Energy annual report 2018: Winds of change

Technological innovation is revolutionising the energy sector, but there is a lack of clarity regarding the future regulation of the market

The energy sector is developing at a frantic pace. Consequently, predicting how these developments will impact on the industry is not easy – for example, lawyers highlight innovations in battery technology, which facilitate the storage of renewable energy, as a potential game-changer. However, investors are ploughing money into the Iberian energy sector with funds, in particular, currently looking to both invest and divest. Infrastructure funds, especially, are among the most active players in the market. However, the prospect of regulatory changes casts an ominous shadow, with many clients and lawyers completely unaware of how the regulatory framework could look in the near future. That said, it is anticipated that there will be a considerable number of M&A transactions in the next two to three years, and this is set to trigger a significant amount of financing and restructuring work for lawyers. Indeed, it is anticipated that there will be a lot of consolidation in the energy sector in the next two-to-three years, with many disposals of energy assets expected. However, if energy regulations do change, and become more onerous, lawyers say that the prospects for some energy projects could be damaged. As one partner remarked, “infrastructure funds and pension funds don’t like regulatory risk”.

A wider variety of players are entering the energy market, with some investors who have not traditionally targeted renewable energy, for example, now doing so as they look to diversify their portfolios. Meanwhile, with regard to the Spanish market, efforts to improve the energy sector’s connections with France are also expected to generate substantial work for lawyers.

Energy lawyers also say that with new technology set to “change the sector dramatically” in the future, greater interaction with technology lawyers will become the norm.

Spain: Regulatory concerns not deterring investors

New players are entering the energy market as they focus on acquiring regulated assets and consequently, it is expected there will be a considerable number of M&A transactions

Event: Iberian Lawyer Energy Roundtable (Madrid)

Host: Bird & Bird

While there is considerable uncertainty regarding the future of energy sector regulation in Spain, it is not deterring foreign investors, attendees at the Iberian Lawyer Energy Roundtable in Madrid said. Oil and coal companies are among the businesses looking to diversify their portfolios and consequently, they are targeting Spanish renewable energy assets. However, with new developments in battery technology facilitating the storage of renewable energy, predicting the future of the industry is becoming increasingly difficult.

While there is considerable uncertainty regarding the future of energy sector regulation in Spain, it is not deterring foreign investors, attendees at the Iberian Lawyer Energy Roundtable in Madrid said. Oil and coal companies are among the businesses looking to diversify their portfolios and consequently, they are targeting Spanish renewable energy assets. However, with new developments in battery technology facilitating the storage of renewable energy, predicting the future of the industry is becoming increasingly difficult.

Bird & Bird partner Hermenegildo Altozano said that despite the fact that energy sector regulation in Spain is frequently changing and is consequently unpredictable, funds still have a significant appetite for investment in energy assets. “There have been a significant number of M&A transactions in the last year, partly because oil and gas companies are looking to invest in other forms of energy,” he added. Altozano said that energy assets are also attractive because the prices of such assets are falling.

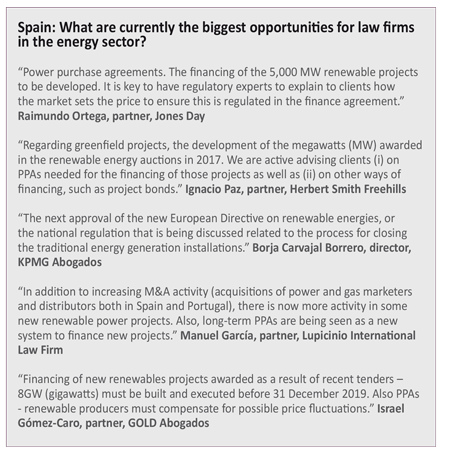

There is significant liquidity in the market and this means there are new players entering the energy sector, according to Ashurst partner Manuel López. He added: “Investors are interested in these assets because they offer regulated revenues.” However, López said that there is also uncertainty about future regulation of energy in Spain because the current regulatory period ends in 2019 and the public is exerting pressure on the government in relation to electricity prices. He added that this means that considerable energy-related regulatory work will be generated for law firms.

Despite the regulatory risks, investment funds from China and the US are interested in regulated assets such as those in the Spanish energy sector, said Uría Menéndez partner Juan Ignacio González Ruiz. He added that there was a lot of potential solar resource that was currently not being exploited. González Ruiz also said that more projects are now being developed on a “merchant basis” [that is, projects that will not receive any (or only fairly limited) tariff support, which in turn means that such plants are assuming, in full, the pool pricing and dispatching risks]. This means that there is a greater likelihood of projects being developed and this generates more work for lawyers.

