KPMG advises KKR on €971m Reintel acquisition

KPMG Abogados has acted as Tax advisor to KKR on its acquisition of a 49% stake in Reintel for €971 million

The Board of Directors of Red Eléctrica Group has approved an agreement reached via its subsidiary Red Eléctrica Corporación with KKR, on the terms of investment by KKR in Reintel, the leading dark fibre infrastructure operator in Spain. The transaction comes after a four-month sale process which attracted the interest of several infrastructure funds.

As part of the transaction, KKR will acquire a 49% stake in Reintel for a total of €971 million. Red Eléctrica Group will continue to be the controlling shareholder and will retain the accounting consolidation of Reintel.

The agreed transaction value represents an enterprise value of €2.3 billion for 100% of the business, implying an EV/2021E EBITDA of 22.1 times, unlocking the hidden value in Red Eléctrica Group and demonstrating Reintel’s leadership position in the Spanish dark fibre market.

Both shareholders are fully committed to creating long-term value for Reintel, underpinned by the company’s existing strong position in the dark fibre market and the deployment of resources by KKR to support its ongoing business and harness future growth opportunities.

KKR is making the investment in Reintel through its core infrastructure strategy which focuses on investing in high-quality assets in developed OECD markets. This will afford long-term strategic support for Reintel.

This transaction represents a key milestone in Red Eléctrica Group’s 2021-2025 Strategic Plan, which provides for the integration of partners into certain strategic assets to allow the Group to harness growth opportunities and optimise the capacity of its telecommunications businesses to generate value.

Roberto García Merino, CEO of Red Eléctrica Group, said: “Following an extremely thorough research process, we are delighted to have reached an agreement with KKR, which will be a highly prestigious, long-term strategic partner to the Group going forward. This agreement clearly underscores the value of the Group’s telecommunications activity and will support its future development, reinforcing the essential services we provide to society.”

The transaction is subject to customary conditions including the applicable regulatory approvals and is expected to close in Q2 2022.

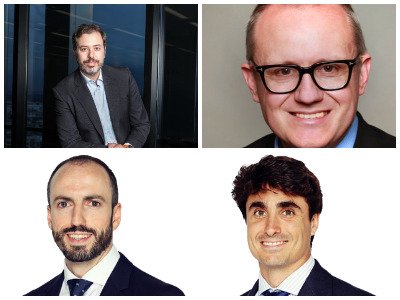

KPMG Abogados Tax M&A area advised KKR on the Tax restructuring and the Tax Due Diligence on this deal with a team led by partner Carlos Marín (pictured left), director David Pascual (pictured top right), senior manager Alberto Fernández (pictured bottom right) and senior associate David Fernández.

Uría Menéndez also advised on the dea and the team consisted of Manuel Echenique (partner, M&A-Private Equity, Madrid); Guillermo del Rio (senior associate, M&A-Private Equity, Madrid); Luis Núñez Lagos (junior associate, M&A-Private Equity); Santiago Saínz (senior associate, finance, Madrid); Manuel Vélez (partner, regulatory) and Tomas Arranz (Partner, antitrust, Madrid).