Global Report 2008: Managing expansion: Slowdown driving international opportunities

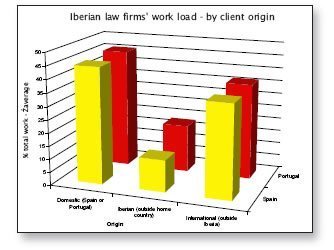

The expansion of Iberian businesses around the world is now more than a business trend, it is business reality, and one that continues to present new and unique challenges for Iberian lawyers.

The consolidation and expansion of the Spanish and Portuguese banking, telecoms, utilities, infrastructure and energy sectors is presenting significant and continuing opportunities for law firms both on and off the Peninsula, Iberian Lawyer’s 2008 Global Special Report shows.

Also, the prospect of recession in Spain and Portugal is pushing Iberia’s businesses to expand their global interests. Companies are looking to target new markets and to balance their exposure to any domestic economic downturns. But at the same time Iberia remains an attractive destination for international investors, many of which now see the prevailing situation as offering low prices and more attractive opportunities.

Expansion

The relative strength of the euro combined with falling asset values internationally is opening up new markets, say lawyers. “Credit restrictions and interest rate increases have made foreign investments more selective, but cross-border M&A legal work remains at a reasonable pace, in particular in countries where equity prices have lowered,” says Jaime Folguera, partner at Uría Menéndez.

The past year has been notable particularly for the expansion of Iberia’s banks. Spanish cajas (savings banks) have expanded into the US, through Florida, Texas and California, while Santander is now the world’s sixth largest bank by capitalisation. July saw it acquire its second UK bank, Alliance & Leicester, and was last year involved in the world’s largest banking takeover, the €71bn acquisition of Amsterdam-based ABN Amro – alongside Royal Bank of Scotland and Fortis – and through which it gained operations in Italy (which it then sold) and Brazil.

Also notable has been the continuing expansion of Portuguese and Spanish infrastructure and construction companies.

Barcelona-based Abertis recently signed the largest road privatisation-ever in the US, €8.2bn for a 75-year concession for the Pennsylvania Turnpike. “The US has been a more recent market that Spanish companies find increasingly attractive using their expertise in infrastructure financing to secure concessions,” notes Luis Riesga, managing partner of Jones Day in Madrid.

In addition, Spanish and Portuguese energy companies are increasingly active across Europe and North America, and the recent announcement by EdP of acquisitions in Brazil marks a selective upturn of interest in Latin America, suggest some. Repsol looks set also to benefit from recent oil discoveries off the coast of Brazil.

Latin America remains an important region for Iberian companies, with a constant flow between the regions, while in terms of outbound work the latest emphasis is now to the US, China, and inevitably throughout Europe, say lawyers.

“It is interesting, for example, to see how Spain has gone from being a recipient of investment from Germany to being an investor not only in Germany but all across Eastern Europe,” says Sonke Lund, partner at MMMM in Madrid.

Portuguese transactions also have an increasing international profile, says João Vieira de Almeida, managing partner at Vieira de Almeida & Associados, the result both of outbound expansion but also as Portuguese companies combine with or are sold to foreign interests. “M&A and banking and finance (corporate and structured finance), as well as projects and tourism, are the areas with the most international feel,” he says.

Portugal is now also benefiting from inbound investment in listed companies, including from countries such as Angola and from Brazil – Petrobras, its state-owned energy company, is now expanding its exploration activities off the Portuguese coast.

But significant also, is the continuing flow of cross-border work within Iberia, with notable movement again in the energy, telecoms and banking sectors, and investment remains significant in Portugal, say lawyers.

“ I believe that from a purely economic point of view, Spain and Portugal are one single market. Notwithstanding the differences in culture and language, our proximity, and the fact that Portugal may multiply its market three times and Spain one third, tells us that this should be so,” says Julio Veloso, partner at Rodés & Sala.

I believe that from a purely economic point of view, Spain and Portugal are one single market. Notwithstanding the differences in culture and language, our proximity, and the fact that Portugal may multiply its market three times and Spain one third, tells us that this should be so,” says Julio Veloso, partner at Rodés & Sala.

