Banking & finance annual report 2018: Fighting talk

Banking lawyers in Iberia are benefitting from a boom in real estate finance, but the legal market is becoming increasingly competitive and retaining talent is a problem

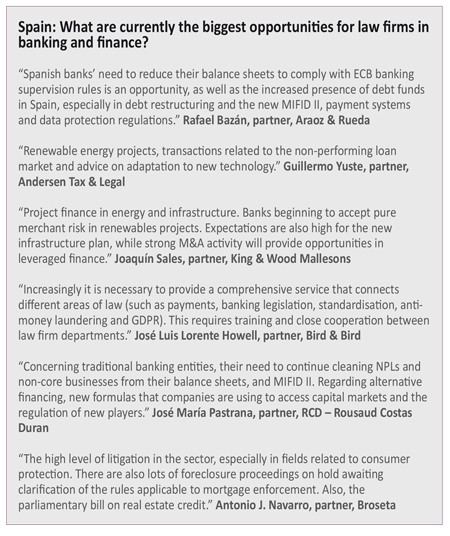

Banking lawyers in Spain are optimistic about what they see as a healthy pipeline of work for the coming year. However, competition in the legal market is becoming more intense, with the result that pressure on fees is a concern. As one partner remarked: “All the top firms are pitching for the same transactions.” Another difficulty faced by banking and finance departments in law firms is the need to retain top talent – some senior banking lawyers talk of a younger generation that is “not really prepared” for the career of a lawyer – especially the long hours that need to be worked – so stopping them from leaving for a job elsewhere can prove problematic. As a result, there is a recognition that firms have to offer young lawyers alternative career paths.

Like lawyers in other practice areas, banking partners also talk of the need to reduce costs, which means firms are having to better utilise technology in order to increase efficiency. However, on a positive note, lawyers remark that the market is extremely active and is attracting significant interest from international players. In particular, real estate finance is booming, with Spain seen as one of the leading European jurisdictions for property investment. Demand for project finance is also increasing, lawyers say, while direct lending is also on the rise.

Meanwhile, some partners view the intensely competitive market as an opportunity for law firms to reinvent themselves by inventing new products that use artificial intelligence to offer more benefits to clients. There are also warnings that, while there is considerable liquidity in the market – similar to the levels seen pre-crisis – it’s important that the lessons that were learnt as a result of the global financial crash are not forgotten.

With regard to the Portuguese banking sector, lawyers expect that there will be more sales of non-performing loans (NPLs) in the coming year – banks are anxious to get rid of poorly performing assets and this trend is expected to generate substantial work for lawyers. In addition, real estate finance and banking regulatory matters are also expected to drive significant demand for legal advice. However, one major concern is the arrival of new players in the Portuguese legal market that are offering advice on NPL deals for much lower fees.

The growth of the fintech sector is viewed as a major opportunity for lawyers in Portugal, while the acquisition of some banks will also generate work, lawyers say. Acquisition finance is also a driver of growth, but there are doubts about the likelihood of an increase in the use of crowdfunding in Portugal. However, project finance work is expected to increase, particularly in the renewable energy sector. Indeed, lawyers say the infrastructure and energy sectors are proving to be particularly attractive to international investors.

Given that the ownership of Portuguese financial institutions has frequently changed in recent years, lawyers now have to put a concerted effort into building relationships with new clients. Meanwhile, like their counterparts in Spain, banking lawyers in Portugal say retaining talent is a significant problem with younger lawyers less inclined to work the long hours that were considered the norm by their predecessors. In addition, law firms also have to contend with a trend for banks to bring more legal expertise in-house by strengthening their legal departments with new hires.

Spain: Direct lending on the rise, while NPL sales continue

Banks’ use of law firm panels increasing with the result that there remains pressure on fees – meanwhile, the use of bonds to finance projects is becoming more common

Event: Iberian Lawyer Banking and Finance Madrid Roundtable

Host: Freshfields Bruckhaus Deringer

Banking lawyers in Spain are doing an increasing amount of work for direct lenders, which are financing an increasing amount of real estate transactions, according to attendees at the Iberian Lawyer Banking and Finance Madrid Roundtable. Meanwhile, the sale of non-performing loans is also generating a significant amount of work for lawyers. However, banks are continuing to put considerable pressure on fees, while the use of law firm panels in the banking sector is becoming more common. Regulatory matters are a growing concern for financial institutions, while issues such as data protection and cybersecurity are leading to more instructions for lawyers.

