TMT annual report 2016: Experts only

Though opportunities for TMT lawyers abound, only those that fully understand the latest cutting-edge technology will be able to cash-in on them

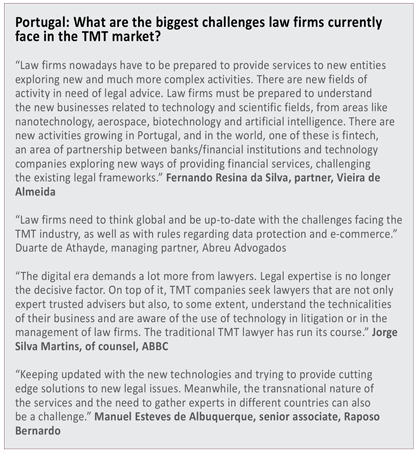

Technological advancement never stops and consequently, the opportunities for technology, media and telecommunications (TMT) lawyers are abundant. In addition to advice on new data protection regulations that come into force in 2018, law firms are also being consulted on issues such as fintech, artificial intelligence and data analytics. Meanwhile, clients are also looking to instruct lawyers in relation to matters concerning drones, robotics, telematics, blockchain and bitcoin.  The challenge for lawyers is that in order to provide effective TMT advice, they need to be knowledgeable about, and up-to-date with, the latest cutting-edge technology. It’s not an easy task – especially when, as some a lawyers point out, even if a law firm does come up with a highly innovative solution to a technology-related legal problem, it quickly becomes common knowledge and TMT companies begin widely applying their new-found knowledge in-house without the need for external counsel. So, simply being a good lawyer is not enough. The practitioners that really excel in this field are those that have a highly-developed understanding of the business their clients are involved in.

The challenge for lawyers is that in order to provide effective TMT advice, they need to be knowledgeable about, and up-to-date with, the latest cutting-edge technology. It’s not an easy task – especially when, as some a lawyers point out, even if a law firm does come up with a highly innovative solution to a technology-related legal problem, it quickly becomes common knowledge and TMT companies begin widely applying their new-found knowledge in-house without the need for external counsel. So, simply being a good lawyer is not enough. The practitioners that really excel in this field are those that have a highly-developed understanding of the business their clients are involved in.

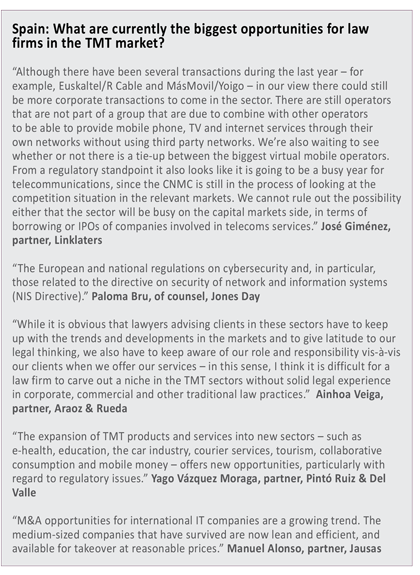

Clients regulatory concerns are providing a lot of opportunities for TMT lawyers, according to Alejandro Touriño, managing partner at Ecija. “There is a new data protection regulation coming into force in 2018, which will generate a considerable amount of work for lawyers. Also, the amendments to the criminal code mean that there are concerns among companies about software licensing compliance,” he adds. Touriño says there is significant work for law firms advising venture capitalists and “business angels” in relation to start-ups as well as acting for incubators. He adds that the “sharing economy” – which includes businesses such as Airbnb and Uber – also faces regulatory issues that clients need advice on. “Cybersecurity definitively represents a challenge too,” he says.

Football broadcasting

Football broadcasting

Ecija chairman Hugo Écija says that the market for football broadcasting rights is also generating a considerable amount of work for TMT lawyers, including advising football clubs and television companies. In addition, more internet companies are boosting their presence in the Spanish market and creating work for lawyers. Meanwhile, CMS Albiñana & Suárez de Lezo partner Javier Torre de Silva says many clients require advice in relation to the issue of a single digital licence for the whole of Europe, while the regulation of over-the-top (OTT) services and the fintech sector is also creating opportunities for lawyers.