Credit crunch

Opinions differ however on the impact of the ongoing global credit crunch and financial uncertainty among the financial sector on clients’ international ambitions. “The difficulties experienced in gaining access to credit facilities experienced by clients are in general slowing their international plans,” believes Juan Ramón Ramos, senior partner at Landwell in Spain.

“International ambitions have not been put on hold as a general rule. Only those clients seeking to raise funds abroad have shelved their projects for the time being,” says Jose Sanchez-Dafos at DLA Piper.

But others suggest that any impact is relative to clients’ business sectors. “Some clients are rather turning towards internationalisation to save on costs or to sell in new markets in order to overcome the crisis,” believes Francisco Lacasa, partner at AGM Abogados in Madrid.

The slowdown in the Spanish economy, may have led some groups to review their investment plans, but clients continue to seek out opportunities worldwide, agrees Albert Collado, Head of the International Committee at Garrigues.

The perception among lawyers in Portugal is similar, albeit the relative scale of the economy and size of transactions by comparison has seen a less significant reduction in activity.

The perception among lawyers in Portugal is similar, albeit the relative scale of the economy and size of transactions by comparison has seen a less significant reduction in activity.

“The crisis has not affected those projects already on course and with an approved finance facility. Project finance hasn’t been affected and we have only noticed some attenuation in the real estate sector,” says Nelson Raposo Bernardo, managing partner of Raposo Bernardo & Associados.

Paulo Câmara, head of finance at Sérvulo & Associados agrees. “We have not seen signs of the crisis having decisively affected the international ambitions of our clients. Large cross-border M&A deals have been suffering a reduction, but for those companies already with an international business profile – notably in energy, projects or construction – the crisis has not determined major changes in their strategy.”

Indeed, the perception is that companies need to hedge against domestic difficulties by expanding internationally. “We have seen our clients continue to expand abroad, more so in the last two years than ever before,” says Manuel Barrocas at Barrocas Sarmento Neves.

But the situation continues to play out, and some lawyers remain cautious. “We have not yet appreciated any major changes prompted by the financial situation, but it is still early days and there are reports now that insurance companies may start feeling the effects in the near future,” says Jesús Vélez, senior partner at insurance specialists Kennedys in Madrid.

Outbound and inbound investment

Iberia’s lawyers report an upturn in work both to and from Latin America and Africa, and of an emerging role for Iberian law firms to facilitate particularly the international, expansion of Latin American multinationals – multilatinas – into Europe. Among them, Petrobras, Cemex, Vale, Modelo, America Movil, and Aracruz.

“We have a strong record of advising Latin American companies investing in Europe, and can envisage this role increasing as more expand overseas,” says Jaime Folguera, partner at Uría Menéndez. “While we have seen less traffic going towards Africa, should Latin American investors shift their focus there, surely Iberian law firms will play a key role – particularly given the weakness of some of these countries’ domestic legal markets.”

Angola is already a significant investor in Portugal, with Angolan investors now holding significant holdings in many of the major listed finance and corporate entities.

A greater challenge for Portuguese law firms suggests João de Macedo Vitorino of Macedo Vitorino & Associados, is managing the specific international demands of Brazilian investors, and to compete with the major Brazilian law firms. “Portuguese law firms are exceptionally well positioned to assist clients in the Lusophone Countries. However, we need to prove that we can do so.”

In Brazil, he suggests that Portuguese firms have little differentiation to offer locally, while in Africa both Brazilian and Portuguese law firms are equally matched. “Perhaps however Portuguese law firms have a stronger desire to expand internationally,” he says.

A similar view is held by Diego Vargas at Maniega & Soler in Madrid. Latin American investors may feel comfortable approaching Iberian law firms for European transactions but no such perception yet exists towards their African investments, he believes. “Only if a Spanish or Portuguese firm communicates and demonstrates its capacity to perform successfully in Africa will it be able to sell its services to Latin American entrepreneurs.”

Iberian axis

Lawyers remain positive that Iberia continues to play a role as an international business axis, between Europe and Latin America, and increasingly now to Africa, but some nonetheless query the attractiveness of Iberian law firms to Chinese investors.

