M&A activity in Portugal slows down due to political deadlock – Caiado Guerreiro

As new coalition backed by ‘extreme left wing parties’ takes shape, investors are exercising caution amid concerns that M&A deals are set to decrease

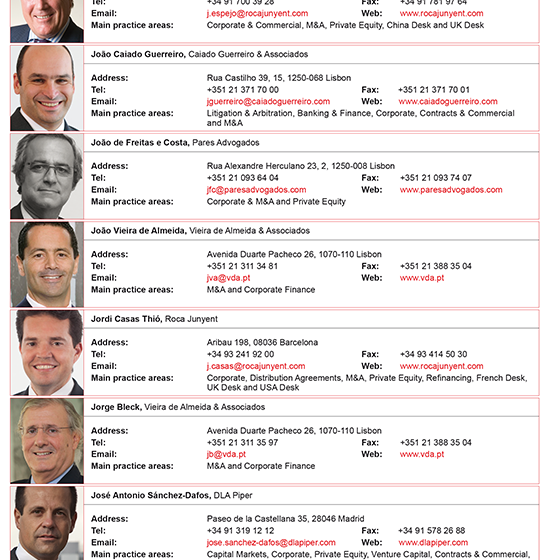

The political impasse caused by the collapse of the Portuguese centre-right government in October has stalled the brisk M&A activity the country had been witnessing over the last two years. Whether there will be a recovery in deal-flow will depend largely on what transpires in the coming months, according to João Caiado Guerreiro, managing partner at Caiado Guerreiro in Lisbon.

However, despite this political uncertainty, there is still optimism that assets in Portugal will remain attractive to foreign investors. Initiatives such as the ‘golden visa’ programme have been successful in luring Chinese investors in the country with the result that investors from elsewhere have followed their lead.

“In M&A we had one of the best years to July, and then we had the election, and that has made investors uncomfortable,” Caiado Guerreiro says. “The Chinese started it,” he says, referring to the buyers who set the M&A ball rolling in the country, with large, headline-making deals such as State Grid and China Three Gorges acquiring REN and Energias de Portugal respectively. “The Chinese investors’ bought many companies, in the energy, services, insurance, real estate and tourism sectors, both buying for themselves as well as with a view to building the companies up for their own clients.” He also points to the fact that European investors, as well as a number from the US have taken advantage of low prices in Portugal to acquire companies.

Unexpectedly quick recovery

Caiado Guerreiro says the non-domiciled tax regime and the so-called ‘golden visa’ programme, allowing major investors to acquire residence permits, are two factors that have contributed to the growth in M&A deals over the last couple of years.

“We were very successful in attracting Chinese investors with the ‘golden visa’ and I think everybody got curious,” he says. “If you had told me three years ago that we would have had such a speedy recovery, and that we would be seeing a lot of activity in the real estate sector, I would have said you were crazy.”

Caiado Guerreiro attributes the surge in investor interest in Portugal to the acquisitions made by Chinese companies, which have resulted in the country becoming the fourth-largest recipient of Chinese investment in the EU, while only being the EU’s tenth largest economy. Caiado Guerreiro says a significant amount of M&A activity is also attributable to the ongoing clean-up from the financial crisis. He adds: “There have been company restructurings, leading to divestments, as many companies were suffering from excess debt and the banks were forcing companies to sell.” The Portuguese banking sector has also attracted the attention of foreign investors, and deals will be struck over the next year and a half, Caiado Guerreiro says.

M&A deal volume will decrease

But the toppling of prime minister Pedro Passos Coelho’s government after losing its majority has put the brakes on M&A activity. “We would have seen more M&A activity if it had not been for the political instability driven by the election,” Caiado Guerreiro argues. “A lot of investors are now waiting to see what will happen, and we are looking at what the new left wing coalition will do which will be a socialist coalition, supported by the extreme left wing parties, and I think that the volume of M&A deals will drop,” he says.

However, Caiado Guerreiro expects that smaller deals will continue to close. In contrast, a very big deal represents a lot more risk, especially acquiring a company producing consumer goods, for example, amid the uncertainty over whether the incoming government will implement a VAT hike, or an “even worse case scenario”, which could represent a significant risk, according to Caiado Guerreiro. He says the injection of Chinese capital into Portuguese firms has enabled them to expand their operations, and with China still enjoying strong annual growth, Portugal remains very well placed to continue attracting investment from China as well as from other countries.

However, Caiado Guerreiro says maintaining political stability and programmes like the ‘Golden Visa’ and the non-domiciled tax regime will be key. He concludes: “The news of Chinese investment activity in Portugal has people in boardrooms in companies from other countries asking themselves why they are not investing in Portugal too.”