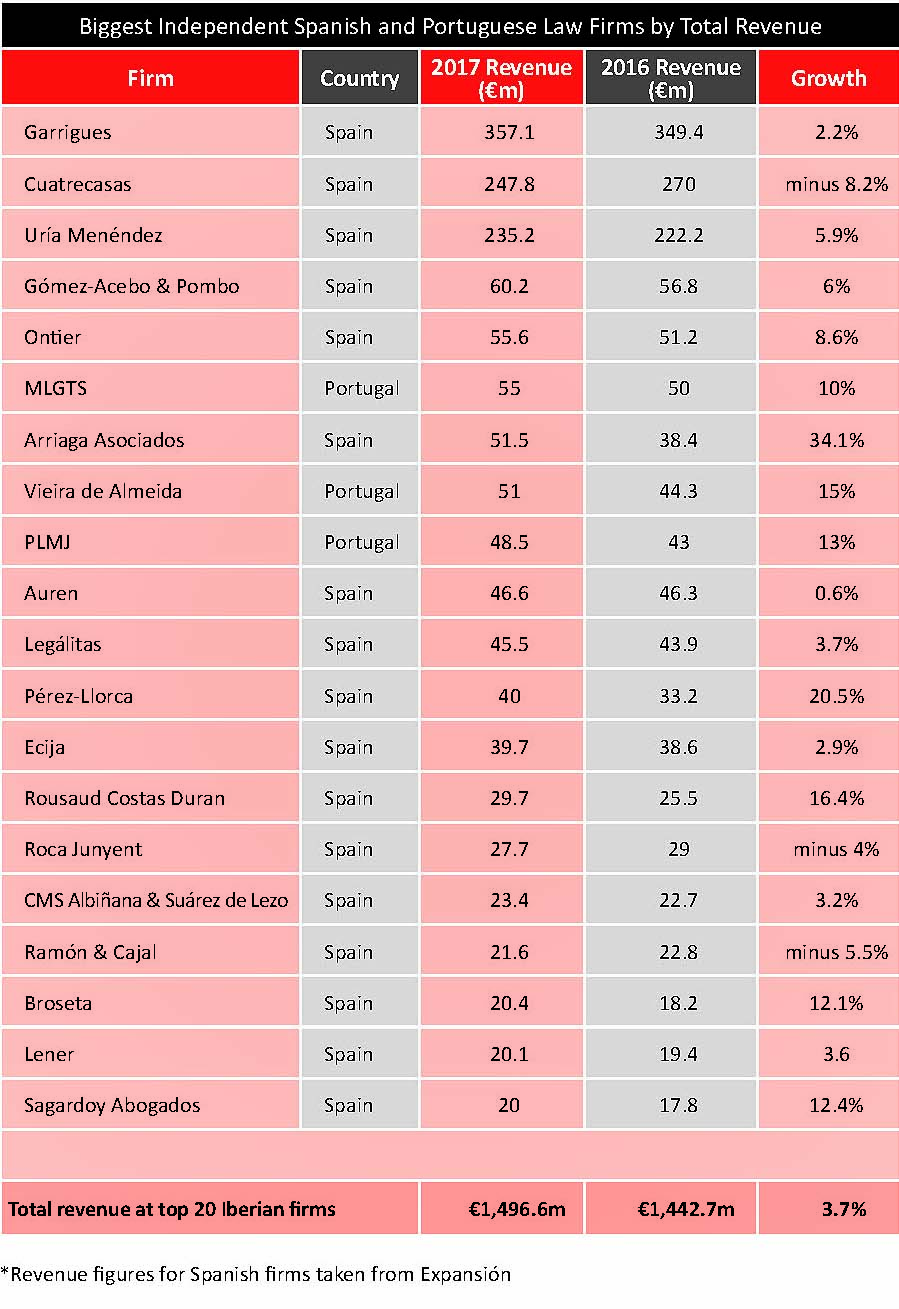

Revenue of top 20 Iberian firms rises to nearly €1.5bn

Surge in corporate and litigation work, as well as drives to increase efficiency, results in corporate law firms in Spain and Portugal experiencing revenue increases of up to 20 per cent

Increases in corporate, finance, tax and dispute resolution work – coupled with new opportunities in overseas markets such as Latin America have enabled most leading Iberian firms to grow their revenue in the last year. The top 20 Spanish and Portuguese law firms increased their total billing by more than 3 per cent to almost €1.5 billion in 2017. The biggest Iberian law firm, Garrigues, reported a 2.2 per cent increase in revenue to €357.1 million with Latin America credited with driving much of the growth. The firm said billing for Latin America-related business increased 30 per cent to €23.5 million. Generally speaking, the firm’s corporate practice as the star performer – billings were up 7.4 per cent, with corporate work accounting for 32 per cent of the firm’s total revenues. Notably, the firm said it invested 3 per cent of its revenue (around €10 million) in “tools to intensify internal collaboration, which are giving rise to new ways of working and enhancing the client experience”. In 2017, the firm signed an agreement with the Instituto de Ingeniería del Conocimiento (IIC) to develop a project using “robots” for document management.