Banking lawyers in Spain are doing an increasing amount of work for direct lenders, which are financing an increasing amount of real estate transactions, according to attendees at the Iberian Lawyer Banking and Finance Madrid Roundtable. Meanwhile, the sale of non-performing loans is also generating a significant amount of work for lawyers. However, banks are continuing to put considerable pressure on fees, while the use of law firm panels in the banking sector is becoming more common. Regulatory matters are a growing concern for financial institutions, while issues such as data protection and cybersecurity are leading to more instructions for lawyers.

The price of debt has reduced and there are much more “borrower-friendly terms available”, said Freshfields Bruckhaus Deringer partner Ana López. However, she added that banks and financial institutions face a considerable amount of regulatory uncertainty.

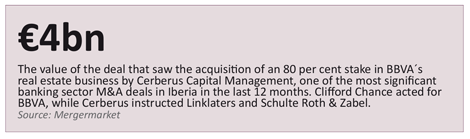

Another significant feature of the market in 2017 were some major debt restructurings, said Uría Menéndez partner Ángel Pérez López, who highlighted Abengoa’s, Celsa’s and FCC’s financial restructurings as the largest transactions of this type in the Spanish market in 2017. In addition, sales of non-performing assets (both non-performing loans and REOs) have also generated substantial work for lawyers, in addition to real estate financing and direct lending transactions, according to Pérez López.

Leveraged buy-outs (LBOs) are becoming increasingly common, according to Gómez-Acebo & Pombo partner Rafael Aguilera. He added that there are a number of “new European funds” that are entering the LBO market. In addition, real estate financing is booming, Aguilera said.

Pérez-Llorca partner Ander Valverde said that direct lending is featuring more regularly in the Spanish market, while there are a number of international investors that are preparing for the divestment of assets as prices go up and this has resulted in “dividend recap financings as well as stapled financings arranged by sellers in M&A transactions”.

Pérez-Llorca partner Ander Valverde said that direct lending is featuring more regularly in the Spanish market, while there are a number of international investors that are preparing for the divestment of assets as prices go up and this has resulted in “dividend recap financings as well as stapled financings arranged by sellers in M&A transactions”.

The clearing up of bank balance sheets is creating a lot of work for law firms, said Herbert Smith Freehills partner Gonzalo Martín de Nicolás. He added that technology, data protection and cybersecurity are major concerns for banks. Meanwhile, Martín de Nicolás said fintech companies were being viewed by some banks as a threat to their business, but other banks were considering fintech companies as “potential partners”.

There is a growing demand for regulatory advice from new banks, said Baker McKenzie partner Francisco José Bauzá. He added that consumer finance work is also on the increase, while funds also have a growing appetite for acquisition finance, though banks are more reluctant to get involved in this area. Direct lending for infrastructure projects is currently a trend, with insurance companies among the players involved in this market, said Dentons partner Jabier Badiola. He also said that direct lenders are financing real estate transactions in situations where banks are unable to provide finance.

The financing of projects via bonds is a growing trend, said Allen & Overy partner Ignacio Ruiz-Cámara, who added that funds from Europe and the US are particularly attracted to such transactions. He added that funds are able to provide finance much more quickly than banks, though they generally require a higher rate of return. Meanwhile, Ruiz-Cámara said that with regard to legal panels, not all banks have them, though some have “started implementing such panels or have suggested they intend to do so in the future”.

There are many international players active in the Spanish banking and finance sector and many of them are “setting up their platforms and teams locally”, said Cuatrecasas partner Íñigo de Luisa. “Spain is currently a key jurisdiction for investors and alternative debt funds,” he added. Financing is becoming more complex in terms of documentation with transactions often involving “different layers of debt and equity instruments”, De Luisa said.

