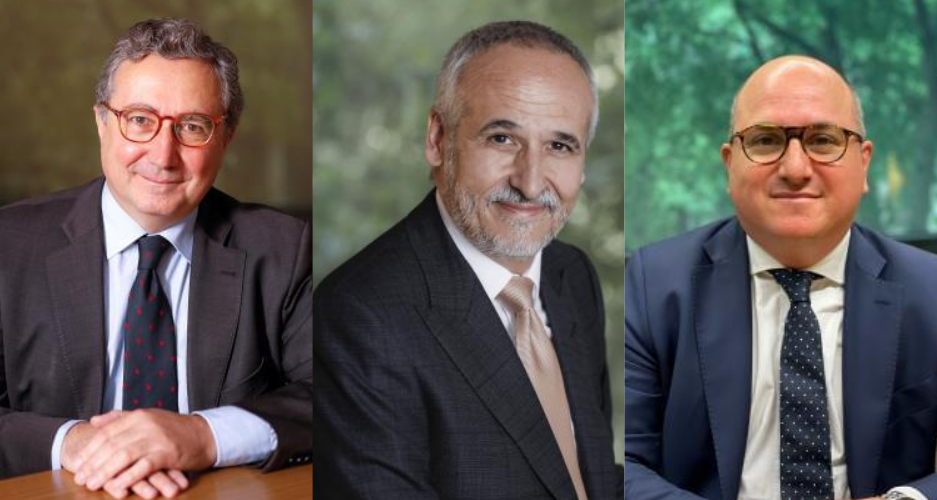

RocaJunyent has advised on the sale of the catalan firm Xarxes de Telecomunicacions Alternatives (XTA) to the infrastructure fund Asterion Industrial Partners. Joan de Figarolas Bosch (partner), Francesc A. Baygual (partner) and Erik Martín Marcos (special counsel) have been in charge of providing legal advice on this operation. Asterion will invest up to €100 million […]

Ecija has advised Puy Du Fou in the negotiation of its II Collective Bargaining Agreement. Carlos Martínez – Cebrián, partner, has led this transaction in which Adrián Aroca and Ignacio Peyró, lawyers of

Pérez-Llorca has advised Duro Felguera on a €90m capital increase. The two new partners, the Prodi Group and Mota-Engil Mexico, have been brought in. The process must still receive authorisation from the National Securities

Andersen advises, BME Growth listed companies, Squirrel Media and Mondo TV Studios on the acquisition of the animation production company. Andersen partners Jaime Aguilar and Patricia Motilla have led the transaction from the M&

FILS has advised the spanish start-up Tropicfeel on a €5 million funding round that has been subscribed by the social impact investment fund Fondo Bolsa Social as a new investor and the VC firm Ona Capital,

Cuatrecasas has advised venture capital firm Kibo Ventures on the launch of ‘Nzyme’, a new private equity fund set up to invest up to 200 million euros in small and medium-sized spanish companies. The Cuatrecasas team

King & Wood Mallesons (“KWM”) has advised Trea Asset Management on the structuring of its new investment vehicle, the Trea Healthcare Ventures Fund. This project has been led by partner and head of the funds

Linklaters has advised WP Carey Development as buyer and landlord in a sale and lease back transaction comprising 8 industrial facilities located in Italy and Spain. WP Carey fund has already invested more than 1 billion in

RocaJunyent has advised BanSabadell on the purchase of an office building. The advice has been led by the partner and the lawyer of real estate law, Roger Pla and Anna Estorach. BanSabadell has closed the

SRS Legal has advised the shareholders of Gresart-Cerâmica Industrial on the sale of 100% of the share capital to Gres Panaria Portugal. This acquisition is part of the growth strategy of the Italian multinational