Madrid annual report 2018: Making your mind up

The issue of technology will mould the future of law firms as many struggle to innovate – indeed, some will look for mergers as a way of effectively adapting to the digitalisation of the economy

It’s decision time for law firm managing partners. The issue of what technology law firms should invest in is proving to be a perplexing one for many in the legal sector. While it is widely acknowledged by law firm leaders that artificial intelligence (AI) does offer some benefits, many admit they are sceptical about it. Some say initial AI trials have been disappointing, while others – though saying they have faith in such technology – admit progress with AI products has been slower than anticipated.

Partners say law firms struggle with innovation and this is a worry as the economy is becoming ever more digitalised. Some managing partners believe firms’ difficulties implementing new technology could drive consolidation in the sector in an effort to increase efficiency. One partner at a leading firm in Madrid predicts more mergers involving the biggest law firms in the world – some of whom have operations in Spain – in the near future.

Diversity is another issue managing partners have to urgently address. Clients are increasingly asking for evidence of law firms’ diversity policies before making decisions about who will be receiving their business.

Calls for lawyers to be ‘ambassadors’, while AI doubts grow

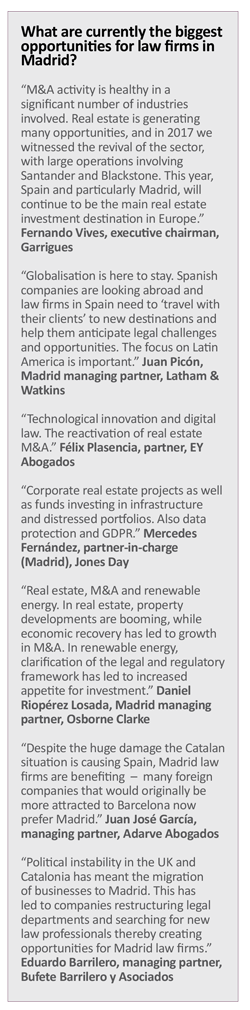

Spain’s strong economic growth boosting law firms, but managing partners predict more legal market consolidation as firms struggle to be innovative

Event: Iberian Lawyer Madrid Roundtable

Host: Allen & Overy

With foreign investors looking to acquire assets in Spain, lawyers can play an important role in giving them the confidence that potential deals will be successful, attendees at the Iberian Lawyer Madrid Roundtable heard. With some regulators in Spain making investors nervous, lawyers can play an ‘ambassadorial’ role and help to give them assurance. Meanwhile, there is doubt among managing partners about the effectiveness of using artificial intelligence in law firms.

With foreign investors looking to acquire assets in Spain, lawyers can play an important role in giving them the confidence that potential deals will be successful, attendees at the Iberian Lawyer Madrid Roundtable heard. With some regulators in Spain making investors nervous, lawyers can play an ‘ambassadorial’ role and help to give them assurance. Meanwhile, there is doubt among managing partners about the effectiveness of using artificial intelligence in law firms.

International investors have a large appetite for transactions in Spain, according to Allen & Overy co-managing partner Antonio Vázquez-Guillen. He added that renewable energy sector disputes are currently generating significant opportunities for law firms, while capital markets work is also increasing. Vázquez-Guillen said law firms have an important role to play in attracting investors to Spain by acting as guarantors for the success of deals. “One of the challenges for Spain is winning the trust of investors, the way some industries are regulated means there are risks,” he explained. Vázquez-Guillen added that law firms in Spain are able to attract the best talent who can act as the “best ambassadors” for the country.

International players are targeting assets in the Spanish infrastructure, energy and finance sectors, according to Clifford Chance Spain managing partner Jaime Velázquez. “There is more confidence in the Spanish market, a few years ago most investment was opportunistic,” he added. With regard to law firms’ investment in technology, Velázquez added that there is a distinction between software that makes firms more efficient and other technology that can “add value” for clients. “For example, there are safe platforms that allow you to work with clients and add value,” he explained.