Ashurst partner Fernando Navarro said project bonds and high yield bonds are becoming more popular in the Spanish market. He added that increasingly banks are using legal panels and this is putting pressure on fees. Jones Day partner Javier López Antón said work for direct lenders is on the increase, while real estate finance and work for sponsors in mid-market deals is also growing. He added: “There is price pressure, but this is nothing new, while banks are using law firm panels for some specific types of work.”

Ashurst partner Fernando Navarro said project bonds and high yield bonds are becoming more popular in the Spanish market. He added that increasingly banks are using legal panels and this is putting pressure on fees. Jones Day partner Javier López Antón said work for direct lenders is on the increase, while real estate finance and work for sponsors in mid-market deals is also growing. He added: “There is price pressure, but this is nothing new, while banks are using law firm panels for some specific types of work.”

López said that she was optimistic about the pipeline of work for banking and finance lawyers, however, participants noted that there was significant competition in the legal market and that this means there is significant pressure on fees. Meanwhile, attendees also said reducing costs and retaining talent were among the major problems faced by law firms. Participants also said that the current environment also represented an opportunity for law firms to reinvent themselves as competing with new market entrants is becoming increasingly difficult. One example cited was law firms developing legal products that use artificial intelligence to better match expertise with clients’ needs.

López said that she was optimistic about the pipeline of work for banking and finance lawyers, however, participants noted that there was significant competition in the legal market and that this means there is significant pressure on fees. Meanwhile, attendees also said reducing costs and retaining talent were among the major problems faced by law firms. Participants also said that the current environment also represented an opportunity for law firms to reinvent themselves as competing with new market entrants is becoming increasingly difficult. One example cited was law firms developing legal products that use artificial intelligence to better match expertise with clients’ needs.

Portugal: Fintech sector providing fierce competition for banks

Consumer lending on the rise, but trend for banks to bring more legal expertise in-house is concern for law firms

Event: Iberian Lawyer Banking and Finance Lisbon Roundtable

Host: Vieira de Almeida

The fintech sector is providing fierce competition for the more established banks in Portugal, participants in the Iberian Lawyer Banking and Finance Lisbon Roundtable said. Fintech companies are generally able to provide loans much more quickly than banks, while there are also other lending platforms that are using cutting-edge technology to match borrowers with potential lenders and this is also having the effect of eroding the client base of banks. Meanwhile, consumer lending is on the rise, while regulatory concerns are growing for financial institutions. The good news for law firms is that more players in the sector means more potential clients. However, lawyers did report that banks are currently seeking to bring more legal expertise in-house.

The fintech sector is providing fierce competition for the more established banks in Portugal, participants in the Iberian Lawyer Banking and Finance Lisbon Roundtable said. Fintech companies are generally able to provide loans much more quickly than banks, while there are also other lending platforms that are using cutting-edge technology to match borrowers with potential lenders and this is also having the effect of eroding the client base of banks. Meanwhile, consumer lending is on the rise, while regulatory concerns are growing for financial institutions. The good news for law firms is that more players in the sector means more potential clients. However, lawyers did report that banks are currently seeking to bring more legal expertise in-house.

The growth of the fintech sector is raising questions about how banks will position themselves in relation to this new type of competition, said SRS Advogados partner Alexandra Valente. She added that it was unclear whether all banks will “come up to speed” with regard to such technology and how they will be impacted by technology such as blockchain and cryptocurrency. Valente also said that regulation such as MiFID II is making it more difficult for financial sector organisations to be competitive. Meanwhile, the sale of non-performing loans, in addition to real estate finance and acquisition finance is generating a significant amount of work for lawyers, according to MLGTS managing associate Maria Soares do Lago. She added that, in the future, traditional banking sector clients may consider partnerships with fintech companies “as a way of keeping up with new market trends”.

M&A finance and regulatory work are other key sources of work for banking and finance lawyers, said Gonçalo dos Reis Martins, partner at PLMJ. He added that banks face strong competition from fintech companies that are able to complete lending deals very quickly. Reis Martins also said that consumer lending is increasing substantially, for example in the areas of car finance and credit cards. Meanwhile, he said that recent work for his firm included advising a UK fintech company that lends to small and medium-sized enterprises on a partnership with a Portuguese bank.

