Litigation & ADR annual report 2017: Getting squeezed

Law firms that defend clients in class actions are buckling under the weight of the thousands of claims they have to contend with – consequently they face the choice of turning down work due to lack of resources or bolstering their teams to meet demand

Class actions are becoming increasingly popular as the public seek to hold financial institutions, in particular, to account for alleged misdemeanours. This phenomenon is enabling law firms that represent plaintiffs to dramatically increase their revenue, but for the firms that represent defendants in such cases, it is a trend that is proving difficult to adjust to. The sheer volume of claims being made in class actions means that some firms admit that they simply do not have the resources to provide their client with the service they expect. And this situation is going to get worse before it gets better – various financiers have spotted an opportunity to make money by financing class actions and have identified Spain in particular as having significant potential in this respect. Hence, lawyers report that potential investors are busily trying to identify what other financial products could potentially be the subject of a mass consumer lawsuit. Meanwhile, in Portugal, dispute resolution lawyers are still overwhelmingly occupied with untangling the mess left by the collapse of Banco Espírito Santo.

Consumer cases rising

Consumer cases rising

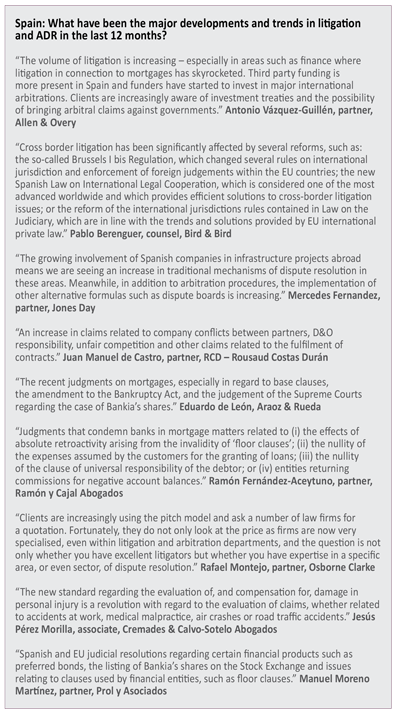

Disputes relating to restructuring and pre-insolvency matters are creating a lot of work for lawyers, according to Miguel Virgós, partner at Uría Menéndez. He adds that, during the crisis, there were fewer transactions completed and consequently, there is now less M&A-related litigation, though it is growing. However, Virgós says there has been a “huge rise in consumer-related litigation”. He continues: “In the financial sector, there have been many class actions and also thousands of individual claims being made against the same defendants – to the point that this has created a new brand of law firm, which will be here for a long period. We think that there will also be more disputes in the field of competition law.”

José María Alonso, managing partner of Baker McKenzie says that an increase in class actions against banks has seen some law firms – that survive on contingency fees – build up huge structures with around 300 lawyers. He claims that there has been an increase in “post-M&A claims” due to an increase in transactions involving mid-sized companies. Meanwhile, white collar crime cases are also generating dispute resolution work for lawyers.

Another trend is for certain groups to see opportunities in class actions and therefore they seek to “invent new types of claim” that could involve telecoms companies or insurance companies, for example, according to Ontier’s Spain managing partner Pedro Rodero. He adds that it can be very problematic for a law firm that is defending a major client against a class action because of the volume of claims. Rodero says that there is a “real industry building up in class actions – investment funds are trying to find opportunities to finance massive class action claims.” Araoz & Rueda partner Clifford Hendel says there is a trend of “very sophisticated, well-heeled global entities financing very large claims” with a particular focus on the Spanish market. Alonso says that new firms handling class actions could create a problem for law firms that defend clients in such cases in that they “will be forced to add more resources, paralegals included, to properly support such clients”. Meanwhile, Pérez-Llorca partner Guillermina Ester says a series of rulings from the European Court of Justice have encouraged increases in consumer litigation.

However, some law firms are having to scale down the size of their dispute resolution teams due to decreases in activity in certain areas, according to Linklaters partner Francisco Málaga. “There has been a fall in banking litigation as well as a decline in insolvency cases, so law firms will have to adapt to this new environment,” he says.

