Customer service

Of all the leading law firms in Spain, Pérez-Llorca reported the largest growth in revenue in the last year – managing partner Pedro Pérez-Llorca says this is due to having “good people” and providing value for clients rather than competing on price

Of all the leading law firms in Spain, Pérez-Llorca reported the largest growth in revenue in the last year – managing partner Pedro Pérez-Llorca says this is due to having “good people” and providing value for clients rather than competing on price

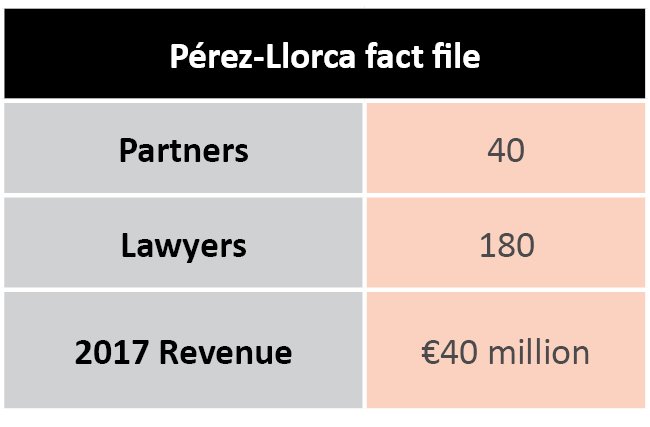

The year 2017 was one of significant growth for many of Spain’s major corporate law firms. However, one firm outperformed all its rivals, and that was Pérez Llorca, which reported a 20 per cent increase in revenue to €40 million. Managing partner Pedro Pérez-Llorca says the rise in income was due to an increase in instructions in three of the firm’s key practice areas: corporate, litigation and regulatory. “All three areas grew significantly,” he says. “In particular, there is plenty of corporate work, there is plenty of deal volume in all sectors.”

Meanwhile, the banking and energy sectors have also provided rich pickings for the firm. Recent highlights for Pérez-Llorca included providing advice to Banco Santander in relation to the €7 billion acquisition of Banco Popular, and acting for CVC Capital Partners on the acquisition of a 20 per cent stake in Gas Natural for €3.8 billion.

The firm’s growing reputation in the banking sector is particularly notable. Both the Legal 500 and Chambers legal directories rank Pérez-Llorca as one of Spain’s top 20 banking and finance firms, but a decade ago the firm had barely penetrated this sector. “Ten years ago, we were not a player in the banking and finance market, but there is a lot of appetite from banking and finance clients for legal services, and we are committed to being a full-service firm,” says Pérez-Llorca. “We advise banks, direct lenders and borrowers, but there is lot more potential for law firms that want to do banking and finance work – funds are now doing direct lending and there is significant transaction flow now.

At present, the firm has two partners (out of a total of 40) in Madrid doing banking and finance work, Ander Valverde and Ildefonso Arenas (who was hired in September this year from DLA Piper, where he was legal director of finance and projects), but Pérez-Llorca says the firm could possibly have more banking and finance lawyers in future.

The firm’s dispute resolution practice has also been a key driver of growth in recent times. However, Pérez-Llorca says that this is a reflection of the quality of the firm’s lawyers rather than a general increase in contentious matters in Spain. “The general volume of disputes is not going up, we have good people – we provide a good service by taking care of what is important in the sense that we staff disputes with as many people as required, not more,” he explains.

Price war?

Has Pérez-Llorca’s pricing strategy been a key factor in its success? Some market observers may speculate that this is indeed the case, particularly given that the firm has, in the past, been willing to provide legal services for practically nothing. The battle to win clients among Spanish law firms is fierce and insiders also talk of corporate lawyers at some Madrid firms providing advice on transactions free of charge in the hope of building a long-term relationship with the client and being given more lucrative work in future. However, Pérez-Llorca insists that his firm does not undercut competitors on price. “The explanation for our growth is that we provide an excellent service, our fees are in line with the rest of the market,” he says, adding that the price of legal services are linked to the dynamics of the market in that it “depends on the volume of demand”. However, he does concede that “there have been years when pricing was critical”. That said, Pérez-Llorca says, at present, clients’ key concern is not fees, but “getting the right team” of lawyers.

