Measures against financial and economic crisis: state guarantees – VdA

Following the international financial crisis and consequent breach of investors’ confidence and the increasing difficulties in liquidity raising by Portuguese credit institutions (CIs), particularly in the second half of 2008, the Portuguese State reacted with the enactment of new laws intended to increase investor confidence.

Law n. 60-A/2008, of 20 October, together with the Ministerial Order n. 1219-A/2008, of 23 October, enabled the granting, until December 2009, of extraordinary personal guarantees by the Portuguese State to the CIs and to branches of international banks with registered offices in Portugal, in the context of financing transactions, intended to re-establish market players’ confidence and the smooth functioning of the financial markets.

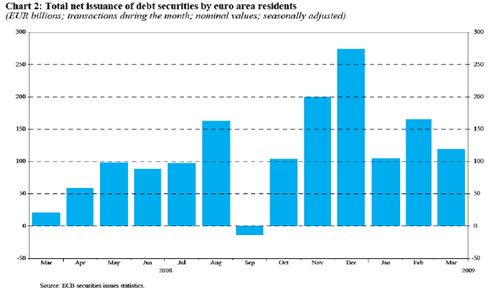

This package of guarantees by the Portuguese State, up to the global amount of €20bn, was approved by the European Commission, as in line with the state aid rules of the Treaty establishing the European Community. Approval was disclosed in the European Commission’s press release dated 30 October 2008, approving the limitation in time and scope, the requirement for payment of arm’s length fees and the availability of this measure, on a non-discriminatory basis, to all CIs with registered offices in Portugal. As a result of the adoption of similar state aid interventions in fifteen European Member States, the total amount of debt issues in the euro area increased very significantly from October 2008 onwards (see chart).

The Ministerial Order sets forth that, if the beneficiary CI calls on the guarantee, it will have to reimburse the Portuguese State in full or exchange the loan for preferential shares. The Portuguese State is also entitled to decide on the adoption of corporate governance measures, on dividend distribution and on the remuneration of the CI’s officers as well as to assign two or more temporary administrators to the CI with similar powers to those granted by the Bank of Portugal to an insolvency agent in an insolvency or financial reorganisation scenario.

Until now, the Portuguese State has granted personal guarantees to seven CIs, mainly to guarantee the obligations arising from issues of bonds, totalling €4.35bn. It is expected that other CIs will require the granting of a personal guarantee up to the end of the year.

According to the follow-up report on the granted extraordinary state guarantees addressed by the Ministry of Finance and Public Administration to the Portuguese Parliament (Assembleia da República), under this scheme, the majority of the bonds guaranteed by the Portuguese State were most likely acquired by CIs and international banks with a view to using them as collateral within Eurosystem transactions, according to the available information on general documentation on Eurosystem Monetary Policy Instruments and Procedures, as they qualify as eligible collateral for ECB transaction’s purposes.

Notwithstanding the above, it is worth mentioning that the first semester of 2009 has witnessed issues of non guaranteed bonds by the major Portuguese banks, among which was the biggest bond issue ever by a Portuguese private bank, which shows signs of the stability and resilience of the Portuguese capital markets, particularly on the debt segment.