Public suspicion

Every few years, a new sector is hit by massive consumer claims, says Cuatrecasas, Gonçalves Pereira partner Alberto Fortún. Consequently, the Supreme Court in Spain has an important role to play in “closing the gates” and stopping more such claims, he says. There is a “certain public suspicion” of financial institutions, says Linklaters partner Borja Fernández de Trocóniz. He adds that this mood has led to a wide variety of claims against all kinds of financial products, even of the “plain vanilla” variety. Fernández de Trocóniz also says that real estate litigation is a growing trend. According to Fortún, with regard to class actions, Cuatrecasas has a pool of lawyers across Spain which it uses to handle claims. He adds that class actions are raising issues with regards to the “type of work we accept in order to ensure that clients get added value”.  The next wave of claims will relate to expenses clauses and the Supreme Court is “opening the doors to this,” says Allen & Overy partner Javier Mendieta. He adds: “For example, clients are looking at expenses incurred when they were granted mortgage deals.” Mendieta says that mass litigation will continue because it is cheap in Spain and “everyone [involved in those type of lawsuits] thinks they will win”. He says another current trend in litigation is claims for damages related to infringements of competition law.

The next wave of claims will relate to expenses clauses and the Supreme Court is “opening the doors to this,” says Allen & Overy partner Javier Mendieta. He adds: “For example, clients are looking at expenses incurred when they were granted mortgage deals.” Mendieta says that mass litigation will continue because it is cheap in Spain and “everyone [involved in those type of lawsuits] thinks they will win”. He says another current trend in litigation is claims for damages related to infringements of competition law.

Managers at companies in Spain have to be educated about the benefits of mediation, according to some lawyers. However, one partner argues that clients are now “more willing to listen and learn about how mediation works”. The partner adds that, in 2016, there was an increase in the number of construction-related cases where parties considered mediation. But other lawyers argue that there needs to be a change in the law before parties in Spain begin to start using mediation – however, this is unlikely to happen soon as it is “not currently a priority” for Spain’s Ministry of Justice, one partner says.

There is huge competition for dispute resolution work among law firms in Spain. Major corporations are more likely to put work out to tender, lawyers observe, and this is added to the fact that increasingly, procurement professionals at companies are responsible for buying legal services rather than general counsel, the problem being that procurement professionals may have a less detailed understanding of legal services than in-house lawyers. As one partner comments: “When I started, clients were loyal to one law firm, but now clients want three or four offers. Law firms now have to adapt their cost structures as they need to maintain their margins, partners need to be involved in matters and this is more expensive – when we talk to people within companies [responsible for buying legal services], they often know nothing about law.” As a consequence, such companies often base their buying decision purely on price. One partner at a leading international firm in Madrid comments: “They only realise their mistake when things go south and they find the work they did was shoddy; choosing the cheap solution may end up being more expensive, but it can be difficult to convince clients to pay double the fee because they are receiving better advice.”

The need to say ‘no’

There is also a perception that Spanish clients are more likely to negotiate hard with law firms in Spain than they would with international law firms. “Spanish clients don’t discuss fees with US or UK firms,” says one partner. Another partner adds: “It’s a case of Spanish clients knowing the marketplace in Spain, they are scared in the US market, there they think that if they choose [and pay for] the best, if things go wrong it won´t be their fault.” Some lawyers say there is a difference between Spanish clients and international clients when discussing fees and that it is often “easier” to deal with international clients.

Other lawyers argue that law firms need to be prepared to turn down work if the proposed fee is too low. “Sometimes clients want you to be innovative, but you need to say ´no’ sometimes. Clients may say they know another firm that is offering their service at half the price, but dumping prices harms the whole sector,” says one partner. As another partner remarks, when clients ask their legal advisers to be “innovative” it generally means they want their legal advisers to reduce their fees. Meanwhile, another partner at a leading law firm in Spain says some international companies “choose three law firms and put them under an umbrella contract and then say, for example, ‘if we give you more than €1 million of work, you will then give us a discount’ – this creates a conflict”.

However, some lawyers claim that declining rates represent an opportunity for law firms. “This is an opportunity to know ourselves better – law firms need to criticise and study their business model,” says one partner. A leading Madrid-based litigator adds: “In some cases, lowering fees might be justified, for instance if it is a new client, but generally when it comes to law firms working for a lower price, they should instead drop cases.”

