Well adapted

The recent merger with Olswang and Nabarro caused some turbulence for CMS in Spain, but José Luís Arnaut, managing partner of CMS Rui Pena & Arnaut in Portugal insists the merger has gone down well in Lisbon

The recent merger with Olswang and Nabarro caused some turbulence for CMS in Spain, but José Luís Arnaut, managing partner of CMS Rui Pena & Arnaut in Portugal insists the merger has gone down well in Lisbon

Despite the promise of benefits such as greater efficiency and potentially, increased profitability, law firm mergers can be an unsettling experience for those involved. When the merger involves three firms, rather than two, the potential for difficulties is multiplied. But the potential pitfalls of a three-way merger did not deter CMS when it combined with Nabarro and Olswang last year, after the firms voted for the merger in 2016. While the tie-up may have caused some initial problems at some CMS offices, José Luís Arnaut, managing partner of CMS Rui Pena & Arnaut (CMS’ operation in Portugal) says the merger has been very beneficial for the Portuguese office. “We had an important merger with Olswang and Nabarro and, in Portugal, they have brought us a lot of technology, media and telecommunications (TMT) and real estate work,” he says. “It’s just the beginning, but I hope this will continue – the merger has gone very well, I have been very involved, the lawyers are very enthusiastic about CMS, so far, so good.”

While the message from Portugal is that the merger is going well, there are indications that the tie-up caused more initial difficulties in CMS’ Spain operation, CMS Albiñana & Suárez de Lezo, from which the Portuguese office receives a significant amount of referral work. Indeed, revenue in the Spanish office dropped by around 6 per cent in 2016, falling from €24.1 million to €22.7 million. There has also been some partner unrest in the Spain office – for example, it was recently reported that partner Blanca Escribano, the Olswang partner who joined CMS Albiñana & Suárez de Lezo as a result of the merger, is to leave CMS after only a year at the firm to join EY Abogados. Meanwhile, partner Patricia Liñan, who had been a lawyer at CMS Albiñana & Suárez de Lezo for 17 years, left the firm for Bird & Bird, just a few months after the merger was completed.

Pitching together

Pitching together

While Arnaut, who was formerly the Portuguese deputy prime minister, says the merger has gone well in Portugal, sources close to the firm acknowledge that 2016 was a difficult year for CMS in some jurisdictions, including the Spanish office, from which CMS Rui Pena & Arnaut receives a significant number of referrals. “We have a lot of common clients with CMS Spain, we often pitch together, we share clients and we share projects,” Arnaut says. “We receive a lot of referrals from Spain.” However, it does seem that the situation at CMS’ Spanish operation is stabilising – the 2017 financial results for CMS Albiñana & Suárez de Lezo showed revenue is growing again, with billing up 3.2 per cent to €23.4 million.

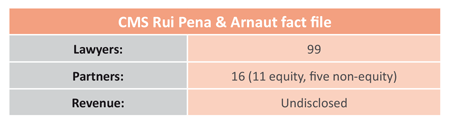

It’s difficult to get a clear picture of the situation at CMS Rui Pena & Arnaut as the firm refused to disclose revenue figures for the Portuguese office; however, Arnaut says the firm has grown by 20 lawyers in the last three years and now has a total of 99 lawyers, of which 16 are partners (11 equity partners and five non-equity partners). “We have grown due to the demands of the market, domestically there has been an increase in restructuring work and also an increase in employment-related work,” says Arnaut. “We have also been representing clients like Goldman Sachs in BES-related litigation, meanwhile there is also a huge amount of work related to GDPR [General Data Protection Regulation].” He adds: “We work for big clients in Portugal, we have had big real estate transactions and we also do a lot of TMT work.” The firm has also advised on deals in the energy sector – in 2017, the firm acted for Explorer Investments on the €70 million sale of propane gas distribution and sales company Gascan to Spanish private equity fund Artá Capital.

Foreign affairs

Around 30-40 per cent of CMS Rui Pena & Arnaut’s work is international, with Lusophone Africa being a particularly strong focus. “We are continuing to invest in our Angola office where we currently have five lawyers,” says Arnaut. The firm also recently took the step of launching a Swedish desk which provides legal advice to Portuguese companies and individuals in Sweden and Swedish companies, investors and private clients based in Portugal. “A lot of Swedes come to Portugal for non-residence tax reasons,” says Arnaut. The firm also has a French desk – which has been developed primarily by CMS Albiñana & Suárez de Lezo in Spain and CMS Bureau Francis Lefebvre in France – which drives a significant amount of work from France to CMS Rui Pena & Arnaut. “We get a lot of referrals from France, the French are important investors in Portugal” says Arnaut.

Some lawyers argue that international clients are increasingly seeing Spain and Portugal as “one market” in the sense that those looking to invest in Spain are generally looking to invest in Portugal too. But Arnaut argues it is “dangerous” to generalise in this way, though he adds that “for some US investors in some sectors, that is the case”.

Size not important

The firm’s partnership in Portugal has also seen some significant changes in recent months. In May this year, the firm promoted two new lawyers to partner: corporate specialist Margarida Vila Franca, and EU and competition lawyer Luís Miguel Romão. The promotions followed the death, at the beginning of the year, of firm founder Rui Pena. Despite the recent appointment of two new partners, Arnaut does not expect the firm to grow significantly. “We don’t want to be a big firm, we want controlled growth, size is not important,” he says.

Arnaut says that with the backing of the CMS network, his firm does not need to get substantially bigger and therefore a merger with another Portuguese firm is unlikely. However, he does anticipate mergers between other law firms in Portugal. “There will be consolidation in the market for sure,” he says.

The last 18 months has seen a number of foreign firms opening in Portugal, for example DLA Piper merged with Lisbon firm ABBC in March 2017, Spanish firm Ecija merged with Antas da Cunha in November last year, while another Spanish firm, Broseta, merged with Roquette, Morais e Guerra in April this year. Despite this flurry of activity, Arnaut does not anticipate a flood of international firms launching operations in Lisbon. “I don’t think there will be many foreign firms opening in Portugal, it’s a small market,” he says. On the issue of the challenge posed by the ‘Big Four’ – PwC, Deloitte and EY have all incorporated Portuguese law firms into their networks in recent years – Arnaut says “Portuguese law will not allow the ‘Big Four’ to work directly [in the Portuguese legal market] and I hope they [the Big Four] will obey the law”.

The personal touch

Arnaut believes the outlook for firms in Portugal is bright. “It depends on the economic situation, but I am confident it will be another good year for law firms in Portugal,” he says. “It’s difficult to predict the future, but I think there will be transactional work and litigation, as well as GDPR-related matters.”

What are Arnaut’s biggest concerns as a managing partner? “I am concerned about keeping a high level of quality, as well as availability [to clients], and also keeping a competitive price,” he says. “It’s also important to keep control of costs, however artificial intelligence is not an issue for the time being as there is no substitute for human intelligence.”

Arnaut says that clients come to CMS Rui Pena & Arnaut for two reasons. “Firstly, we have a good reputation, we have international standards at a national price – the international market knows CMS, we have a good track record. Secondly, we are always available 24 hours a day, we are completely transparent with clients and they value that.” Given the new players entering the Portuguese market, Arnaut will be hoping this is a winning proposition.