Private equity and pension funds targeting Spanish assets

Significant M&A activity in the infrastructure, real estate and energy sectors means confidence among lawyers regarding deal flow for the next 12 months is high

Spanish M&A lawyers are optimistic regarding the pipeline of deals for the coming year with private equity funds, hedge funds, major pension funds and venture capitalists increasingly targeting assets in the country. Fears that the political situation in Catalonia could deter investors from acquiring Spanish assets have subsided and consequently, there has been substantial deals activity in the infrastructure, real estate and renewable energy sectors. However, investors are also targeting Spain’s healthcare, technology and financial services sectors because, although asset prices may be slightly higher than they were earlier this year, there is still a perception that they are very reasonably priced and offer attractive returns.

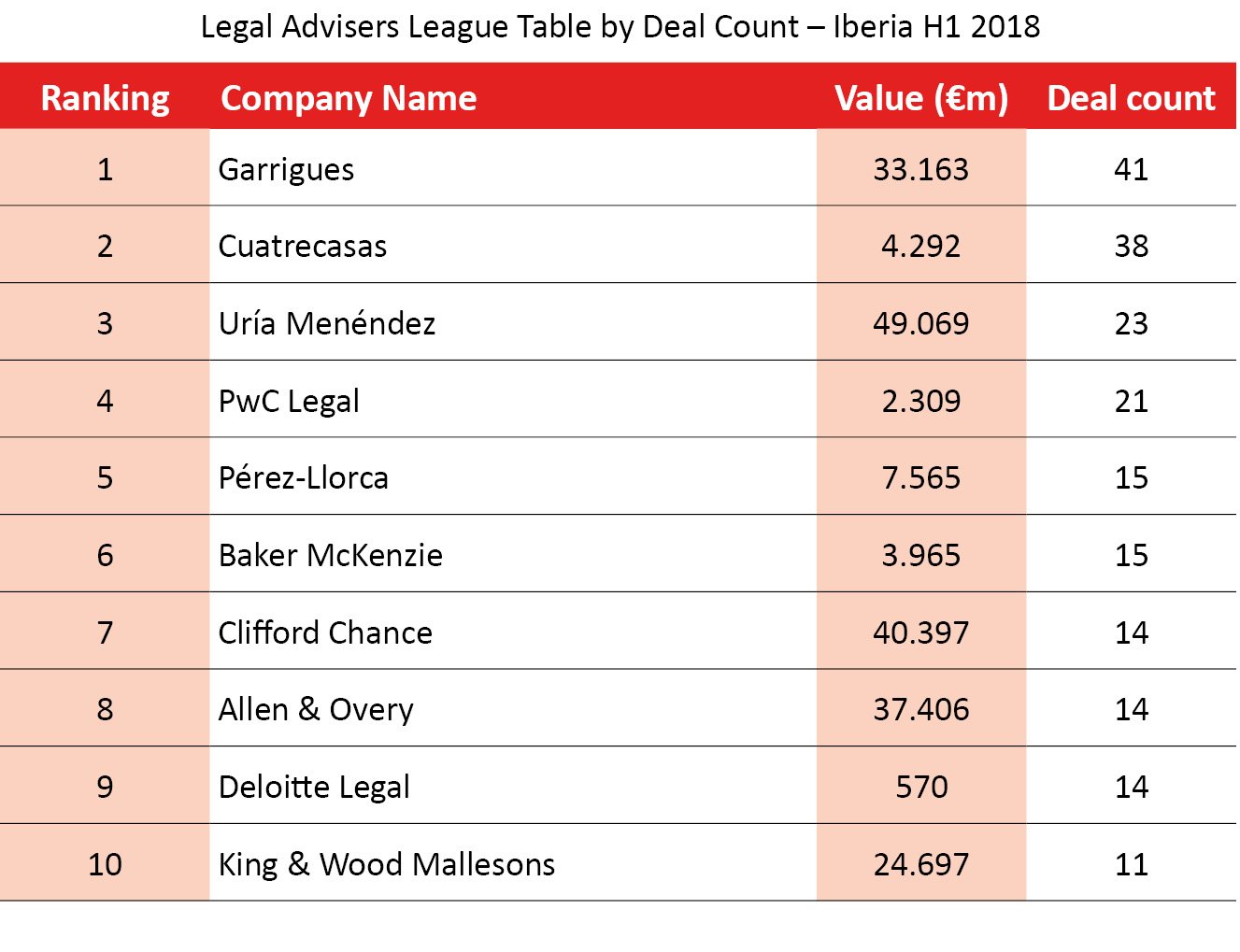

Major Iberian deals in 2018 have included the sale of Abertis Infraestructuras to a consortium including ACS, Atlantia and Hochtief for €32 billion – Abertis’ legal advisers included Garrigues, Uría Menéndez and Herbert Smith, while the acquiring consortium instructed Allen & Overy, Baker McKenzie, DLA Piper, Freshfields Bruckhaus Deringer, Linklaters and Clifford Chance. Other significant transactions included CVC Capital Partners and Corporacion Financiera Alba’s acquisition of a 20 per cent stake in Gas Natural Fenosa for €3.8 billion – legal advisers on this deal included Uría Menéndez, Garrigues, Linklaters, Clifford Chance and Pérez-Llorca.

IPO pipeline

There is considerable activity in the infrastructure, energy and real estate sectors, says Allen & Overy partner Ignacio Hornedo (pictured). He adds: “There are some interesting IPOs in the pipeline, some of which are being run as dual-tracks such as the sale of [oil and gas company] Cepsa. Meanwhile the EDP situation [a Chinese consortium, advised by Linklaters, is bidding to takeover Portuguese utility company EDP] is also generating a lot of interest among investors.” Hornedo also says the restaurant business is another sector currently being targeted by investors.

Infrastructure funds and private equity houses are particularly active in the market, according to Hornedo, who adds that large pension funds are also hunting for assets as they are “forced to diversify their scope of targets in order to be able to deploy the substantial amount of cash they hold”. Meanwhile, private equity funds are particularly keen on mid-market companies at present. “There is still vast confidence in the fundamentals of the Spanish economy and neither the recent government changes, the Brexit uncertainties, nor the situation in Catalonia have affected momentum,” claims Hornedo.

