Tax annual report 2018: Criminal behaviour?

The international fight against tax avoidance is intensifying; clients are scared of reputational damage and there is a concern that tax advisers could be perceived as facilitating crimes

The global drive to tackle tax avoidance means that domestic tax authorities are feeling increasingly empowered and consequently, tax inspections are on the rise. Clients are terrified that their tax structures could be interpreted as tax avoidance, with the result that their reputations could be completely destroyed. As a result, there is increasing pressure on lawyers to not only provide legal advice but also assess the potential reputational risk associated with certain tax structures. It’s a difficult environment for tax lawyers to operate in. As one partner puts it, there is now “an increasing focus on tax advisers as potential criminals”.

The global drive to tackle tax avoidance means that domestic tax authorities are feeling increasingly empowered and consequently, tax inspections are on the rise. Clients are terrified that their tax structures could be interpreted as tax avoidance, with the result that their reputations could be completely destroyed. As a result, there is increasing pressure on lawyers to not only provide legal advice but also assess the potential reputational risk associated with certain tax structures. It’s a difficult environment for tax lawyers to operate in. As one partner puts it, there is now “an increasing focus on tax advisers as potential criminals”.

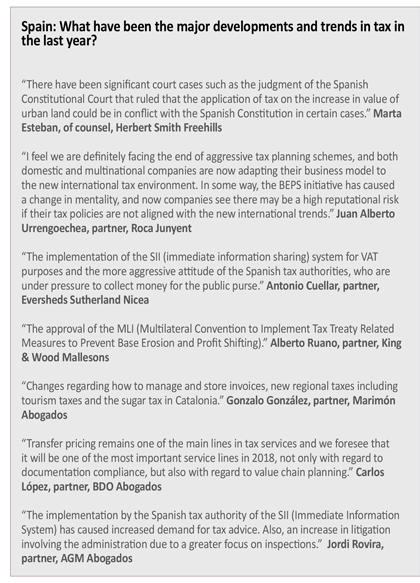

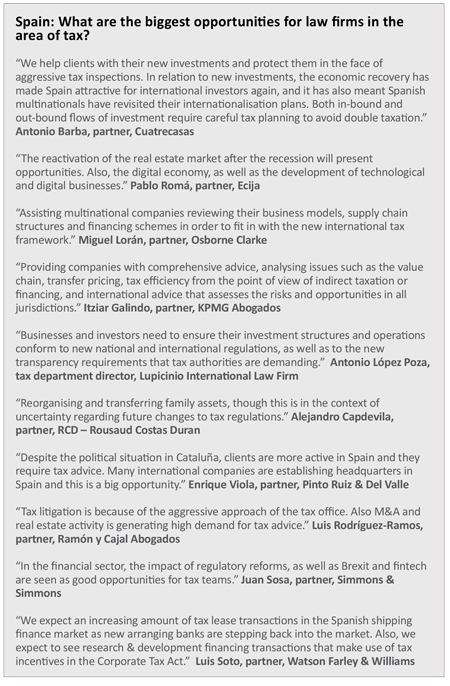

The economy is improving and, as transactions are increasing, there is a greater demand for tax advice, says Broseta lawyer Luis Alaix. “Tax inspections and related litigation is also a hot topic,” he adds. “During the crisis, inspections increased, as the tax authorities needed to complement the revenues they were losing as a consequence of the reduction in taxpayers’ income – though the economy is improving, we still see significant tax inspection activity.” Meanwhile, with regard to recent trends and developments, Baker McKenzie partner María Antonia Azpeitia says that the Spanish corporate income tax law of 2015 is “not only a challenge for practitioners, but also for the administration, and this means a delay in the processes”. One partner says: “Changes in personnel at the Spanish tax inspectorate mean that getting answers from inspectors can be a slow process, because the new members of the inspectorate were not big advocates of the new law.”

There is still uncertainty surrounding the Organisation for Economic Co-operation and Development’s BEPS (base erosion and profit sharing) initiative, according to Javier González Carcedo, partner at PwC Tax and Legal Services. “Many domestic jurisdictions have implemented BEPS, but there is now uncertainty due to the EU Anti-Tax Avoidance Directive (which must be implemented by member states by 2019); the issue is how the deployment of this directive will be aligned with BEPS,” he says.