Uría Menéndez partner Pablo González-Espejo says the telecoms and audiovisual sectors are facing an “earthquake in regulation”. He adds: “All regulations will change and lawyers have to be imaginative in order to foresee the outcome.” González-Espejo says the extent of the regulation of the audiovisual sector will be shaped by the entry of players in the market, such as Amazon or Netflix. He also observes that there has been an increase in requests for advice on outsourcing technical platforms, particularly those related to financial institutions and insurance.

Work advising TMT companies from the UK that are eyeing the Spanish market is on the increase, according to Rafael García del Poyo, partner at Osborne Clarke. He adds that other growth areas for law firms include fintech, artificial intelligence, data analytics, drones, robotics, telematics, blockchain and bitcoin. Baker & McKenzie partner José María Méndez says that the TMT-related matters are creating opportunities for law firms in all practice areas. “There is potential work related to the implementation of the European Union Trade Secrets Directive, as well as the Copyright Directive and changes to the Digital Single Market.” Another key source of work for lawyers will be advising video-on-demand (VOD) service providers on the implications of the EU Audiovisual Media Services Directive.

Global struggle

Smaller law firms and big law firms operating in the TMT sector both face challenges, though they are different in nature. As one partner puts it: “Smaller niche firms struggle with the global approach as they have to compete with international law firms, while the challenge for large firms is that they may lack the technical knowledge that is vital when advising TMT sector companies.” Competing with the ‘Big Four’ is another problem for law firms. “When providing advice to TMT companies, it’s impossible to advise on everything – for example, tax advice is a big opportunity,” he continues. “Lawyers from other areas, such as competition, corporate, and tax are breaking into the TMT market.”

Another specialist TMT partner at a law firm in Madrid says a major challenge for law firms is implementing technology within in order to remain competitive: “We need to add value by using technology in the provision of services.” In addition, client demand for a “one-stop-shop” means that law firms are under pressure to restructure their firms into teams that specialise in specific industry sectors. Meanwhile, Latin America is a market with huge potential for TMT lawyers, says González-Espejo. “Latin America has the potential for more development in the TMT area; it’s a great place to grow.”

Another problem for law firms is that, while the initial advice they provide clients is usually highly specialised, as knowledge becomes more widespread the legal work becomes commoditised. “For example, take blockchain: eventually companies develop their own teams to handle this matter so law firms have to change quickly and become pioneers [in another area],” says one partner. Law firms frequently have to adapt to new fee structures too and clients often prefer to use three or four different law firms for legal advice, explains one partner based in the Madrid office of an international firm. He adds: “The lack of legal certainty in this area means that lawyers also have to take on the role of business consultants and advise clients on what approaches to take [to particular issues] in future.”

Bargaining power

Bargaining power

There will be an increasing number of TMT lawyers in future, says Iban Díez López, associate at Gómez-Acebo & Pombo. He adds: “TMT lawyers have to be internationally oriented, they have to be specialised and business oriented and technology oriented. With regard to fintech, for example, we have to build multidisciplinary teams – with expertise in compliance and tax, for example – because TMT is not always the ‘best friend’ of banking.”

Clients have tremendous “bargaining power” when it comes to fees, says one partner at a leading Spanish law firm. “They are sophisticated and they know how to get the best out of negotiations – however, if the matter is critical to their business they are prepared to pay whatever it takes.” Another partner points out that multinational companies put “big pressure on fees”. He continues: “Firms also have to get through the filter of a panel. However, SMEs in Spain are prepared to use more expensive international law firms as they are able to open doors for them around the world.” Law firms are also prepared to advise TMT start-ups on what is effectively a pro-bono basis and, in doing so, “bet on them [the start-ups] in the medium to long-term.”

Industry expertise is now a key requirement of clients, explains one partner based in the Madrid office of a global firm. “Clients are looking for a partner who understands the issues – in-house counsel very quickly know if a lawyer doesn’t know what he is doing,” he explains. “Consequently, firms are moving away from practice groups and towards industry groups – however, creating such groups internally is not easy as compensation systems need to be adapted to motivate partners to become part of an industry group and it can be a challenge to get people on the same page.” The partner adds that, in this respect, the legal arms of the ‘Big Four’ auditors have an advantage in that they are “already structured in industry groups”. However, other lawyers argue that the ‘Big Four’ do not have it easy. “The consultancy firms are having a hard time,” says one. “Clients want multiple law firms in addition to auditors.”

