Strategic thinking – Cuatrecasas, Gonçalves Pereira

Cuatrecasas, Gonçalves Pereira’s astute senior partner Rafael Fontana acknowledges that with the balance of power shifting from lawyers to clients, law firms need to change the way they operate

“Lawyers have to leave their comfort zone because lawyers are losing their power.” This is the honest assessment of Rafael Fontana, senior partner at one of the biggest law firms in Iberia, Cuatrecasas, Gonçalves Pereira.

He’s discussing the firm’s new strategic plan, which covers the period 2016-2020. Fontana says that it was crucial that – when developing the plan – the firm did not only take into account the input of its own lawyers.

“We prepared the strategic plan with the help of consultants – it was important that the plan did not only come from us – the methodology for creating the plan included meeting with clients and asking what they expect from the firm,” he says. “We are looking at what clients ask for, analysing their needs, and organising our teams in different ways, for example by sector specialisation – we worked a lot with the strategic plan to change the way we operate.”

However, in addition to ensuring the firm meets the expectations of its client, Fontana says that the plan also aims to improve the firm’s performance and satisfy the aspirations of its lawyers. “The strategic plan has high profitability as one of its goals, as well as providing value to our clients and our people, giving our people a career,” he says.

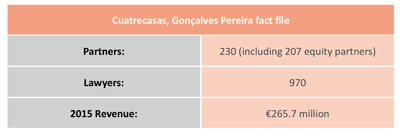

So these are Cuatrecasas’ plans for the next four years, but what is Fontana’s view of the firm’s current position? “We’re very happy,” he says, referring to the fact that the firm’s billing increased 4 per cent in 2015 to €265.7 million, representing the firm’s sixth consecutive year of revenue growth. “The Spanish economy has been very good and this has enabled our corporate practice, in particular, to keep growing, advising Spanish and foreign investors on a significant number of transactions.” Notable deals in the 12 months included advising on the sale of Eolia Renovables and the sale of Finerge by Enel Green Power. The firm’s Lisbon operation also had a notable year, with its work advising on the privatisation of the Portuguese airline TAP being one of the highlights.

New Mexico office

New Mexico office

The international market contributed around 20 per cent of the firm’s total billing in 2015 and the firm intends to further enhance its global offering. To this end, the firm has opened a Mexico office – initially staffed by two Spanish lawyers, the plan is to eventually hire Mexican lawyers and boost the office’s numbers to 10-15 fee-earners. The firm took the decision to open in Mexico due to its work for Pemex, which Cuatrecasas is advising on projects in the context of the country’s energy market reforms.

In terms of international markets, Fontana says the Pacific Alliance countries – namely Mexico, Chile, Colombia and Peru – will be a key focus for the firm in the coming year. However, he adds that the firm is unlikely to open further offices in the trade bloc in the near future. Fontana says that while the firm took the step of opening in Mexico due to its relationship with Pemex, Cuatrecasas’ strategy in the other three countries will be to forge “close links with top tier firms”. He adds: “We prefer joint ventures [with leading local firms] and keeping our independence – it would be easy to take a stake in a mid-sized or small firm, but our main goal is to provide the client with a top quality service.” Cuatrecasas’ global expansion plans are not confined to Latin America – announcing its 2015 results earlier this year, the firm praised the “excellent performance” of its China desk and its office in Shanghai. In an effort to build on this success, the firm is to open a new office in Beijing later this year. Fontana describes one of the firm’s key goals as “becoming a global firm with a special focus on Latin America”.

Political instability

Fontana expects the firm’s volume of international work to increase in the coming year – partly due to the new offices in Mexico and Beijing – and contribute to anticipated revenue growth of 5 per cent across the firm in 2016. He adds: “We expect the Spanish economy to grow, corporate law will be strong and international work will grow.” However, Fontana argues that Spain’s economic prospects could be further improved with the assistance of the country’s politicians. “We need help from politicians,” he says. “Political instability is causing some concern, some investors are freezing operations and are waiting until we have a new government – there has been a slowdown in activity at the beginning of 2016 when compared to 2015.”

Fontana wants to make technology a driver of the firm’s business rather than merely using it to increase efficiency. “Artificial intelligence, big data can ensure there is more accuracy in our business,” he adds. “Artificial intelligence will arrive in the European market and, in future, it may be doing half of firms’ due diligence work.” Fontana acknowledges that in the distant future there is a possibility that artificial intelligence could mean that law firms get smaller in terms of lawyer numbers, but he adds that “legal technology is a long way from substituting lawyers”.

Portugal is the firm’s second largest market after Spain and Fontana says that the Lisbon office has grown at an average rate of 5.5 per cent over the last three years. However, there were a number of leadership changes at the Lisbon office in the last 12 months – on 1 July last year, co-managing partners Maria João Ricou and Diogo Perestrelo were replaced by Frederico Pereira Coutinho. However, less than five months later, Pereira Coutinho stepped down for “personal reasons and to refocus on corporate law”. He was replaced by Ricou, who was reappointed to the role.

Despite the upheaval, Fontana says he is happy with the performance of the Portugal office, adding that the firm is in the process of hiring new lawyers in Lisbon. “The Portuguese and Spanish firms are now fully integrated and, as such, our new strategic plan is to be implemented in Portugal at the same pace as Spain,” he adds. “The role of Portugal within the firm’s strategy outgrows the country’s borders, for Portugal is a bridge to, and from, all the Portuguese speaking countries in Africa, Latin America and Asia, especially Angola, Mozambique, Brazil and East Timor.”

Overseas alliances

Overseas alliances

With regards to the Spanish market, Fontana believes the outlook for law firms is improving. “The legal sector is following the global economic trend and law firms are reporting positive results – large transactions came back onto the scene and law firms are benefiting, however the legal market is competitive,” he says. “There are good prospects for Spanish law firms and they are making efforts to evolve and adapt to clients’ needs.” While Fontana does not anticipate mergers among Spanish firms, he says that “all kinds of alliances overseas may arise”.

Challenges overcome by firm in recent years included significantly increasing the ranks of equity partners, as well as the departure of Emilio Cuatrecasas following a tax investigation.

Fontana says one of the main challenges he faces in the coming year is to create a better firm, not only for Cuatrecasas’ clients, but also for “our people and our society”. He adds: “We would like to have all our people happy.” Fontana says the firm has made a commitment to “leverage the talent of women” and says it has increased the number of women in executive committees by 30 per cent in the last year. He continues: “Next year, we are celebrating a century of history. That is a lot of responsibility. Not only for me, as senior partner, but for the firm – we need to face the challenges of the global society and be able to meet all our stakeholders’ expectations.” Fontana concludes: “Decisions need to be taken to take the firm on a further step. I am glad because we have a strong partnership that is rowing in the same direction and believes in the future.”