Linklaters, Cuatrecasas advise on €50m Nexus’ securitisation fund launch

Linklaters has advised Mirabaud Group on the launch of a €50 million asset-backed securities fund for Nexus Energía, counselled by Cuatrecasas, to enhance its financing through credit rights derived from its turnover

Nexus Energía has launched two new instruments to improve and diversify its sources of financing and accompany the growth of the company. Firstly, Nexus Energía has just registered the securitisation fund HT NEXUS FT with the aim of obtaining financing from the credit rights derived from its turnover. The fund, which will have a maximum amount of €50m, will be instrumented through securitisation notes that will be listed on the Mercado Alternativo de Renta Fija (MARF) and to which Axesor has given a rating of A-.

The fund will enable Nexus Energía to obtain recurring financing at competitive interest rates for the purchase of energy from the resources of interested investors, who will acquire securitisation notes backed by their outstanding invoices insured by Coface.

Swiss bank Mirabaud, with extensive experience in securitisation transactions and an international distribution network, acted as Structurator and Global Coordinator of the transaction.

Haya Titulización, a benchmark in the Spanish securitisation market, acted as fund manager and advisor registered with MARF. Linklaters and Cuatrecasas acted as legal advisors to Mirabaud and Nexus, respectively. As part of this strategy of diversification of funding sources, Nexus Energía has also renewed the promissory note programme registered in the MARF, for a total value of €50 million.

In this regard, the appropriate management of derivatives and the company’s financial diversification has contributed to Axesor Rating upgrading Nexus Energía’s BB rating to a positive trend. The company plans to allocate the resources obtained to consolidate the growth of Nexus Energía and green investments, such as the signing of new renewable energy purchase agreements (PPA, Power Purchase Agreement).

Nexus Energía’s CFO, Albert Rams, said: “These two operations are an example of Nexus Energía’s ability to diversify its sources of financing and show the market’s confidence in the company’s project, which operates in a sector with as much potential as the commercialisation of sustainable energy.”

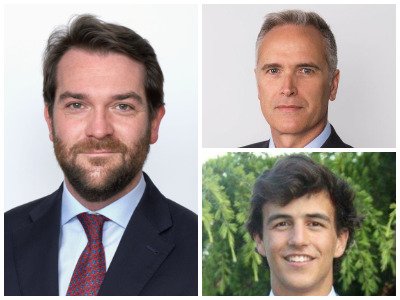

Linklaters´ team was made up of partner Jorge Alegre (pictured top left), counsel Juan María Lamo (pictured bottom left) and associate Héctor Garrido while Cuatrecasas´ team was formed by partner Miguel Cruz (pictured top right) and associate Alfonso Peña (pictured bottom right).