Such is client desire for industry expertise, that even if a large firm puts together a multidisciplinary team – including, for example, corporate and labour lawyers – if the team “does not have a good understanding of the client’s business, this is not enough”, says one partner. Another TMT partner adds: “Sometimes, if labour lawyers, for example, are leading on a matter, TMT lawyers will have to help them.”

While many TMT companies may be start-ups with limited capital, lawyers argue that it is vital that they do not jeopardise their futures by limiting legal spend. As one partner comments: “I’d say ‘can you afford not to pay us?’ There are increased legal risks and the legal consequences of failures may not be apparent yet.”

Portugal: Technological invasion

Portugal: Technological invasion

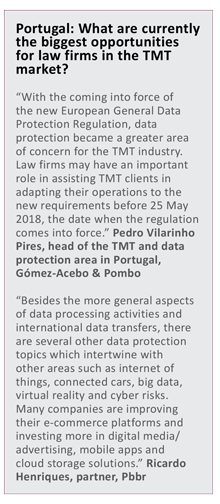

In the Portuguese market, data protection-related matters are the biggest opportunity, according to PLMJ partner Daniel Reis. “Clients are struggling to adapt to Regulation 2016/679 which will apply from 25 May 2018 and are interested in hiring outside counsel to help them,” he adds. However, Reis adds the caveat that the “explosion of data protection work means that it is no longer a niche area”. He continues: “TMT practices need to concentrate on the more complex and sophisticated work where they can offer real value to clients.”

Another significant opportunity for TMT lawyers in Portugal is the fact that a wide range of sectors are becoming increasingly reliant on technology. “Sectors such as agriculture, aviation, construction, communications, defence, distribution, energy, financial services, insurance, medical devices, health, tourism and transport face a growing and undeniable dependence on technology,” says Magda Cocco, partner at Vieira de Almeida. “All this is evidenced by the increasing importance of e-health, e-government, e-commerce, smart cities, surveillance and tracking technologies in our day-to-day life.” Cocco adds that, until very recently, TMT practices in most law firms where focused on the “electronic communication, media and technology sectors”, but with other sectors experiencing an invasion of technology, TMT practices have enlarged their client base and are now working with clients from a wide range of sectors.

The trend for consolidation in the TMT sector will mean the major players will increasingly do more legal work in-house, MLGTS managing associate Gonçalo Machado Borges warns. “This may contribute to downward pressure on fees or encourage further in-sourcing of services,” he adds. “The overall backdrop is one of stable or decreasing ‘telco’ market revenues which poses a challenge for the market players themselves and for all external service providers, legal counsel and others.”

Francisco Brito e Abreu, partner at Uría Menéndez-Proença de Carvalho, expects there to be more TMT-related transactional work for lawyers in Portugal. “The reconfiguration of the Portuguese TMT market has generated, in recent years, several significant transactions, such as the acquisition of PT Portugal by Altice and the merger between Zon and Optimus,” he says. “This reconfiguration is likely to continue to evolve, and this may generate a relevant workload for law firms.”

Grow or die

Grow or die

According to Maria Leonor Piconez, a lawyer at Caiado Guerreiro, the fact that, in the highly competitive TMT market, only the strongest and most innovative companies survive presents an opportunity for lawyers. “Small companies have to grow fast or will lose their chance – therefore, one of the important opportunities lies in assisting these players in obtaining funding,” she says. “In the TMT sector, either you grow or you die.”

The fact that TMT clients want fast responses from their lawyers presents a significant challenge for firms, according to Patrícia Nunes Borges, senior associate at F. Castelo Branco & Associados. “Not only do they [clients] want quality, but they need answers by the hour – getting advice on time could mean getting the deal through and clients expect to get their answers 24 hours a day, seven days per week,” she says. “As such, the biggest challenge is, while maintaining the quality of our work, still being able to turn it around very quickly, which is not an easy task.”

With regard to the biggest trends in the coming year, Vieira de Almeida partner Margarida Couto says wireless technologies and more innovative and sophisticated handsets will continue to dominate the telecoms sector, while the use of satellite technology will become more prominent. She adds: “The increasing number of satellite constellations in orbit will also assume growing importance in several sectors, notably in shipping, aviation and defence.”