There are an increasing number of power purchase agreements (PPAs) being signed in Spain and these are attracting a lot of investors, says Watson Farley & Williams Madrid managing partner María Pilar García Guijarro. She added that developments in battery technology – which enables the storage of renewable energy – are expected to generate more opportunities for law firms. In addition, García Guijarro said that access conflicts, which is “one of the bottlenecks in relation to solar energy”, will also generate work for lawyers. She also said that there are a wide variety of energy assets on sale in Spain and that different types of investors, “who are able to access capital at different costs, are able to acquire all kinds of assets given the different returns on the investments that each investor can accept”.

Oil and coal companies are keen to add renewable energy projects to their portfolios and are interested in such assets in Spain, said Freshfields Bruckhaus Deringer of counsel Ignacio Borrego. He added that a lot of investors are coming from Asia, and specifically China and Japan – the attraction of the Spanish market is that the country has a good track record in relation to energy projects: “We know how things are done.” In general, Borrego believes there will be a significant amount of energy market transactions in future, while regulatory matters will also generate substantial work for law firms.

Oil and coal companies are keen to add renewable energy projects to their portfolios and are interested in such assets in Spain, said Freshfields Bruckhaus Deringer of counsel Ignacio Borrego. He added that a lot of investors are coming from Asia, and specifically China and Japan – the attraction of the Spanish market is that the country has a good track record in relation to energy projects: “We know how things are done.” In general, Borrego believes there will be a significant amount of energy market transactions in future, while regulatory matters will also generate substantial work for law firms.

Spanish energy assets are currently attractive to investors, especially those who are looking to diversify their portfolios, said Cuatrecasas partner Luis Pérez de Ayala, who added that there were now larger scale energy projects being developed than was the case in previous years. However, he added that with energy-related technology developing so quickly it is difficult to accurately predict the future of the sector. “The sector is moving very quickly, there is new technology, for example battery storage is there, things will change quickly,” Pérez de Ayala said.

MVA Associados partner Gervasio Martínez- Villaseñor said that the Spanish energy grid is well-developed and this is an advantage for the country in terms of attracting investors. He added that large utility companies and oil companies will be major acquirers of renewable energy assets in Spain “in the long run”. Martínez- Villaseñor also said that investment funds are currently very active in the energy sector. “Investment funds are driving the green field development of renewable energy plants while infrastructure funds are also looking to acquire regulated assets”, he said.

MVA Associados partner Gervasio Martínez- Villaseñor said that the Spanish energy grid is well-developed and this is an advantage for the country in terms of attracting investors. He added that large utility companies and oil companies will be major acquirers of renewable energy assets in Spain “in the long run”. Martínez- Villaseñor also said that investment funds are currently very active in the energy sector. “Investment funds are driving the green field development of renewable energy plants while infrastructure funds are also looking to acquire regulated assets”, he said.

There is a growing demand for legal advice related to energy projects, with regulatory and M&A work in particular increasing, said Rousaud Costas Duran partner Federico Belausteguigoitia. However, there is little transparency regarding the energy regulator’s decisions, argue some lawyers. “It would be advisable to have more transparency regarding the decisions of the Spanish energy regulator,” said Linklaters partner José Giménez. He added: “When the regulator announces changes to the regulation but fails to specify the scope and timeline, investors tend to either cancel or postpone their deals – therefore, the more regulatory changes there are (or uncertainty regarding such changes), the fewer M&A operations and the more work for regulatory lawyers.”

Portugal: Solar and biomass projects on the increase

Development and construction of renewable energy projects that sell into the ‘spot market’ or via PPAs represent significant opportunities for law firms

Plans to develop new solar and biomass projects in Portugal represent a significant opportunity for the nation’s lawyers. Meanwhile, advising banks on energy financing, as well as advising on energy-related corporate restructurings are also expected to generate considerable work for law firms. However, “disruptive technology” could change the sector considerably and create openings for new market players.

Plans to develop new solar and biomass projects in Portugal represent a significant opportunity for the nation’s lawyers. Meanwhile, advising banks on energy financing, as well as advising on energy-related corporate restructurings are also expected to generate considerable work for law firms. However, “disruptive technology” could change the sector considerably and create openings for new market players.

Among the biggest developments in the Portuguese energy sector in the last year was the introduction of new rules for obtaining electricity generation permits when the requested capacity exceeds grid capacity, says MLGTS partner Catarina Brito Ferreira. She adds that the aim of these new rules was to establish a new framework for such circumstances – the aim is to tackle the “excessive requests for capacity for solar energy”. Brito Ferreira also says the major opportunities for law firms in the near future include the development, construction and operation of renewable energy projects selling in the “spot market” or through long-term power purchase agreements (PPAs), as well as energy storage and self-generation/self-consumption.

Vieira de Almeida partner Ana Luís de Sousa says there are a significant number of new greenfield energy projects being discussed and planned for the near future, particularly solar and biomass projects. She adds: “It is worth highlighting the first financing of a full merchant photovoltaic project, under a corporate PPA.”