Potential criminals

Potential criminals

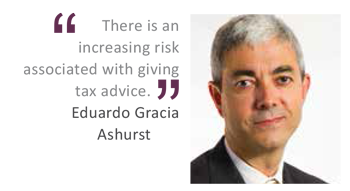

The BEPS and European Union fight against tax avoidance is giving more power to tax authorities and reducing the rights of taxpayers, says Ashurst partner Eduardo Gracia. As a result, tax advisers and tax lawyers are now being scrutinised by the tax authorities, he adds. “There is an increasing risk associated with giving tax advice,” he explains. “There is now a focus on tax advisers as potential criminals – advisers have to be more conservative now, whereas in the past, they would be more creative.” In the view of Allen & Overy partner Adolfo Zunzunegui, the main role of tax lawyers has “moved from tax planning to tax compliance and tax risk management advice”.

However, though lawyers’ work may now involve less tax planning, there is “still room” for this type of work, says Javier Garcia-Pita, partner at Linklaters. “The tax authorities like to collect revenues and the tax rules are open to interpretation,” he says. Garcia-Pita adds that tax inspections in Spain are creating a less attractive environment for investment: “It’s becoming more difficult to attract investment and there needs to be more focus on attracting investors.” Rafael Fuster, partner at Uría Menéndez, says that there is now pressure on tax lawyers to be “broader in their approach” when advising. He adds: “Tax is now critical, rather than just technical, it can impact on reputation and on management liability – tax lawyers have evolved in that they are now largely risk assessors rather than creative planners.” One partner says that the business community now sees tax planning as a “terrible thing, so there is a problem with the public image [of tax planning]”.

Rafael Fuster, partner at Uría Menéndez, says that there is now pressure on tax lawyers to be “broader in their approach” when advising. He adds: “Tax is now critical, rather than just technical, it can impact on reputation and on management liability – tax lawyers have evolved in that they are now largely risk assessors rather than creative planners.” One partner says that the business community now sees tax planning as a “terrible thing, so there is a problem with the public image [of tax planning]”.

Clients are now more concerned about how the public will perceive their tax arrangements, according to Clifford Chance counsel Roberto Grau. “Lawyers are pushed by clients to assess the reputational risk,” he adds.

Burden of proof

Burden of proof

Economic analyses used to be distinct from legal analyses, but now, given the changes in accounting rules as well as initiatives such as BEPS, tax lawyers have to incorporate economic analysis into their legal analysis. “The economic nature of a transaction forms an integral part of its legal (and tax) nature,” says Fuster. “Tax rules and authorities are increasingly looking at the economic effects of things, not only the legal effect.” Ramón Palacín, partner and head of international tax at EY Abogados, says that the “relevance of factual evidence” is increasingly important in tax matters. “Tax Administrations are scrutinising the tax schemes of companies with an increased emphasis on the burden of proof, which has been shifted from the tax authorities to the tax payer,” he adds.

Brian Leonard, partner at Deloitte Legal, says there is a difference between a US multinational’s conception of tax and that of a European multinational. He adds: “A US taxpayer is able to claim economic substance in foreign tax savings – the mismatch in understanding of acceptable and unacceptable tax planning is up to the policymakers to resolve.” The US has recently overhauled its tax code – with a reduction in corporate income tax from 35 per cent to 21 per cent – and this will have a significant impact on tax on a global scale, Leonard says. “The US tax reform will change all the rules, even BEPS.” Palacín says there is a feeling among some clients in the US that BEPS has been “implemented by the EU against US multinationals”.

Leonard adds that there is the possibility of the EU introducing rules for regulating tax professionals. “There is clearly political capital in safe regulation by accounting/auditing institutions and bar associations,” he says. Azpeitia argues that “one should not lose sight of the fact that tax professionals are very often lawyers, and therefore, they are protected by all the privileges of such status”. However, she adds that it raises the issue of whether tax professionals who are not lawyers “would be equally protected”. While it is becoming an increasingly risky environment for tax lawyers, one partner argues that tax lawyers’ credibility will be their biggest asset. “If lawyers are taking more risk, they’ll be better paid,” he says.

There has been speculation in the past that some law firms may scrap their tax practices due to the heightened risk of providing such advice, but Gracia believes this to be unlikely. “The tax aspects of transactions are key,” he says. “Not having tax lawyers could increase the risk for law firms.” Another partner remarks that “transactional firms must make tax a core practice and provide tax advice that adds value to the client and the firm”.

Defending tax payers in cases is a growing area of work for law firms, according to Gracia, who adds that rulings by the European Court of Justice – based on the EU human rights charter – have established the principle that taxpayers can defend themselves in cases against tax authorities where rights have been granted by EU law. Pérez-Llorca partner José Suárez says that defending “clients’ rights and, in general terms, clients’ positions vis-à-vis the tax authorities will be more difficult in the next few years due to the higher standard of tax transparency and administrative collaboration”. Zunzunegui says clients have generally tended to avoid litigation, but adds that they “need to be prepared” to litigate against tax authorities.