The strength of the Spanish economy is creating many opportunities for law firms, said Baker McKenzie Madrid managing partner Rodrigo Ogea. “Spain has had the strongest growth in the Eurozone for the last three years,” he added. Ogea also said there were significant opportunities for law firms in relation to private equity deals, fintech, blockchain and the General Data Protection Regulation (GDPR). He added that one of the major challenges and opportunities for many industries is “digital transformation”. From a macroeconomic standpoint, Ogea said that rising oil prices and the “expected end of quantitative easing and recent political developments were creating uncertainty”.

There will be mergers among law firms, according to Ogea, who added that most law firms “still struggle to be truly innovative”. He continued: “Law firms’ positioning on digital transformation is key, clients don’t want to deal with reactive law firms any more – they expect innovative legal advisors with the ability to anticipate legal threats and opportunities resulting from disruptive technology.”

Given that in the past five years, Spanish companies have managed to adequately refinance, there are many opportunities to invest in good companies, said Ontier managing partner Pedro Rodero. He added that law firms in Spain have a high level of knowledge and talent to offer clients, but they face the challenge of remaining profitable. “We are facing a fight on prices and we have to create proposals that offer good quality and seniority [of lawyers], the major firms have to position themselves for top quality work,” Rodero said.With regard to the issue of law firms investing in technology, Rodero said it is not always clear what type of technology firms should invest in and when they should do it. “There is confusion – technology can be obsolete in 12 months, in the next two years, firms may team up with companies full of professionals that do due diligence in partnership with law firms,” he added.

Despite the political uncertainty in Catalonia, there has been considerable M&A and private equity activity in Spain, according to DLA Piper Spain managing partner Pilar Menor. “Real estate is attracting foreign investors, particularly the shopping centre and residential sectors,” she added. “Meanwhile, GDPR, e-privacy and post-M&A workforce restructuring work is also generating opportunities for lawyers.” Menor also said she expected to see some consolidation in the legal market as well as a “fight for talent”, which will lead to more lateral hires. She added it was possible there could be new players entering the legal market. Meanwhile, Menor said law firms face the challenge of managing “two generations” within law firms, specifically older lawyers and younger ‘millennials’, who want more flexibility in their careers.  There is considerable liquidity in the market, which means it is a “good moment” for corporate law firms, said Roca Junyent Madrid managing partner Carlos Blanco. However, he also warned that, with the US Federal Reserve increasing interest rates, there is likely to be an interest rate increase in Europe too. But Blanco said the “risk of populist parties taking power in Spain was disappearing because the economy is improving”. He added that mid-market companies in Spain have learned to export “more and better” and that investors now know that, given the internationalisation of Spanish companies, if they invest in a Spanish company, they are “not only investing in the Spanish market”.

There is considerable liquidity in the market, which means it is a “good moment” for corporate law firms, said Roca Junyent Madrid managing partner Carlos Blanco. However, he also warned that, with the US Federal Reserve increasing interest rates, there is likely to be an interest rate increase in Europe too. But Blanco said the “risk of populist parties taking power in Spain was disappearing because the economy is improving”. He added that mid-market companies in Spain have learned to export “more and better” and that investors now know that, given the internationalisation of Spanish companies, if they invest in a Spanish company, they are “not only investing in the Spanish market”.