Mendieta says he expects litigation to grow, particularly consumer-related claims. “New products will be found to claim against,” he says. Meanwhile, Mendieta says there will also be an increase in restructuring-related disputes in the coming year. Gómez-Acebo & Pombo partner Javier Izquierdo says he is optimistic that work will increase in the next 12 months. “There will be work representing financial entities and probably also real estate litigation,” he adds. Virgós says that events such as Brexit mean we are in “times of change”, but he adds: “The uncertainty they [such events] bring about, though bad for society, is creating new opportunities for the legal profession.”

There will be less restructuring and banking-related litigation and more disputes relating to M&A and white collar crime, says Málaga. “Some major firms are currently not handling white collar crime disputes but they will need to because they will boom,” he adds. Meanwhile, Hendel says third party funders will stimulate large, innovative cases “not only in traditional areas such as investment claims or mass consumer claims, but also in areas such as bankruptcy, competition law and IP”. In addition, there will be an increase in international investment arbitration, according to Fórtun.

Portugal: D&O cases increasing

Portugal: D&O cases increasing

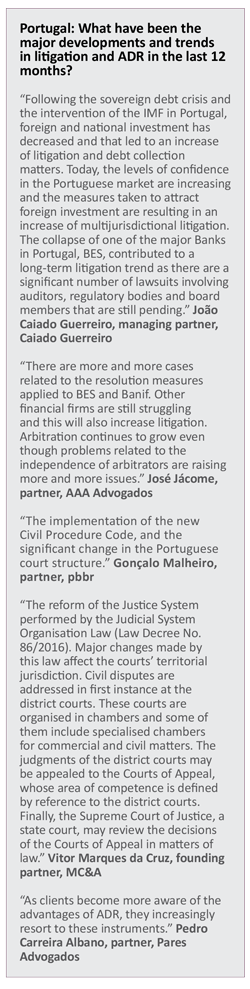

Much of Portuguese law firms’ dispute resolution work relates to the collapse of Banco Espírito Santo (BES) three years ago, explains PLMJ partner Nuno Líbano Monteiro. “There are new cases starting, many of which are complex and high value,” he adds. Líbano Monteiro says there is significant litigation related to clawback [for example, payments to senior employees that need to be returned in instances where a company goes bankrupt]. Such conditions have led to a large number of complex directors and officers (D&O) cases, he says, some of which involve directors of banks and telecoms companies. In addition, Líbano Monteiro says there has been significant growth in arbitration work in the last 12 months.

Disputes involving Portugal Telecom – which relates to financial mismanagement at the company linked to the collapse of BES and the way former board members ran the business – has been a trend in the last year, says Frederico Gonçalves Pereira, partner at Vieira de Almeida. He adds that another new trend has been litigation related to the international expansion of Portuguese companies, specifically disputes involving public works in some African countries. “There has been litigation connected to bank warranties related to investments in a number of countries,” Gonçalves Pereira says. He continues: “We are seeing more international investment arbitration, while arbitration relating to public works in Angola is another opportunity.”  Francisco Proença de Carvalho, partner at Uría Menéndez – Proença de Carvalho say that litigation and ADR is a major growth area for the firm. “We now have seven partners [in Portugal] working in this area – a lot of the work relates to financial institutions and includes white collar crime and civil litigation, while there is also litigation relating to insolvency, restructuring and real estate, as well as international arbitration.”

Francisco Proença de Carvalho, partner at Uría Menéndez – Proença de Carvalho say that litigation and ADR is a major growth area for the firm. “We now have seven partners [in Portugal] working in this area – a lot of the work relates to financial institutions and includes white collar crime and civil litigation, while there is also litigation relating to insolvency, restructuring and real estate, as well as international arbitration.”

There was an “explosion of civil litigation” in 2016, according to MLGTS partner Miguel de Almada. “The BES issue has shaken the market, and companies, investments and projects have been affected and there are more disputes,” he says. “There has been steady growth in alternative dispute resolution (ADR) work, though financial institutions still resist arbitration and seem to feel safer with litigation.” Nuno Pena, partner at CMS Rui Pena & Arnaut says financial institutions often refuse to enter into arbitration because of the issue of transparency. He adds: “There is a concern that the public will see it as things being cooked behind closed doors.” However, Linklaters counsel Ricardo Guimarães says clients are increasingly using ADR because some court cases are “still taking too long and clients do not wish to perpetuate their disputes”.