Not black and white

Not black and white

Generally law firms are doing more contentious tax work, and specifically more litigation, one partner says. “Our litigation practice expanded through the crisis,” he adds. “Also private clients are generating new tax matters – generally, Spain is getting more investment and this is providing more work.” However, other partners argue that litigation is not always the “best instrument for solving issues – the courts look at it in black and white, but you have to anticipate a lot of opinions”. The partner adds that law firms are also experiencing an “increase in demand from boards of directors who are looking to protect themselves [from possible tax-related issues].”

It’s vital that law firms are more selective in terms of which clients they provide with tax advice, argues one partner. “A client could impact on a law firm’s reputation, so firms have to conduct more thorough due diligence on potential clients,” he says. “We are saying no to a lot of new mandates and we need to do more thorough research with existing clients – this makes the value of the independence of lawyers even higher.” Another partner at a global firm says: “The single most important thing is our brand, we must do the utmost to protect that brand, we cannot damage it.”

Some tax partners report increases in fees, though they acknowledge that this could be largely due to general economic growth in Spain. They also say there is a growing trend for clients to have a number of different tax advisers, whereas in the past, they were more inclined to rely on one firm.

There is a big opportunity for tax lawyers to become “trusted advisers” who are at the core of their client’s decision-making, says one partner. However, he adds that being held “personally liable” for tax advice is a major risk faced by lawyers. Similarly, tax lawyers argue that they have an opportunity to make their practice area a “core department” at their firms. However, one partner adds that there is a great deal of uncertainty surrounding tax regimes and this is one of the big risks tax lawyers face. “A major risk is the speed of change in tax policy and legislation,” says a partner at a major global firm.

Helping multinationals to navigate BEPS is a huge opportunity for lawyers, says one partner. However, he adds: “To do this, firms need a global reach and an understanding of business as well as digitalisation and data analytics; this is an opportunity and a challenge.” Another opportunity for tax lawyers is presented by the current trend for companies to review their financial structures on a “country by country basis”, a lawyer at one of the law firms connected to the ‘Big Four’ auditors says.

Tax lawyers are playing an increasingly crucial role in M&A deals, and the number of such deals in Spain is increasing, say law firm partners. Suárez says: “Lawyers are required to future-proof clients’ tax structures – if clients implement good corporate governance, they will be able to see what their potential liabilities are.” Another partner at a leading Spanish firm remarks: “Tax lawyers are needed now more than ever so there are big opportunities ahead – however, there is the risk of causing potential harm to your client or your own firm.”

Portugal: Fat tax

Portugal: Fat tax

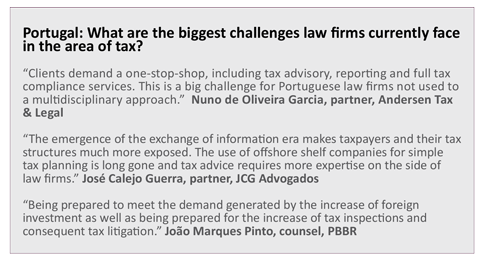

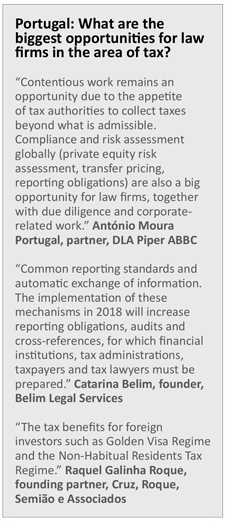

Portuguese tax policy has played a major role in the country’s efforts to alleviate the effects of the austerity imposed by the European Union, the International Monetary Fund and the European Central Bank, says António Lobo Xavier, partner at MLGTS. He adds: “There is a tax break trend in personal income tax, including special regimes for attracting high-net-worth individuals.” Meanwhile, Lobo Xavier says the country’s tax authorities have become more vigilant with regard to tackling tax avoidance which has led to a significant increase of litigation.

Other major tax-related developments in Portugal include the introduction of a new property tax called AIMI (Adicional Imposto Municipal Sobre Imóveis), a ‘fat tax’ on sugary drinks, as well as new tax breaks for investment in start-up companies, says Tiago Marreiros Moreira, partner at Vieira de Almeida. He adds that significant trends include the provision of tax structuring advice on major real estate transactions, as well as advice on restructuring of renewable energy groups.

