Litigation & ADR annual report 2018: Consumer conflict

Consumers are showing an increased willingness to take on banks and major corporates, a trend that is being driven, in part, by increases in third party funding – meanwhile, there are calls for the establishment of an ‘arbitration hub’ in Iberia

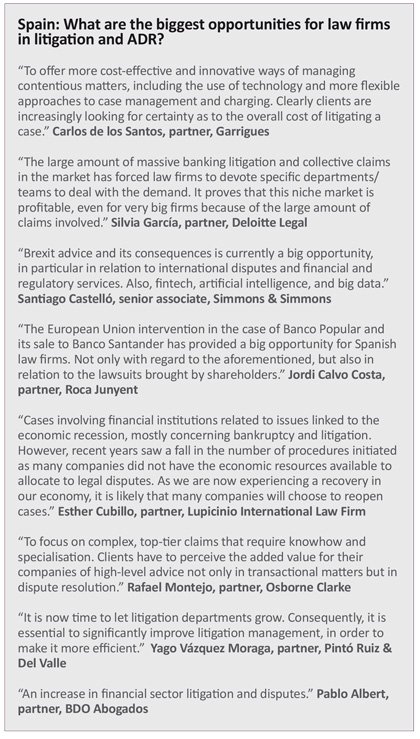

Consumers of financial products in Spain and Portugal are growing in confidence and now know that they have the ability to take legal action against banks that have mis-sold them any of their products. Indeed, financial sector disputes are a key source of work for lawyers in Iberia. However, though class actions may be most common in the finance industry at present, energy and telecoms consumers are also expected to increasingly seek legal redress if they believe they have been mistreated by major corporates. Meanwhile, third party funding is expected to fuel a surge in such claims, in addition to anti-trust disputes. Elsewhere, arbitration is growing in popularity, so much so that lawyers in Madrid say steps should be taken to establish the city as an ‘arbitration hub’ given the popularity of the Spanish language around the world. They also argue that Spain’s close links with both South America and North America, and its proximity to Africa, make it the ideal choice for international arbitration.

Banks selling NPLs

Banks selling NPLs

Óscar Franco Pujol, partner at DLA Piper, says claims for antitrust-related damages is a growing area for law firms. He adds that the sale of non-performing loans (NPLs) by banks should also generate a significant amount of contentious work. “In the last year, around €50 billion of NPLs have been sold in Spain and some of this will turn into litigation,” Franco Pujol says.

Acquisition of debt and shares by funds will also lead to a significant amount of litigation, says Linklaters partner Borja Fernández de Trocóniz. “Funds are more aggressive in the way they act as shareholders – they want returns, they are fearless about litigation and they think less about relationship issues.” he adds. Financial litigation related to banking matters is another major source of legal work, according to Uría Menéndez partner Álvaro López de Argumedo, who adds that his firm has acted for banks in many such cases. Meanwhile, though class actions may, at present, be most common in the finance sector, they are likely to soon become a feature in other consumer sectors, such as energy and telecoms, argues Borja de Obeso Pérez-Victoria, partner at Gómez-Acebo & Pombo.

Increasingly, the defence of class actions is being handled by clients’ in-house lawyers rather than being referred to external law firms, says José Antonio Rodríguez, partner at Ashurst. “Some law firms, meanwhile, have created departments of paralegals to handle such claims,” he adds. Alberto Fortún, partner at Cuatrecasas, says there are already well established firms that are focused on creating new types of class action. He cites recent international news referring to class actions brought against Intel or Apple. “From the perspective of law firms representing the defendants in such cases, you need to have good co-ordination of the defence and this requires teams of lawyers used to working with other jurisdictions,” Fortún adds.

There is a huge appetite for the third party funding of legal claims, says Pérez-Llorca partner Fernando Bedoya, who adds that consumer, antitrust and restructuring-related claims are among the types of business being targeted. Cristina Coto, partner at Ruiz Gallardon Abogados says third party funding is “now on the rise in Spain, particularly in relation to international disputes”. Lawyers say that major law firms generally don´t handle consumer cases – which may involve thousands of claims – rather, they develop a defence strategy for the initial cases brought against new products and then when the number of claims multiplies, these are passed on to “factory firms” that are geared up to handle lots of cases. Mass consumer litigation does not generate significant work for major law firms as the profitability of handling such cases tends to be lower, says Fernández de Trocóniz. Fortún adds that product liability litigation, especially in relation to the intellectual property aspects, is a growing area of work for law firms. M&A and investment-related disputes are another significant growth area for law firms, according to Bedoya.

