Changing perceptions? – Deloitte

With data showing that Deloitte Abogados is now amongst the top five firms in Spain when it comes to deal flow, market perception has yet to catch up with this reality

Only three law firms in Iberia advised on more M&A deals than Deloitte Abogados in 2015, yet managing partner Luis Fernando Guerra acknowledges that some legal market rivals claim they are not competing with Deloitte. “If no one wants to compete with us, that’s not a problem, but in my view we are already competing,” he adds. Data from Mergermarket gives credence to Guerra’s claims – Deloitte advised on 34 deals in 2015, a deal count bettered only by Cuatrecasas, Gonçalves Pereira (which advised on 72), Garrigues (57), and Uría Menéndez (56).

Some competitors in the market say the reason Deloitte figured so highly in the 2015 deal tables is that there was a boom in mid-market M&A deals in the last 12 months, and that when it comes to the biggest transactions, clients still turn to the traditional heavyweight firms rather than the legal arms of the ‘big four’ auditors.

However this is another perception that Guerra questions. “We´re not a mid-market M&A firm, though it may be how competitors think of us,” he says. “We have elevated our focus towards the top clients and we now represent around 90 per cent of the IBEX 35 companies – we have to convince clients that we can act for them no matter the size or complexity of the deal.”

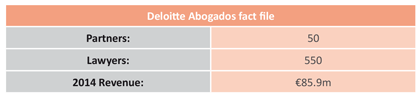

Guerra says he envisages a scenario where the firm will be advising on more of the market’s biggest deals in future. “We are prepared to face any challenge, we will focus on high-value added services where you need more experienced people so we will probably reduce our leverage in future [with 50 partners and 550 associates in Spain, the firm’s leverage is currently 1:11]. Guerra also indicates that the firm intends to be handling larger, more complex deals in the coming years, which means “in future, we will probably have less clients and less engagements”.

Building the brand

Market perceptions aside, there is no disputing the fact that Deloitte Abogados is getting bigger. Revenue increased by 11.7 per cent in 2014 to €85.9 million, and Guerra is anticipating that the results for 2015 will show a similar level of growth. “We have grown every year in each of the last seven years,” he says. Guerra says the firm’s profitability is also increasing, but he adds that this is not the firm’s primary objective. “We have a comfortable level of profitability so this means we do not have to focus on increasing profitability in the short term,” Guerra claims. “We are focusing on where we will be in three to five years, and working to make the law firm sustainable in the medium to long term, so we don’t focus on maximising profitability now but on building a better firm for the future.”

Guerra acknowledges that there may still be a perception that Deloitte is primarily an auditor rather than a law firm, but he says that the firm’s clients are being provided with a legal service that often surpasses their initial expectations. “Some law firms may have better brands, but when we evaluate client satisfaction – which is something not every firm does – we are exceeding expectations, Guerra says. “There is the link to the audit business, but we need to create the Deloitte legal brand.”

Avoiding class divides

Avoiding class divides

Guerra attributes the firm’s continuing growth to the “huge transformation” it has undergone in the last six years. “We created a new culture, we changed the way we render services as well as the way we use technology,” he adds. “We became closer to our clients and we have built close personal relationships – our growth is accelerating because we’re doing things better than others, we’re more proactive than our competitors.”

Guerra says that Deloitte spends more time than some of its rivals on building professional relationships and adds that the firm is more efficient, provides better services and has lower costs than many other law firms. He continues: “We anticipate the needs of clients – regulatory compliance is one of clients’ biggest concerns, we invested in this area two years ahead of our competitors.”

Another reason Deloitte is flourishing is because of the culture of cooperation within the firm, according to Guerra. “There is no internal competition and we share our efforts, we’re a single team, it’s not a silo model,” he claims.

While around 25 per cent of the firm’s partners are non-equity partners, Guerra says this does not mean there are two classes of partner at Deloitte. “Everyone goes through the non-equity partner stage [before becoming an equity partner], the existence of different classes of partner is extremely dangerous, but at some other firms different groups of partners have different email groups and different meetings.”

Attracting talent

The strong belief in the partnership ethos at Deloitte is one of the reasons the firm has been able to recruit partners from other leading firms in Spain, according to Guerra. He cites the examples of recent arrivals Dulce Miranda, an intellectual property partner who joined from Garrigues, and Ignacio Sanjuro, who was previously with Cuatrecasas, Gonçalves Pereira. “I think they joined because we offered them a very ambitious project and also because of the way we think and believe in our partnership.” He adds that Deloitte is also able to remunerate its lawyers in a way that makes the firm an attractive proposition. “Apart from being convinced by our ambition, I like to think they come because they are being well paid – if people are not joining us, it’s not a question of money.”

While Guerra says Deloitte has been more successful than other firms in terms of reducing costs, he adds that the firm’s revenue is not growing because it charges lower fees than rival firms. “Our fees are not lower, we have competitors that quote half our fees, if you provide high quality services, clients are willing to pay more,” he says. “In my experience, I´ve not seen a situation in which we were chosen for being the cheapest – we have increased our profitability above the growth in fees.”

Boosting the ranks

There have been suggestions in the market that some lawyers have exited Deloitte in the past because the work they were doing was not of the level or quality that they had anticipated. Guerra’s response when this issue is put to him was “I’m sure that anyone who may have said those things is not now working on bigger deals.”

The outlook for Deloitte in 2016 is positive. “We will maintain our path of double-digit growth,” says Guerra. “We are also going to maintain one of our main competitive advantages, that is being close to our clients through our international network, which has a presence in more than 150 countries. This makes us one of the few legal networks with a global dimension.”

Guerra adds that the firm is now focusing on hiring senior associates, though the firm will also be hiring a number of partners in the coming months. He adds: “We’re continually scrutinising the market for talent – meanwhile, in June, we’ll promote four or five non-equity partners to the equity partnership”. Guerra identifies the major growth areas for the coming year as corporate/M&A, regulatory compliance, labour law, and tax: “We will focus on these four areas as in these areas we are clearly winning the battle to be recognised in the market. We want to break the legal market status quo and we believe it is possible, Deloitte is on the way up.” IL