Freshfields secures Project Finance protection for Portigon before ICSID

Freshfields Bruckhaus Deringer has represented Germany´s Portigon against Spain before ICSID, securing a ground-breaking decision for project financiers

On 20 August 2020, the ICSID arbitration tribunal in Portigon AG v Kingdom of Spain rendered a ground-breaking decision that opens the doors of investment treaty protection to project financiers in circumstances where the projects they financed are adversely impacted by state measures.

The arbitral tribunal held that Project Finance (in the form of long-term loans and interest rate hedging instruments) constitutes a protected investment under the Energy Charter Treaty (ECT) and the ICSID Convention.

German financial services provider Portigon AG, alongside many other international banks, provided hundreds of millions of euros in financing for the development, construction and operation of over 30 Renewable Energy projects in Spain.

Portigon’s claim against Spain is based on the reduction in value of the financing provided: the drastic changes to the regulatory framework adversely affected the cash flow of the Renewable Energy projects financed by Portigon, impairing their creditworthiness, and thus the value of the financing.

This decision will likely have significant implications for financial institutions and their Project Finance investments, since Project Finance lenders may seek protection under international investment treaties against state measures adversely affecting the project.

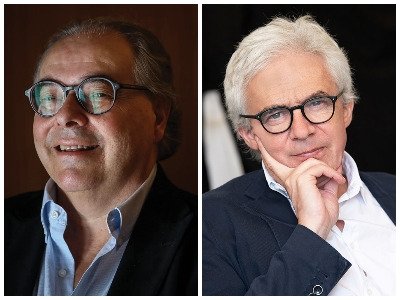

Freshfields represented Portigon with a cross-border team from Germany and Spain. The Spanish team was led by Corporate/M&A of counsel Ignacio Borrego (pictured left), together with Corporate/M&A senior associate Ana Calvo (pictured right), both experts in Regulatory and Energy practice.