In addition to the aforementioned hire of Arenas, the firm also recently hired competition partner Juan Jiménez-Laiglesia from EY Abogados. Pérez-Llorca says there is “no reason” why there will not be more lateral hires in future. “We’re seen as a good platform from which to develop your career.” The firm should have plenty of room to accommodate any new arrivals given that it is in the process of moving some of its lawyers to new offices in Madrid’s Torre Foster. Around 60 professionals (the firm has 180 lawyers in total) are moving into the new office, though the firm will keep its current headquarters in Madrid’s Paseo de la Castellana.

New offices  When announcing the move earlier this year, the firm said its workforce had “increased substantially over the years” and that, to “continue with our strategic plan” it needed new premises to complement those it already has in Madrid, London, Barcelona and New York. “We are happy in the building [in Paseo de la Castellana], we have a long-term commitment there, but we didn’t want to be constrained; we looked at renting space close by, but Torre Foster (which is approximately five kilometres away) was the best option,” says Pérez-Llorca. “We will be moving 60 people there, but there is room for growth – there will be lawyers there doing client work and meeting rooms, and it means we will also be able to add more lawyers in our Paseo de la Castellana office.”

When announcing the move earlier this year, the firm said its workforce had “increased substantially over the years” and that, to “continue with our strategic plan” it needed new premises to complement those it already has in Madrid, London, Barcelona and New York. “We are happy in the building [in Paseo de la Castellana], we have a long-term commitment there, but we didn’t want to be constrained; we looked at renting space close by, but Torre Foster (which is approximately five kilometres away) was the best option,” says Pérez-Llorca. “We will be moving 60 people there, but there is room for growth – there will be lawyers there doing client work and meeting rooms, and it means we will also be able to add more lawyers in our Paseo de la Castellana office.”

Pérez-Llorca argues that the Spanish legal market is largely characterised by its stability. “I have been in this business for 25 years and I always see less change than I expect,” he says. “There is a lot of choice for clients, and there’s not a lot of appetite for new firms entering the market, this market is not as profitable as other legal markets.”

With regard to competitors in the market, Pérez-Llorca remarks that the Big Four have been successful in luring top lawyers from rival firms. “There have been good people attracted to the ‘Big Four’,” he says. Last year, Pérez-Llorca lost tax partner Pablo Ulecia Rubio to EY Abogados, but Pedro Pérez-Llorca says his firm does not encounter the ‘Big Four’ in transactions or cases. “In terms of the work we do, we tend to see large Spanish firms or large English firms on the other side, we don’t see the ‘Big Four’,” he says.

Pérez-Llorca says that the ‘Big Four’ have an important role to play in transactions, but argues that they complement law firms rather than being in competition with them. “If I was doing a deal, I’d be happy to have three people on my side: an investment bank, a law firm and one of the ‘Big Four’.”

Top of the cycle

Pérez Llorca believes law firms in Spain have the potential to grow in a wide range of practice areas. “There are opportunities everywhere, in M&A, capital markets, dispute resolution and regulatory,” he says.

However, there are some doubts about how long the sense of buoyancy in the market can be maintained. “We’re in the hot part of the cycle, at the top of the cycle the priorities concern human resources, retaining talent and attracting talent,” says Pérez-Llorca. “The outlook is bright for 2018, but let’s see what 2019 will bring us – there’s still a lot of interest from investors, but GDP will decrease and tourism won’t be growing.”

The other major concern for law firms is technology, according to Pérez-Llorca. One of the biggest issues is ensuring firms make the “right investment”, he adds. “We try to be an early adopter [of technology], but in doing so we have to be ready for some solutions that do not work.”

Pérez-Llorca is using artificial intelligence technology and Pedro Pérez-Llorca says the firm is better off with it than without it. He says: “Work is more and more complicated every year, it is more specialised and it has to be done more quickly.”

Given that Pérez-Llorca grew so significantly in the last year, technology doesn’t appear to have hindered it in any way.

However, being at the top of the cycle, the firm will be hoping that the descent will not be too steep when it comes.