Revenue up at leading firms due to growth in M&A and LatAm markets

Billing increases at Uría and Cuatrecasas reflecting acceleration of transactional activity in Iberia and Latin America – real estate, finance, TMT and energy deals expected to generate further growth in 2016

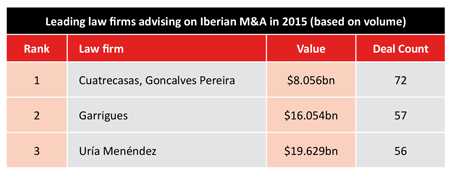

Major Iberian M&A deals as well as an increase in work in Latin American markets have resulted in major Spanish law firms reporting major revenue growth. Uría Menéndez and Cuatrecasas, Gonçalves Pereira attributed increases in billing in 2015 to significant transactional activity in Spain as well as an increasing flow of investment and transactions in Latin America. Uría Menéndez is yet to announce official revenue figures for the 2015 financial year, but a spokeswoman confirmed that the initial projections were that the firm’s revenue had increased by 8 percent to €208.4 million. Meanwhile, Cuatrecasas, Gonçalves Pereira confirmed that its billing had increased by 4 percent to €265 million. Garrigues, Spain’s largest firm by revenue, had yet to announce its financial results when Iberian Lawyer went to press.

Revival in major deals

Cuatrecasas said its corporate department had contributed the biggest proportion of the revenue, being responsible for 36.5 percent of the total billing. The firm advised on a number of major deals including the €919 million sale of Eolia Renovables and Enel Green Power’s €900 million sale of Finerge. Meanwhile, the firm’s Portugal office advised on the privatisation of Portuguese airline TAP. “Large transactions came back on the scene and law firms are benefiting,” says Cuatrecasas senior partner Rafael Fontana. “Spain’s economic growth in 2015 enabled our corporate practice to keep growing, advising Spanish and foreign investors on a significant number of financial and corporate transactions.”

Fontana is bullish about the prospects for the coming financial year and consequently the firm is targeting 5 percent growth in 2016. “We expect a stronger recovery in the Iberian economy that will boost transactions and provide safety for foreign investments,” Fontana says. “In terms of business, real estate, finance, TMT and energy will be booming this year.”

More Latin American investment

More Latin American investment

International business accounts for 20 percent of Cuatrecasas’ total billing in 2015, and the firm has identified Latin America, in particular, as one of its preferred markets. To this end, the firm recently announced the opening of a Mexico office. “Our international strategy has been a proven growth driver – there is an increasing flow of investments and transactions carried out by Latin American companies and groups,” says Fontana. “We have been working in Mexico over the last few months – our debut in the Mexico market has been enhanced through our client Pemex, whom we are advising on some important projects within the framework of the country’s energy reform.” Fontana adds that, with regard to the other jurisdictions in the Pacific Alliance – specifically Chile, Colombia and Peru – the firm continues to develop relationships with the “best firms”. He adds: “We are keeping our flexible strategy because it grants us a privileged position of independence when attracting business.”

Meanwhile, Uría Menéndez says the firm’s anticipated 8 percent growth in revenue is in part due to a good performance by its Latin American operation Philippi, Prietocarrizosa, Ferrero, DU & Uría (PPU). In its first year, PPU reported 15 percent growth and in an effort to build on this success, the firm announced in January this year that it would be supplementing its Chilean and Colombian operations by opening in Lima via the incorporation of the Peruvian firms Ferrero Abogados and Delmar Ugarte. Announcing the opening of the Peru office, the firm stated that it would now be able to cater for the “growing demand for comprehensive professional services in the region sought by multinational, European, Asian and American companies – the gradual integration of the economies of the Pacific Alliance has made the region one of the most attractive places for investment.” The firm is also currently considering how best to tackle the Mexican market and one option under consideration is strengthening ties with Galicia Abogados – where the firm currently has one associate stationed.

Spanish M&A boost

Spanish M&A boost

However, Spanish M&A activity has also had a key role in boosting Uría´s revenue – corporate and commercial work contributes half of the firm’s revenue. Major deals in which the firm had a role in the last year included the €5.7 billion acquisition of Coca-Cola Iberian Partners by Coca-Cola Enterprises.

The third member of Spain’s ‘Big Three’, Garrigues, has yet to announce its results, but the country’s fourth largest firm by revenue Gómez-Acebo & Pombo also reported an increase in billing in 2015. The firm, which earlier this year appointed a new managing partner, Carlos Rueda, announced that revenue increased by 2.1 percent to €60.2m in 2015. The firm also said that, in addition to revenue, profitability had also increased in the last year.