Meanwhile, Allen & Overy partner Javier Castresana points out that in cases where “new players have taken control over corporates after an equity investment or a loan to own strategy, it is becoming more and more common for new owners to revise decisions taken by former shareholders and consider legal action against directors and former directors”. He adds: “Although we expect a decrease in the amount of restructuring and insolvency litigation, we expect it to become much more sophisticated and complex.” Another trend is for transactions to involve litigation from the outset, with funds using litigation as part of “workout” processes, lawyers say.

Madrid’s opportunity

López de Argumedo says that, when Spanish companies have disputes abroad, they find it preferable to go to arbitration instead of foreign courts. He adds that Madrid has an opportunity to establish itself as an arbitration hub, particularly considering the amount of arbitration involving parties in Latin America, which has the same language and a similar culture to Spain. However, other partners argue that there is a lot of mistrust among Spanish clients regarding arbitration.

However, one says that when it comes to disputes abroad, Spanish clients are willing to go to arbitration, “otherwise they have to rely on a court in an obscure jurisdiction”. That said, lawyers also point out that, in the infrastructure sector, clients are more familiar with arbitration and therefore more willing to use it for resolving disputes.

Regarding arbitration, Obeso Pérez-Victoria says Spain “needs to think in global terms and not from a domestic perspective”. He adds: “We should be able to refer to Madrid as an international arbitration hub as we have all the tools to achieve it: (i) our language, history and culture is the same as that of millions of people from many other countries; and (ii) we have a privileged geopolitical situation (as a member of the EU, with very strong connections to both North and South America and we are the nearest European country to Africa).” Obeso Pérez-Victoria continues: “There is no doubt that nowadays Paris is a reference in the arbitration world. Our challenge is to position Madrid as the next international arbitration hub in the coming years.”

However, López de Argumedo argues that the number of arbitration cases is increasing in Spain and that the country is ranked fourth in the world, according to ICC statistics, in terms of jurisdictions supplying the most parties in arbitration cases.

There are problems in the arbitration community in Spain in that the “same faces” are often seen in arbitrations and this “creates mistrust”, according to Rodríguez. Fortún says that there needs to be more “due diligence” carried out when selecting arbitrators. He adds: “Continuing legal training is also a requirement for arbitrators as the quality of awards is not good – the parties should have a clear understanding of why they have won or lost the case.”

Some lawyers say that one of the benefits of arbitration is that, compared to litigation, it is a quicker way of resolving disputes. However, others argue that arbitration does not necessarily mean a speedy end to conflicts. One partner at a leading Spanish firm says: “Arbitration is not quick, it can take two or three years, and that’s not acceptable.” He adds that the cost of arbitration can also act as a deterrent for some clients: “Arbitrators are not brave enough to impose costs on the losers.”

Great future for mediation?

Arbitration, and alternative dispute resolution (ADR) in general, is becoming a bigger source of revenue for law firm’s dispute resolution departments. Fortún says that “two-thirds of the billable hours generated by Cuatrecasas’ dispute resolution department is ADR-related, (including arbitration)”. However, the ratio in other major firms is closer to 50 per cent, lawyers say. Though it is not a major trend, clients are showing a greater tendency to consider mediation, says one partner. Rodríguez is convinced that mediation has a “great future” in Spain. “I think Spain will follow the path of the UK, though litigation is cheaper in Spain than it is in the UK,” he adds.

Clients embarking on major arbitrations increasingly ask their legal advisers what technology they will be utilising and whether or not they use project managers, Castresana says. “There will be a battle for time and cost efficiency,” he adds. In addition, clients ask for fee estimates and, more specifically, they want fees charged for “each phase” of the work that is done, says one partner. International arbitration, particularly involving parties from Latin America, is a big opportunity for Spanish law firms, lawyers say. “One of the most exciting and promising trends in ADR is the rapid expansion of international arbitration,” says Dechert partner Érica Franzetti. “Particularly noteworthy is the expansion of international commercial arbitration beyond the Western world and into a broader array of industries—including life sciences and financial services.” Franzetti says that investor-state arbitration is also on the rise. “Some observers thought that the number of investor-state cases would dwindle in the face of political and social criticism,” she says. “The fact that the reverse has been true speaks to the fairness, utility and efficacy of the investor-state system – Mexico’s recent decision to join ICSID is a key illustration of this fact.”