“Iberia is already a global business axis between both Europe and Latin America and between Europe and Africa in many economical areas. We believe this trend will develop over the next few years,” says Jorge Brito Pereira at PLMJ – which has close ties to Angola’s MG Advogados. Indeed, many note that Africa particularly is opening up to foreign investment, and with an obvious lack of internationally experienced local law firms it is a region in which both Portuguese and Spanish lawyers are reporting an upturn in client interest.

“We do see very significant opportunities to assist Spanish clients in Africa,” says Cliff Hendel at Araoz & Rueda. In the last year his firm has assisted clients with infrastructure projects in Algeria and Burkina Faso and advised the World Bank (IFC) in financing the expansion of Mixta Africa in the Magreb and Ethiopia.

In addition, lawyers also see an upturn in disputes and arbitrations involving African parties, including states – already familiar ground for many Portuguese firms, a number of which have long-established practices in Angola and Mozambique, and also track records in countries such as Cape Verde.

Portuguese law firms have extensive market knowledge of African issues, from a business, cultural and legal perspective, adds Manuel Barrocas. “These are still largely untapped markets with limited, in some cases no, representation by international law firms. Portuguese law firms have been operating, albeit through associated offices, in these markets for decades.”

Portuguese law firms have extensive market knowledge of African issues, from a business, cultural and legal perspective, adds Manuel Barrocas. “These are still largely untapped markets with limited, in some cases no, representation by international law firms. Portuguese law firms have been operating, albeit through associated offices, in these markets for decades.”

There remain mixed opinions however as to the ability of Spanish firms to assist Asian investors – hungry for investment opportunities and commodities – in either Africa or Latin America.

“It is not purely by being a Spanish firm that we will be able to give legal assistance to an Asian company in Africa or South America. You cannot forget that, for example, in Latin America there is more Asian presence than in Iberia,” says Diego Vargas, originally from Peru, at Maniega & Soler in Madrid.

“We do not foresee a very relevant role for Iberian law firms in assisting Asian investments in Africa and Latin America, unless these investors choose Iberia as their European headquarters for their operations,” agrees Ramón Ramos at Landwell.

Nonetheless Portuguese law firms are well-placed in the West and South of Africa, while Spanish firms are now present in Morroco and Ecuatorial Guinea. But even among experienced Portuguese lawyers, a belief persists that Iberian firms may still have only a limited role.

“Asian investors have normally a ‘political’ approach towards such opportunities and rely on local lawyers – who are often also politically integrated – for implementation,” says José Alves Pereira of Lisbon’s Alves Pereira & Teixeira De Sousa.

Some however clearly disagree. A strong driver behind Garrigues’ Shanghai office is as a point of reference for local Chinese businesses to engage with the firm’s African practice, and eight-strong Latin American Affinitas alliance, and to capitalise on its lawyers’ international experience.

Some however clearly disagree. A strong driver behind Garrigues’ Shanghai office is as a point of reference for local Chinese businesses to engage with the firm’s African practice, and eight-strong Latin American Affinitas alliance, and to capitalise on its lawyers’ international experience.

Preferred strategies

Looking ahead, Iberian law firms continue to see increasing international demand from clients and for them to react accordingly. “We definitely expect to increase our international coverage and relationships and therefore, our international business,” says Rafael Montejo, head of the International group at Legalia Abogados.

The events of the past year have not made firms change their plans but many nonetheless remain alive to the changing economic environment. “We expect to increase our international coverage, but who knows in the present context,” says Gabriel Nadal at Jausas.

Nonetheless, there remains a strong independent streak among Iberian firms. “We will follow our own route map, which basically consists of remaining independent, but being involved in the best cases and transactions, and strengthening cooperation with law firms which share our principles worldwide,” says David Arias at Pérez-Llorca.

Firms are clearly however alive to the issues that surround the need to manage client expectations and to be able to add value as they expand internationally. For some, this means opening their own offices – Cuatrecases has, for example, this past year opened in Morrocco and will soon open in Shanghai. “With the extent of our network we are now in a very comfortable position to service our clients as they go international,” says Diogo Perestrelo at Cuatrecasas – Goncalves Pereira Castelo Branco, in Lisbon.