Solar projects represent the biggest opportunity for law firms, according to CMS Rui Pena Arnaut partner Mónica Carneiro Pacheco. “Solar capacity in Portugal is growing quickly, partly due to the decrease in photovoltaic (PV) modules prices,” she adds. Regarding the aforementioned new regulations for obtaining electricity generation permits when the requested capacity exceeds grid capacity, Carneiro Pacheco says: “It is not certain that this regime will help the solar sector to grow but the intention seems to be as such.” PLMJ partner Manuel Santos Vitor says other significant opportunities for law firms include advising developers on renewable energy projects, advising banks on energy financing, as well as representing investors in M&A deals. However, Santos Vitor adds that a significant problem for clients is the “considerable time” it takes to address licensing and environmental requirements and “get answers from public agencies”.

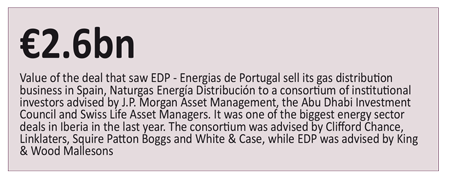

In the coming year, there could potentially be an increase in energy-related corporate restructuring “in order to integrate portfolios acquired by purchasing entities”, says Cuatrecasas partner Francisco Santos Costa. He adds: “Furthermore, EDP Group’s ongoing deleveraging process and divestment of non-core assets will certainly continue to boost the domestic M&A market.” Santos Costa says he expects the increase in M&A activity will largely involve “small-to-medium-size portfolios”. He continues: “Core areas are still the wind sector, as overseas investors are looking for stable regulated assets, and the solar PV sector, where the bulk of the opportunities lie in green field projects licensed under the general regime as a result of the sponsors’ need to share projects’ risk and comply with the tight deadlines applicable to the construction phase.”

In the coming year, there could potentially be an increase in energy-related corporate restructuring “in order to integrate portfolios acquired by purchasing entities”, says Cuatrecasas partner Francisco Santos Costa. He adds: “Furthermore, EDP Group’s ongoing deleveraging process and divestment of non-core assets will certainly continue to boost the domestic M&A market.” Santos Costa says he expects the increase in M&A activity will largely involve “small-to-medium-size portfolios”. He continues: “Core areas are still the wind sector, as overseas investors are looking for stable regulated assets, and the solar PV sector, where the bulk of the opportunities lie in green field projects licensed under the general regime as a result of the sponsors’ need to share projects’ risk and comply with the tight deadlines applicable to the construction phase.”

The development of merchant PPA contracts which, “depending on size, also entail sophisticated project financings,” represents an opportunity for Portuguese law firms, says Uría Menéndez-Proença de Carvalho partner Bernardo Ayala. He adds that energy company EDP’s 278 municipal concessions of low voltage electricity distribution networks are “starting to expire” and this will generate work for law firms. “New public tenders for the awarding of new concession contracts are expected to take place between 2018 and 2019,” Ayala says.

The biggest challenges energy clients face include market and regulatory changes resulting from the Winter Package [as the EU’s Clean Energy Package 2020-2030 is known], capacity constraints and “lack of financing when price certainty is not ensured”, says Vieira de Almeida partner Vanda Cascão. She adds: “Technology disruption and new methods of producing and using electricity add to investors’ uncertainty.”

Meanwhile, Linklaters managing associate Vera Eiró says “strategic and financial investors such as private equity and infrastructure funds are faced with a myriad of competition and regulatory issues in the sector”. She adds this poses the problem of having to “understand the regulatory context and trying to anticipate the political moves that may lead to changes affecting how projects are implemented”.

Other issues clients have to address include “disruptive innovation and technological development, which are unlocking potential right across the energy sector and creating opportunities for those who can adapt fast”, says Cavaleiro & Associados partner João Cavaleiro. He adds that, with regulators having an inconsistent approach, cross-border compliance is “exceedingly tricky”. Meanwhile, areas such as anti-bribery, trade sanctions, tax and “anti-cartel” laws pose a “potentially devastating risk” for clients, according to Cavaleiro.

Other issues clients have to address include “disruptive innovation and technological development, which are unlocking potential right across the energy sector and creating opportunities for those who can adapt fast”, says Cavaleiro & Associados partner João Cavaleiro. He adds that, with regulators having an inconsistent approach, cross-border compliance is “exceedingly tricky”. Meanwhile, areas such as anti-bribery, trade sanctions, tax and “anti-cartel” laws pose a “potentially devastating risk” for clients, according to Cavaleiro.

Meanwhile, Miranda & Associados partner João Rosado Correia argues that it is important to acknowledge the need for cooperation between the electricity and the gas sectors, by “developing integrated solutions and reinforcing the complementary nature of both energy systems”. He adds that this could involve “allowing recourse to power-to-gas solutions in order to store energy supply surpluses and to lower demand via combined heat and power (CHP) solutions”. Telles de Abreu counsel Ivone Rocha says “decentralised production and energy performance contracts for energy efficiency in the public sector” currently represent the biggest opportunities for law firms.