The “above-EU average” performance of the Portuguese economy in 2017, as well as a politically stable environment, means lawyers should expect an increase in M&A, real estate and tourism-related tax work, says PLMJ partner Nuno da Cunha Barnabé. He adds: “Furthermore, private client work should remain stable due to the country’s international reputation and the competitiveness of the Portuguese non-habitual tax scheme. Meanwhile, complex tax litigation work should increase as the tax inspection authorities are moving to a risk-based approach for major taxpayers.”

Marta Pontes, partner at Uría Menéndez-Proença de Carvalho, highlights the important tax measures contained in the country’s 2018 state budget. It includes a reduction in personal income tax, an increased surcharge for corporate entities with a taxable income higher than €35M (from 7 per cent to 9 per cent), and a change in how Portuguese sourced-income is defined in order to include capital gains related to certain classes of property located in Portugal that are achieved by non-resident individuals and entities. Meanwhile, there is now no need to apply for real estate transfer tax, stamp tax and registration fees exemptions in relation to corporate restructuring transactions as they are now automatically applied (with certain exceptions). Pontes adds: “The Portuguese tax authorities remain very aggressive and have higher tax collection targets and therefore tax litigation and arbitration should definitely be an important area of opportunity.”

The coming year will provide lawyers with significant tax-related opportunities in the real estate sector, particularly in connection with tourism, as well as the office and residential markets, says Cuatrecasas partner Diogo Ortigão Ramos. He adds that there will also be high demand for advice relating to “private equity transactions, refinancing operations and the sale of assets to meet more demanding financial regulatory requirements”. In addition, Portuguese family offices and the restructuring of Portuguese companies will also generate tax work for lawyers, says Ortigão Ramos.

Getting tense

Getting tense

Against this background, there is a growing tension between the European Union/internationally-driven tax legislation that focuses on combatting tax evasion and achieving a “fair tax framework and the fact that changes to domestic tax laws around the world are increasingly prone to erratic and politically-biased views prevailing over technically solid approaches to the underlying issues and challenges”, says Linklaters partner Rui Camacho Palma. “EU Directives are seeping into national legislation and disrupting existing structures and creating challenges regarding compatibility with international tax law and constitutional law principles, all against the backdrop of increasing pressure for tax collection by the tax authorities,” he adds. One of the most significant challenges facing tax lawyers is the digitalisation of the economy, says Caiado Guerreiro partner Tiago Caiado Guerreiro. He adds that this results in a need to “speed up answers and have a more pragmatic international overview for our clients”. Meanwhile, CCA Ontier managing associate Frederico Velasco Amaral says the need of multinational corporations to ensure compliance represents a significant opportunity for law firms, as does increased regulation and the impact of technology on the tax compliance, which, he says, will change the way tax authorities work.

One of the most significant challenges facing tax lawyers is the digitalisation of the economy, says Caiado Guerreiro partner Tiago Caiado Guerreiro. He adds that this results in a need to “speed up answers and have a more pragmatic international overview for our clients”. Meanwhile, CCA Ontier managing associate Frederico Velasco Amaral says the need of multinational corporations to ensure compliance represents a significant opportunity for law firms, as does increased regulation and the impact of technology on the tax compliance, which, he says, will change the way tax authorities work.

Tax lawyers face more pressure than lawyers in some other practice areas to keep up-to-date with new regulations, according to AAA Advogados senior associate Joana Tavares de Oliveira.  She adds: “The challenges posed by the need to balance the diverse ideological backgrounds of the coalition parties in the Portuguese parliament and the ambitious collection targets that the deficit reduction objectives entail have resulted in tax legislation of questionable quality.” Tavares de Oliveira says that the collection targets set for the tax authorities justify the “increasingly ‘pro-treasury /anti-taxpayers’ position that has been adopted”. She continues: “Managing the relationship with the tax authorities in a fast-paced regulatory context while keeping clients permanently updated is one of the main challenges that tax practices face.”

She adds: “The challenges posed by the need to balance the diverse ideological backgrounds of the coalition parties in the Portuguese parliament and the ambitious collection targets that the deficit reduction objectives entail have resulted in tax legislation of questionable quality.” Tavares de Oliveira says that the collection targets set for the tax authorities justify the “increasingly ‘pro-treasury /anti-taxpayers’ position that has been adopted”. She continues: “Managing the relationship with the tax authorities in a fast-paced regulatory context while keeping clients permanently updated is one of the main challenges that tax practices face.”