For others nurturing closer best friend and referral alliances is the preferred option – Rodes & Sala, for example, has now aligned itself to London-based Nabarros’ European network – while others continue to prefer ad hoc arrangements, dependent on the deal type, client and jurisdictions involved.

“We would like organic but not compulsive growth, but a law firm cannot work focused only on its own preferences. International alliances and fest friend agreements bring true advantages, but you must bear in mind that you cannot put your client in the hands of a third party just because you are a member of an alliance or have signed a best friend agreement,” says Vargas at Maniega & Soler.

Such a perception is already evident among some of the major international law firms in Madrid. “Firms like ours clearly benefit from our networks and ability to advise on US and UK law, but increasingly we are seeing our domestic Spanish clients look to us for transactional management skills, even on deals in places in which we do not operate locally,” says Miguel Klingenberg at Freshfields.

Such a perception is already evident among some of the major international law firms in Madrid. “Firms like ours clearly benefit from our networks and ability to advise on US and UK law, but increasingly we are seeing our domestic Spanish clients look to us for transactional management skills, even on deals in places in which we do not operate locally,” says Miguel Klingenberg at Freshfields.

Even in the face of the prevailing international economic difficulties firms must nonetheless remain true to their strategies, believes José M. Balañá, managing partner of Lovells in Madrid. “Opening new offices is part of a long term strategy which is not affected by short term developments.”

A number of firms express the sentiment that they could perhaps have been bolder earlier in the international ambitions.

“I wish we had opened in London before last year,” says Manuel Martín, managing partner of Gómez-Acebo & Pombo. “We have been pleasantly surprised with the impact that our presence has had, and not only in terms of networking but also in producing interesting work.” A tactical delay is not something he is likely therefore to repeat. “With regards to Portugal we can confirm that we are aiming to open an office before the end of the year.”

How firms go about managing their international strategy will of course depend on their ambitions and client base, but the desire to continue to expand and to prepare for emerging client demand remains evident among many.

“If the economic events of the past year have shown us anything it is that for every crisis, there is an opportunity,” says Miguel Teixeira de Abreu, managing partner of Abreu Advogados. João Espanha at Espanha e Associados in Lisbon agrees: “We continue to bet a lot on our international development – we move counter-cyclical, and believe that now is the time to move up, not down.”

There is clearly however no single correct way to manage international clients’ needs.

“We have realised that to better service our clients and to attract new ones, mainly international clients, we must increase beyond Iberia, and with our own methods and means, by opening our own offices in foreign countries,” says Raposo at Raposo Bernardo.

Others are evidently keen to take more of a mixed approach. “Our preferred strategy is to open our own offices following our clients’ needs, but depending on markets’ maturity, we will continue to use other methods, such as the firm’s Latin American Affinitas alliance,” says Collado at Garrigues.

His firm has previously stated its intention to compete equally opposite the dominant global UK and US law firms. Over the past year Garrigues has opened in Warsaw and more recently in Bucharest, and is looking to new markets such as Bulgaria.

![]() Equally flexible is Uría Menéndez, which through its best friend’s network continues to play a prominent role in the expansion plans of many of Iberia’s largest companies – most recently working alongside Slaughter and May in Santander’s UK Alliance & Leicester acquisition, and British Airways bid for Iberia (which had previously used Clifford Chance globally).

Equally flexible is Uría Menéndez, which through its best friend’s network continues to play a prominent role in the expansion plans of many of Iberia’s largest companies – most recently working alongside Slaughter and May in Santander’s UK Alliance & Leicester acquisition, and British Airways bid for Iberia (which had previously used Clifford Chance globally).

“Our international strategy is designed to assist our clients beyond the Iberian Peninsula, by the most appropriate means for each client and each transaction. Thus, we combine a number of strategies to provide what we believe is the best service for international deals,” says Folguera.

{mosimage}For Iberian law firms becoming increasingly used to operating on an international stage it matters little where clients go, what is clearly important is that they have the correct arrangements in place to help them to do so. Some may be following their clients, but some are also now following their clients’ strategies – expanding their operations in order to expand their revenue base and to hedge against any potential local economic downturns.