Emerging threat – EY Abogados

EY Abogados is planning significant expansion in the coming years, but are its ambitions to be recognised as a multi-disciplinary firm realistic?

The ´big four´ auditing firms are starting to cause unease in Madrid. Managing partners at the capital´s leading law firms talk of the growing threat posed by the major accountants and their legal arms. EY Abogados is one of those ´big four´ that are making firms in Spain a little anxious. And it is not hard to see why.

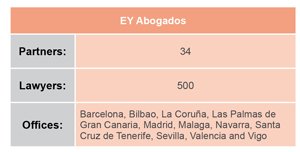

The firm is targeting explosive growth in the Spanish market – it currently has 500 lawyers across its 11 offices in Spain, but it aims to double this total to 1,000 by 2020. And it may be of concern to rival firms that EY Abogados is prepared to use the considerable financial resources of its worldwide network to try and attract the best lawyers in Spain. “The firm is committed to investing in high level lawyers,” says EY Abogados managing partner Federico Linares. “We are looking to recruit high level lawyers from law firms in Spain and we are also interested in teams.”

This sounds impressive, but does the firm have any evidence that it can back up this strategy of taking top lawyers from rival firms with action? Yes, Linares argues, pointing to the recent recruitment of Freshfields Bruckhaus Derringer´s global people partner Richard Norbruis in its London office – Norbruis was responsible for recruitment, learning and development, partner development and leadership in his previous role. Commenting on Norbruis´ appointment at the time, Cornelius Grossmann, EY’s global law leader, said Norbruis´ experience in the legal services market would bring “strong momentum to the ongoing global expansion of our law practice.”

Leading Spanish firms could suffer

Market insiders say that it is the leading Spanish firms – rather than the US and UK heavyweights – that should be the most worried about any threat posed by EY Abogados. “It´s difficult [for the auditors] to fight the Anglo-Saxon law firms,” says one lawyer at a rival audit firm´s legal arm. “But the likes of Uría Menéndez, Cuatrecasas Gonçalves Pereira and Garrigues could suffer because they are offering the same kinds of services [as EY Abogados].”

This commitment to growth represents the continuation of EY Abogados´ strategy in recent years, a period that has seen fairly dramatic growth. Linares says the firm has grown by 30 percent in the last three years. “We have had an average annual double digit growth rate in each of the last three years, which is remarkable when you consider the situation with the Spanish economy,” he adds.

There have been a number of hires in the last year. Some of the higher profile recent recruits include José Antonio Bustos, who joined from Deloitte Abogados, and former chief state attorney Óscar Figueres. These two hires followed the recruitment of Simeón Garcia-Nieto Nubiloa (from Fornesa Prada Fernández) last year, in addition to Pilar Fernández Bozal (who joined from the Catalan Government) and José Luis Prada (who previously worked at the Tax Office).

The firm sees the escalation of Spanish businesses´ international ambitions as one of the key pillars on which it can support its expansion. “We aim to grow significantly stronger and not only in Spain as this is our global strategy,” says Linares. “We see many opportunities in the Spanish market – because of the globalisation of domestic companies, we are strengthening a number of practice areas including supply chain, human capital, transfer pricing, and cross-border tax controversy.”

Valuable lessons

Some managing partners at more traditional law firms in Spain have admitted they can learn a lot from the auditing firms, specifically the way their processes are more streamlined as well as the way in which they generally use fewer lawyers to deal with matters rather than sending an army of lawyers to every meeting. Linares says that EY Abogados´ “more efficient and consistent processes” give it a competitive advantage. “We have a global IT function and a global financial system that makes us much more efficient [than traditional law firms] – for example, it means we don´t manually produce reports on a country by country basis.”

Not surprisingly, given its strong auditing connections, EY Abogados is highly rated for its tax work. Linares has a good reputation for his work advising multinationals and large Spanish companies on their operations abroad. Similarly, Javier Martín, Eduardo Sanfrutos, José Luis Gonzalo, José Luis Prada, Adolfo Zunzunegui and Víctor Gómez de la Cruz are also renowned tax experts.

But EY Abogados sees itself as more than simply a law firm specialising in tax. The firm also promotes itself as having expertise in corporate and commercial, mergers and acquisitions, employment, bankruptcy, litigation & arbitration, as well as public law and regulated sectors. “The aim is to be a multi-disciplinary firm,” says Linares.

Building a reputation takes time

But what kind of reputation does the firm have in these areas? Recognition of its work other than that related to tax is limited. In Legal 500 and Chambers, for example, EY Abogados is recognised only for its tax and employment expertise (labour law specialist Raúl García is recognised in Chambers). One lawyer at a rival firm says: “They are a typical law firm relying on auditors – they are so strongly linked to an auditor that clients tend to ask for tax and financial advice – because of this dependence on auditors, it takes a while to develop a name as a law firm.”

Linares acknowledges that some clients may see EY Abogados as providing purely tax-related legal advice. However, he is confident that the firm is proving its capability in other areas. “This is our challenge for the next two years, but we believe clients´ perception is changing,” he says. “As an example we have been mandated to provide integrated tax and legal advice in relation to the divestment of the energy business of one of the largest multinationals in Spain.” Linares adds: “We are betting on clients´ perceptions changing because we can demonstrate the quality of our lawyers.” That said, Linares acknowledges that 75 percent of EY Abogados´ lawyers specialise in tax.

Doubtful future?

However, new EU rules have been introduced that could provide an obstacle to EY Abogados´ expansion plans. The rules – which have cast doubt on the position of auditors as legal service providers – relate to the statutory audit of public-interest entities. Specifically, a new European Parliament and Council regulation states that, among other prohibited activities, an audit firm carrying out the statutory audit of a public-interest entity, should not directly, or indirectly, provide to the audited entity any “prohibited non-audit services”. These prohibited services include legal services such as the provision of general counsel, negotiating on behalf of the audit client, or acting in an advocacy role in the resolution of litigation.

So will this interfere with EY Abogados´ expansion plans? “We have a well-balanced and diversified practice,” says Linares. “We don´t think we will lose market share as the new rules will not create significant conflict – we are a well diversified firm, but I think that other ´big four´ firms that may not be so diversified may face more challenges.”

Some managing partners at rival firms acknowledge that the “big four” audit firms are generally more accomplished at developing their lawyers´ softer skills, such as selling and business development. One managing partner at a firm in Madrid says: “Historically, the big accounting firms have been much better at the personal development of their accountants.” In Linares view, it is crucial that a lawyer has business and sales capabilities, and this influences the type of training the firm gives its lawyers. “The profession of lawyers has changed dramatically – commercial skills are as important as technical skills,” he says. “We develop both soft and technical skills because a lawyer has to understand the business of their client.”

Managing partners in Spain are well aware that EY Abogados´ desire to take the best lawyers from rival Spanish firms is not an empty threat. They acknowledge that the firm, along with the other members of the ´big four´ are better able to attract partners from competitors than perhaps they were in the past. And they know that this is largely because they are in some cases able to pay them better. Linares says: “We are committed to investing in the right opportunities.”