International arbitration, particularly involving parties from Latin America, is a big opportunity for Spanish law firms, lawyers say. “One of the most exciting and promising trends in ADR is the rapid expansion of international arbitration,” says Dechert partner Érica Franzetti. “Particularly noteworthy is the expansion of international commercial arbitration beyond the Western world and into a broader array of industries—including life sciences and financial services.” Franzetti says that investor-state arbitration is also on the rise. “Some observers thought that the number of investor-state cases would dwindle in the face of political and social criticism,” she says. “The fact that the reverse has been true speaks to the fairness, utility and efficacy of the investor-state system – Mexico’s recent decision to join ICSID is a key illustration of this fact.”

With regard to the increase in international investment arbitration, it will be important for law firms to create “pan-European teams” that are able to handle such matters, says Baker McKenzie partner José Ramón Casado. However, he adds that there is little interest in arbitration in the domestic Spanish market.

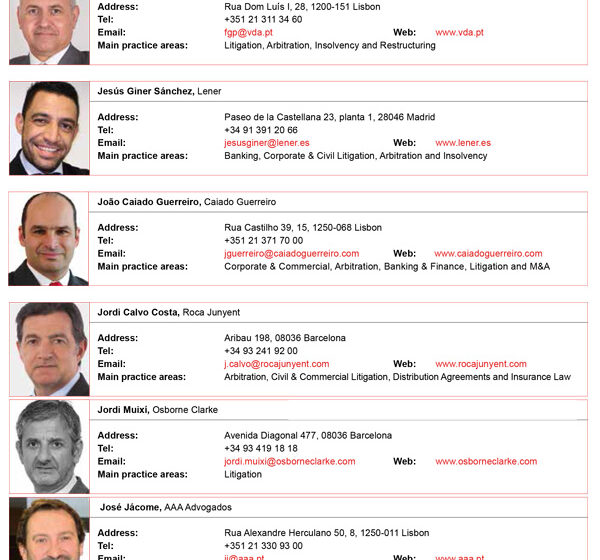

Portugal: Class actions emerging

There was considerable financial sector litigation in Portugal in the last year, says João Duarte de Sousa, partner at Garrigues in Lisbon. “The ongoing litigation in the wake of the collapse of Banco Espírito Santo has been one of the driving forces behind litigation in Portugal,” he adds. Duarte de Sousa also says there has been a significant number of real estate-related disputes as a large amount of foreign investment has come into the sector. In addition, he says that, “while insolvency cases are in decline, there is a high demand from clients for insolvency risk assessment, primarily for two reasons: firstly, many of the relevant transactions involved distressed or high risk assets; and secondly, the issues of the past are still fresh in everybody’s minds, causing a dramatic rise in investors’ fears and anxiety that counterparties will fail to honour their commitments”.

Meanwhile, in the ADR arena, the number of disputes resolved through arbitration continues to increase, according to Duarte de Sousa. He says: “Among other factors, the efforts of recent years to include arbitration clauses in commercial contracts are now paying off.” However, he adds there is little enthusiasm in Portugal for mediation to resolve commercial disputes.

Class actions are an emerging trend in Portugal, according to MLGTS partner Filipe Vaz Pinto. He says: “There are new small, sophisticated players in the legal market promoting collective actions against companies, they are commercially driven and inspired by class actions in the US.” Vaz Pinto cites the example of investors launching “multiple coordinated actions” against banks and he predicts that there will be similar “collective actions or even class actions in the telecoms and energy sectors”. Class actions will also be given further impetus by those brought against car manufacturer Volkswagen in relation to diesel emissions, says PLMJ partner Pedro Metello De Nápoles.

Financial sector litigation is increasing because there is now a feeling that “anyone can go up against banks” in a dispute, according to Abreu Advogados partner Alexandra Nascimento Correia. And it is expected that financial sector litigation will continue to be a major source of work as banks will continue to “come under close scrutiny from regulators”, says Uría Menéndez-Proença de Carvalho partner Alexandre Mota Pinto. Meanwhile, Vieira de Almeida partner Sofia Ribeiro Branco says that there could be an increasing number of antitrust private enforcement cases in future “if Portugal adopts the European rules governing actions for damages for infringements of the competition law provisions of the Member States and of the European Union Text”. What is EU Text?

Third party funders

There has been an enormous increase in court fees in Portugal in recent times, which has had the effect of dissuading clients from being litigious, says João Caiado Guerreiro, managing partner at Caiado Guerreiro. “Consequently, some clients are not willing to take on very big companies,” he says. Caiado Guerreiro adds that court fees plus lawyers’ fees can sometimes amount to as much as 4 per cent of the settlement.

