Roca Junyent guides Nina Capital´s second fund

Roca Junyent has advised VC firm Nina Capita on the launch of its second investment fund for early-stage companies

The Venture Capital firm Nina Capital has launched its second fund, which specialises in investing in startups. The vehicle was registered with the Spanish Securities and Exchange Commission (CNMV) on 4 June.

Marta-Gaia Zanchi, founder of Nina Capital commented in a statement to La Vanguardia: “The goal is to raise €40 million and it looks like we are going to achieve it easily. In just one week, we have €18 million committed.” The fund’s limited partners include healthcare companies, family offices and individual investors. These are mainly foreign investors from countries such as Italy, Germany, Switzerland and the United States.

Like the first vehicle, the second vehicle will focus on investments in early-stage or very early-stage companies with amounts ranging from €300,000 to €600,000. The geographic focus will also be primarily in Europe, as well as the US, Canada and Israel. With the first fund Nina Capital only invested in a Spanish company, Methinks, based in Barcelona and specialized in an early detection system for stroke with artificial intelligence.

In May 2019 Nina Capital announced the launch of its first vehicle, endowed with €18 million. Among its latest investments is Subtle Medical, in which it participated along with 3E Bioventures, Fusion Fund, Data Collective, Delta Capital, Tsingyuan Ventures and Crista Galli.

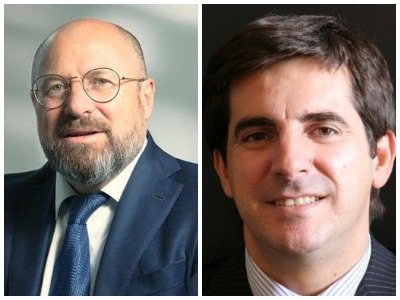

Roca Junyent advised Nina Capital on the constitution of this second investment vehicle focused on financing emerging companies in the medtech sector –medicine and technology– after almost completing the activity of her first fund with a Barcelona office team led by B&F-Commercial/M&A partner Xavier Foz Giralt (pictured left) and Commercial/M&A senior associate Jordi Bermúdez Gutiérrez (pictured right).