Risk tolerance

The fact that there is currently a “sellers’ market” in Spain means that potential buyers are prepared to tolerate substantial risk. “Some private equity houses are prepared to make acquisitions with no R&W [representations and warranties] coverage,” says Hornedo. “On private equity exits, warranty and indemnity insurance continues to be a hot topic, being considered in almost all deals and finally used in almost half of those exits, according to our own deal stats.”

While financial sector investors, such as private equity funds, continue to be among the most active players in the market, industrial companies are becoming more prominent, says Javier García de Enterría, partner at Clifford Chance, which recently advised telecommunications company Ufinet Spain on its acquisition by private equity firm Antin Infrastructure Partners. García de Enterría adds that the outlook for deals activity in the coming year is positive. “The fundamentals continue to be promising,” he says. However he warns: “There are possible risks, such as possible political instability or a possible reduction of liquidity derived from changes in monetary policy or the macroeconomic situation.”

Pension funds eye Spain

There has been an increase in the number of international pension funds – particularly from Canada and the US – targeting the Spanish market, according to Javier Gómez, partner at Pérez-Llorca. Recent examples of this trend include OPSEU Pension Trust acquiring a 60 per cent stake in Spain-headquartered Bruc Management Projects – the legal advisers were Allen & Overy (for OPSEU) and CMS Albiñana & Suárez de Lezo (for Bruc). Gómez adds that sovereign funds from the Middle East and Asia are also completing deals in Spain. Gómez continues: “The final group is international industrial companies who want to build up their organisations through acquisitions in Spain.”

A surge in takeover bids is one of the most significant M&A trends at the moment, according to Gómez. He adds: “Another trend is the high number of bidders making binding offers [an offer made by a bidder to acquire a target company after the due diligence phase of a sale process is complete – this offer constitutes a formal contract between the bidder and seller should the seller accept the bidder’s terms] in the majority of selling processes.”

Víctor Xercavins, partner at Cuatrecasas, says: “In general terms, global players are seeking to invest in large corporates and mid-market companies.” He adds: “Private equity, hedge funds and even private investors (including family offices) are coming into force as strong players – venture capital is also active as new entrepreneurial businesses are flourishing.”

Source: Mergermarket