Squire Patton Boggs has signed Mayte Requejo, until now of counsel of the same practice at Pérez-Llorca. She also joins Javier Izquierdo‘s team as of counsel to lead the economic criminal area Mayte

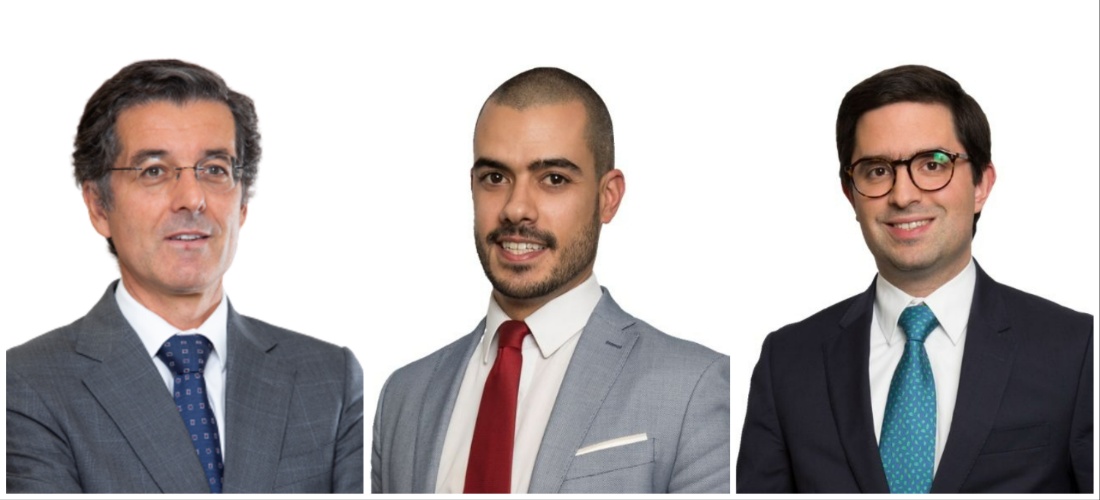

Eversheds Sutherland FCB have announced the promotion of (pictured from left to right) Ricardo Couto, Fábio Loureiro and João Rocha de Almeida to the partnership. Ricardo Couto, who joined Eversheds Sutherland FCB in 2021

The most relevant news of the week published on Iberian Lawyer, read and analysed by Ilaria Iaquinta and Michael Heron. A new episode of the “Week in review”. Every week, Ilaria Iaquinta and Michael Heron

Castellarnau Penalistas, a law firm specialized in economic criminal law and criminal compliance, has moved its headquarters from Barcelona to new offices located at Avenida Pau Casals 7, first mezzanine, also in Barcelona. Image: Eloi Catellarnau,

The Garrigues partners’ meeting, held in Barcelona, has approved – effective January 1, 2024 – the appointment of 16 new equity partners, as well as the appointment of Rosa Zarza as the first woman to hold the position of senior

Eversheds Sutherland Spain has advised Be Mate Apartments in the reorganization of its shareholding resulting from the exit of Room Mate Hotels after the sale of its stake in favor of a new investor, Barlon

Montero Aramburu advises on the acquisition of Cualitas Industrial and

Montero Aramburu Abogados has advised Purever Industries, a leading European group that offers solutions in technical insulation, on the acquisition of the Spanish companies Cualitas Industrial and Instaclack Internacional. The aim is to strengthened its

Andersen advises on the registration of Atlantica new promissory note

Andersen has participated as legal advisor in the promissory notes program of Atlantica Sustainable Infrastructure, for an outstanding balance of 100 million euros. Banca March will be the arranger and, together with Norbolsa, the underwriters. Atlantica

Clifford Chance advises on a 236MW project finance in Spain

Clifford Chance has advised Galp on the Project Finance of five PV plants with an aggregate capacity of 236 MW located accross Spain. Image: partner Jose Guardo, with senior associate Eduardo Sánchez. The c.€120m

Watson Farley & Williams has advised Banco de Sabadell and Banco Pichincha España in a syndicated financing in favor of the student residence Livensa Living Riera-Blanca, owned by Temprano Capital and Brookfield, and granted