Banks are facing competition from lending platforms that use algorithms to quickly match borrowers and lenders, according to Linklaters counsel Gonçalo Veiga de Macedo. He added that banks “continue the deleveraging process” and are selling loan portfolios that are attracting interest from private equity funds and international investment banks and this trend is driving demand for legal advice. Veiga de Macedo also said that, despite the rise of fintech companies, their “potential and benefits cannot yet extend to tailored and structured transactions, which cannot be done by fintech companies – you always need specialist teams”.

Vieira de Almeida partner Pedro Cassiano Santos said that the Portuguese financial market is “inevitably small, and consequently, lending terms are very strict and there is a scarcity of players”. He added that specialist lenders in the real estate finance and acquisition finance markets often offer finance at a better rate than the older, more established lenders. Cassiano Santos said the emergence of smaller banks and other types of lenders means that there are more potential clients for law firms, though as larger banks encounter competition from smaller players, they will “also tend to adapt their offer”. He added that, with regard to fees, they tend to be “on a fixed-fee basis, set up front and lowered”. Therefore there is a need for increased efficiency and the “proper management of teams and lawyers involved in each assignment”.

Financial institutions are facing increasing regulatory pressure, said Uría Menéndez-Proença de Carvalho partner Pedro Ferreira Malaquias. He added that the European Union Mortgage Credit Directive, the General Data Protection Regulation, MIFID II and the Payment Accounts Directive are among the regulations that are having an impact on banks’ costs and their profitability. Ferreira Malaquias also said that banks “see fintech typically as a threat” and that consequently banks are calling for fintech companies to be subject to the same rules as banks. He added: “However, we are also advising on mergers between national banking associations and associations of fintech companies and it may well be that, in perhaps five years’ time, the banking and fintech industries could merge.”

Portuguese banks are integrating their investment banking subsidiaries into their retail banking operation due to “increased competition from new players in the investment banking sector and the need to save costs”, said Garrigues partner Diogo Leónidas Rocha. He added: “Legal work regarding investment banking services is therefore facing a slight decrease.” However, Leónidas Rocha said there is significant lending activity in the construction sector as well as high demand for legal advice relating to the sale of non-performing loans. He added: “There is a lot of shadow banking, with private equity focusing on real estate finance.” Leónidas Rocha also said that banking work is increasing and that there are a lot of players in the market, “which is good for lawyers”, though he adds that banks are, in general, trying to grow their in-house legal teams.

Brexit is causing concern for some clients in the financial sector, according to Abreu Advogados partner José Maria Corrêa de Sampaio. “Some banks are thinking of moving their offices out of the UK, possibly to Ireland, and others in the UK are already adjusting their structures in order to adapt to Brexit,” he added. With regard to the competition banks face from fintech companies, Corrêa de Sampaio predicts that, in future, there could be examples of banks acquiring fintech companies, and vice versa, in order to “stay ahead in the new banking market that is emerging due to technological developments and the new EU banking regulations”. He added that fintech companies are already “creating value” for banks, for example by developing platforms enabling customers in other European jurisdictions to place deposits in Portuguese banks: “This and other new services generates regulatory work for lawyers in Portugal.”

Brexit is causing concern for some clients in the financial sector, according to Abreu Advogados partner José Maria Corrêa de Sampaio. “Some banks are thinking of moving their offices out of the UK, possibly to Ireland, and others in the UK are already adjusting their structures in order to adapt to Brexit,” he added. With regard to the competition banks face from fintech companies, Corrêa de Sampaio predicts that, in future, there could be examples of banks acquiring fintech companies, and vice versa, in order to “stay ahead in the new banking market that is emerging due to technological developments and the new EU banking regulations”. He added that fintech companies are already “creating value” for banks, for example by developing platforms enabling customers in other European jurisdictions to place deposits in Portuguese banks: “This and other new services generates regulatory work for lawyers in Portugal.”

Meanwhile, there are also significant opportunities for Portuguese banking lawyers in African countries, such as Mozambique. In particular, the use of mobile phones to transfer money is a growing trend, while project finance is also on the rise.