Cuatrecasas announced 2017 revenues of €247.8 million, which compared to revenue of €270 million the previous year – a spokesman accounted for the discrepancy by saying: “The current figure is not comparable with previous years due to an accounting adjustment of consolidated results.” As a result, the firm claimed its reenues actually grew 2 per cent last year. The corporate department was the practice that contributed the largest share of the revenue with 37.9 per cent, with finance and tax responsible for 37.1 per cent and litigation and arbitration contributing 22.3 per cent. In terms of outgoings, the firm spent more than €2 million (and 500 hours of teaching) on a “technology training plan”.

Cuatrecasas announced 2017 revenues of €247.8 million, which compared to revenue of €270 million the previous year – a spokesman accounted for the discrepancy by saying: “The current figure is not comparable with previous years due to an accounting adjustment of consolidated results.” As a result, the firm claimed its reenues actually grew 2 per cent last year. The corporate department was the practice that contributed the largest share of the revenue with 37.9 per cent, with finance and tax responsible for 37.1 per cent and litigation and arbitration contributing 22.3 per cent. In terms of outgoings, the firm spent more than €2 million (and 500 hours of teaching) on a “technology training plan”.

Better utilisation

Aside from class action specialist Arriaga Asociados (which increased its revenue by 34 per cent to €51.5 million), the firm that reported the biggest increase in billing was Pérez-Llorca, where income rose by a fifth to €4 million. The firm’s managing partner Pedro Pérez-Llorca says the corporate, litigation and regulatory practices were key drivers of the growth. He adds that the increase in revenue was also attributable to “increase utilisation”.

Pérez-Llorca says: “Efforts to better organise our practice groups to better serve clients has resulted in more efficient working.”

The largest law firm in Portugal, MLGTS, saw its revenue increase 10 per cent to €55 million last year, with the growth partly attributable to increase interest from Spanish investors in Portuguese assets. MLGTS partner Tomás Vaz Pinto (pictured) says: “Portugal has successfully overcome the financial crisis and, since 2015/16 the country is back on the map in terms of being a trustworthy place to invest – Portugal is also benefiting from the recovery of the Spanish market as Spain invests a lot in Portugal.” Another one of the heavyweight Portuguese firms, PLMJ, experienced an even bigger increase in revenue with billing going up 13 per cent to €48.5 million – there was substantial growth in corporate and M&A revenue (up 54 per cent), while the EU and competition practice increased billing by 53 per cent. Increases in efficiency also contributed to the increase in revenue: the firm introduced an initiative called PLMJ Focus, which aims to improve interaction between the firm’s accounts department and the different practice areas and “reduce the time needed to issue and send bills” – the stated aim of the initiative is to “reduce errors and bad debts”. Of the ‘big three’ law firms in Portugal, Vieira de Almeida was the one that recorded the biggest increase in billing, with revenue up 15 per cent to €51 million. The increase in income was partly due to a significant increase in work for private equity funds, as well as more work advising pension funds and infrastructure funds.

The largest law firm in Portugal, MLGTS, saw its revenue increase 10 per cent to €55 million last year, with the growth partly attributable to increase interest from Spanish investors in Portuguese assets. MLGTS partner Tomás Vaz Pinto (pictured) says: “Portugal has successfully overcome the financial crisis and, since 2015/16 the country is back on the map in terms of being a trustworthy place to invest – Portugal is also benefiting from the recovery of the Spanish market as Spain invests a lot in Portugal.” Another one of the heavyweight Portuguese firms, PLMJ, experienced an even bigger increase in revenue with billing going up 13 per cent to €48.5 million – there was substantial growth in corporate and M&A revenue (up 54 per cent), while the EU and competition practice increased billing by 53 per cent. Increases in efficiency also contributed to the increase in revenue: the firm introduced an initiative called PLMJ Focus, which aims to improve interaction between the firm’s accounts department and the different practice areas and “reduce the time needed to issue and send bills” – the stated aim of the initiative is to “reduce errors and bad debts”. Of the ‘big three’ law firms in Portugal, Vieira de Almeida was the one that recorded the biggest increase in billing, with revenue up 15 per cent to €51 million. The increase in income was partly due to a significant increase in work for private equity funds, as well as more work advising pension funds and infrastructure funds.