Blanco said that given the digitalisation of the economy, traditional companies and venture capital funds are increasingly investing in newer companies whose business is based on ´Big Data’. He continued: “Some of these big data companies have a high valuation, we’re now seeing deals of €20 million, €30 million and €50 million in value, with these valuations based on future expectations for the company, instead of EBITDA (earnings before interest, taxes, depreciation and amortization) – there are now new deals that involve such companies whose price could potentially be hundreds of millions.” Spanish companies have now become international players with the result that law firms in Spain are able to refer a significant amount of work to their international networks, said Ashurst Spain managing partner María José Menéndez. She added: “Clients are now much more knowledgeable about the legal market and more likely to use different firms – this is an opportunity for law firms to differentiate themselves in the market for high-end work where price doesn´t matter that much.” Menéndez said law firms face a “fight for talent” and the “shape of the careers” wanted by younger lawyers was not always clear. Meanwhile, it is becoming more unusual for leading corporate firms to do due diligence work, said Menéndez. She added the ‘Big Four’ have made inroads into the legal due diligence market and that it is often packaged with their financial due diligence offering. But Menéndez said major firms that now do less due diligence will need to find new methods for training young lawyers who, in the past, “used to learn a lot by doing due diligence”.

Spanish companies have now become international players with the result that law firms in Spain are able to refer a significant amount of work to their international networks, said Ashurst Spain managing partner María José Menéndez. She added: “Clients are now much more knowledgeable about the legal market and more likely to use different firms – this is an opportunity for law firms to differentiate themselves in the market for high-end work where price doesn´t matter that much.” Menéndez said law firms face a “fight for talent” and the “shape of the careers” wanted by younger lawyers was not always clear. Meanwhile, it is becoming more unusual for leading corporate firms to do due diligence work, said Menéndez. She added the ‘Big Four’ have made inroads into the legal due diligence market and that it is often packaged with their financial due diligence offering. But Menéndez said major firms that now do less due diligence will need to find new methods for training young lawyers who, in the past, “used to learn a lot by doing due diligence”.

Regulatory matters, arbitration, as well as finance-related and capital markets work is generating a lot of work for lawyers in Spain, said Juan Manuel de Remedios, executive partner in White & Case’s Madrid office. However, he added pricing is a major challenge for law firms, as is procurement in the sense that lawyers have to increasingly deal with procurement professionals. “You have to talk to people who don’t know you and who just have a budget,” Remedios said. He added law firms also face the issue of having to make decisions about which technology to invest in – for example, when addressing the issue of cybersecurity – and such investment “can affect profitability”. With regard to the issue of major corporate firms doing less due diligence and using less junior lawyers, Remedios warned that if firms “reduce the base of the pyramid, it will impact negatively on profitability”.

Law firms are benefiting from significant activity in sectors such as real estate and technology, said Pérez-Llorca senior partner Pedro Pérez-Llorca. He added law firms now need to invest the income they are receiving, and that not doing so involves many risks. “Partners should not overpay themselves,” he said. He added that, while law firms have chosen to invest in artificial intelligence, the “potential success of such investment is still questionable”. He also said the success of the ‘Big Four’ in the Spanish market has been limited and that they do not have major roles in the biggest deals.

While law firms are increasingly using artificial intelligence, the impact of such technology has been slower than expected, according to Linklaters Madrid managing partner Iñigo Berricano. He added that artificial intelligence will probably mean law firms have to train young lawyers differently and that it could have an impact on how law firms hire people. He said, ultimately, firms will have fewer junior lawyers in future. Meanwhile, Berricano predicted that “agile working” will become a more common legal market trend in future as studies have shown law firm offices are often under-occupied. He also said there is certain to be more law firm mergers and added that Linklaters is “bound to have an alliance with a US firm” eventually.

Deciding how to invest resources in a growing M&A market is a key issue for law firms, said Freshfields Bruckhaus Deringer Madrid managing partner David Franco. “There is a risk of trying to capture too much work and overlooking client relationships,” he said. Franco added he is sceptical about law firms’ ability to develop “proprietary artificial intelligence” that sets them apart from the rest. “Artificial intelligence is for the time being about training and using a tool in ways that not all other law firms will – AI doesn’t add the same value in all areas, though it can be particularly useful, for instance in antitrust investigations.” Franco says AI provides law firms with opportunities to improve service and increase profitability, but firms should ensure they do not offer commoditised AI-based services.