There has been a notable trend of third party funders contacting major law firms in Portugal with a view to possibly funding legal disputes says Cuatrecasas partner Rita Gouveia. Vaz Pinto points out that third party funders are not only targeting clients that do not have the financial resources to pay for litigation: “Third party funders are also focusing on clients that want to manage litigation risk in a different way.” Caiado Guerreiro says that there have been cases of third party funders from the UK and the US offering to advance sums of €1m to fund disputes in return for getting a bigger share of the eventual settlement.

Metello De Nápoles says that the use of arbitration is increasing in Portugal, but it can still be difficult to convince domestic clients that arbitration is a quicker way of solving disputes. He adds that one of the possible reasons why arbitration is not more popular among domestic clients is that litigation is cheaper in Portugal than it is in other jurisdictions.

One of the biggest challenges for Portugal in the near future is to convert Lisbon into an attractive seat for international arbitration “involving parties from Portuguese-speaking countries”, says Duarte de Sousa. He adds: “This goal should be taken nationwide and underpinned by Portuguese public authorities, as the economy will not only benefit from it, but thrive.” Caiado Guerreiro says that finding the appropriate experts to participate in arbitration cases can be difficult: “Often the details are significant and it can be difficult to find someone to translate mining terms into Portuguese, for example.” Arbitration is criticised in some quarters because there is a view that it is “not based on fact, but rather on negotiation,” Gouveia says. She adds that some clients are requesting that contracts allow the possibility of appealing against arbitration rulings, while some are also asking for foreign arbitrators to be appointed.

Angolan arbitration

Angolan arbitration

Arbitration where Angolan law is the applicable law is an “opportunity for lawyers in Portugal to cooperate with Angolan Lawyers”, according to Vaz Pinto, particularly where arbitrations are “seated outside Angola”. In this context, he highlights opportunities in the oil, construction, transport and infrastructure sectors. Meanwhile, with regard to Portugal, Vaz Pinto says there is a significant number of post-M&A disputes, particularly in relation to price-adjustment mechanisms and breaches in ‘reps and warranties’

The complexity of cases in Portugal and the sophistication of the parties involved is increasing, and this means more demanding and challenging work for legal advisers, according to Linklaters counsel Ricardo Guimarães. He adds that, with regard to arbitration, there is “a perception that the associated costs are high”. Guimarães continues: “But this is partly because, with arbitration, parties have to pay the court fees over a shorter period of time than when taking disputes before the state courts. The fact is that, in general terms, and above a certain threshold, arbitration can involve lower costs than litigation in state courts.”

The issue of arbitration not offering the prospect of appeal could be one reason for its unpopularity lawyers say. Regarding the issue of whether arbitration should be permitted in proceedings related to public procurement, Caiado Guerreiro says there are doubts about whether it is “politically feasible” to do so. He cites the example of the head of the IMF, Christine Lagarde, being found to be negligent for not contesting a state pay out of around €400 million – following arbitration proceedings – to the businessman Bernard Tapie, when she was France’s finance minister.

Ribeiro Branco says that the confidentiality of arbitration proceedings offers benefits for the parties involved. “In civil litigation conducted by the judicial courts, anyone can have access to sensitive information which can then be used against the parties,” she adds. Gouveia says Cuatrecasas has a dedicated team for international arbitration as well as a team focusing on insolvency litigation. Meanwhile, Metello De Nápoles says around 30 per cent of the revenue generated by PLMJ’s dispute resolution lawyers is arbitration-related.

Gómez-Acebo & Pombo partner Ricardo Campos says that his firm has separate teams for arbitration and litigation. He adds that, with regard to arbitration in particular, the firm has a very strong construction practice. “Construction cases are often very complex and always involve very technical issues,” Campos explains. He also says that international construction-related disputes, namely disputes related to FIDIC (the International Federation of Consulting Engineers) contracts, are usually resolved by Dispute Adjudication Boards, which are composed of panels of impartial experts.

Lawyers in Portugal acknowledge that major firms are often unprepared for defending class actions. “The larger firms are typically more focused on individual cases, but class actions may have to respond to 30 to 40 claims – this puts a lot of pressure on younger lawyers,” one partner says.

While clients are increasingly demanding fixed fees from their legal advisers, they are willing to pay high success fees, lawyers say. One partner argues that price is not always the main concern of clients and that some place a greater emphasis on “credibility and experience of high-profile cases”.

The increased investment in the Portuguese real estate and tourism sectors will inevitably lead to disputes, say lawyers. Other growth areas for law firms are anticipated to be litigation related to regulatory issues as well as infrastructure-related disputes. Meanwhile, sport arbitration is also expected to present significant opportunities for law firms, says Nascimento Correia. She adds that there is also the potential for post-insolvency disputes, as well as construction-related cases in Angola and Mozambique.