There has been an increase in professional liability disputes relating to company directors and officers, but also in relation to other professions such as doctors, lawyers and engineers, says Maria José de Tavares, partner at SRS Advogados. She adds: “We are also advising on an increasing number of disputes between companies – in the pharmaceutical, oil, and telecoms sectors – related to indemnity claims connected to the violation of competition laws. Abreu Advogados partner Natália Garcia Alves says there has been a rise in professional liability cases involving doctors and hospitals. Meanwhile, Pena says the EU Directive on Antitrust Damages Actions will present opportunities for lawyers.

The resolution of the Portuguese bank Banif will result in litigation, according to Líbano Monteiro. He adds that there will also be disputes involving non-performing loans. In addition, Libano Monteiro says there will be telecoms-related disputes, while there has also been a significant increase in class actions and mass litigation related to pollution and the environment.

Investing in litigation

Investing in litigation

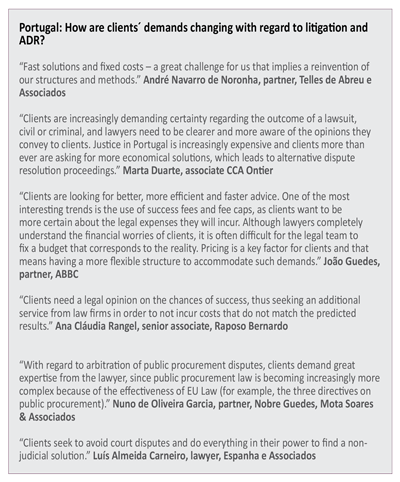

Law firms are investing a lot in their litigation departments, says Guimarães. “Firms’ litigation and arbitration departments have bigger workloads and therefore need bigger and more specialised teams to handle these matters,” he adds. Guimarães says there are more professional negligence cases and this is a trend that is likely to grow. He also says that, with regard to compliance, there is growing demand for legal advice because of stricter regulations. In addition, the “Brexit effect” could also lead to more litigation and arbitration work, according to Guimarães.

Fees are going up, according to one partner at a leading firm in Lisbon. “Fees are not as problematic,” he says. “Clients are more aware of the importance of a good lawyer and good lawyers cost money – we have lost some cases on price, but we have won others with little discussion on fees; Portuguese entities recognise the importance of a good lawyer.” Lawyers say mortgage-related litigation will be an opportunity in the coming, while it is anticipated that class actions will also increase. “Class actions are coming to Portugal, it is cheap to file a class action here,” says one partner.

There will be a steady growth in litigation in the next 12 months and there will be more lateral moves between law firms involving litigators, according to some lawyers. “Forty per cent of our firm’s revenue comes from litigation – firms will try to reinforce their departments in the coming year,” says one partner.

MLGTS’ De Almada says his firm is increasingly involved in international disputes, including arbitration with no direct relation to Portugal. The prospect of Portugal having to have a second European Union/International Monetary Fund bailout is a concern among lawyers. “If there was a new bailout for Portugal, that could mean more litigation,” says Rui Tabarra e Castro, associate at FCB Sociedade De Advogados. He adds: “Fees might become a problem [for litigation and ADR work], clients want capped fees.” Pena says he is “concerned about the possibility of a second bailout for Portugal, the last bailout deterred investors in Portugal”.

Disputes related to debt transactions represent an opportunity for law firms, according to Garcia Alves. She adds: “Compliance is also leading to an increase in litigation because regulators are becoming more effective, especially in areas such as health and hospitals.” Cuatrecasas, Gonçalves Pereira partner Miguel Esperança Pina says: “The number of cases will decrease [in the coming year]; there will be a decrease in arbitration activity – I don´t see the Portuguese economy growing, though I think the real estate sector will generate more work.” However, De Tavares says litigation departments will keep growing, but the number of disputes will decrease. She adds: “Our work is not only related to the courts, we also analyse [for clients] the risk of disputes, as well as liability, in relation to transactions.”