Tax annual report 2016: Lost in translation

Moves to tackle tax avoidance schemes around the world are gathering pace, but the discrepancy between the measures implemented in different jurisdictions is creating a minefield for clients

“In an increasingly interconnected world, national tax laws have not always kept pace with global corporations, fluid movement of capital, and the rise of the digital economy, leaving gaps and mismatches that can be exploited to generate double non-taxation – this undermines the fairness and integrity of tax systems.” This is the global tax scenario as described by the Organisation for Economic Co-operation and Development (OECD), and it was in an effort to tackle this problem that it launched the base erosion and profit shifting (BEPS) initiative. Though lawyers say progress has been made on BEPS in the past year, the issue is that not all countries are adopting the same level of urgency when implementing its requirements. The only conclusion that can be drawn is that “ensuring the fairness and integrity of tax systems” is not every nation’s top priority.

Lawyers say that BEPS reinforces the need to have strong litigation practices as well as good international networks. This creates a number of significant challenges for law firms, not least of which is trying to ensure their clients receive the same standard of service in all the jurisdictions they operate. Meanwhile, a new role for lawyers is being envisaged – that of intermediary between clients and the tax authorities. With a lack of trust existing between the two parties, some see tax lawyers as having a vital role in bringing both sides together.

How serious is the US?

How serious is the US?

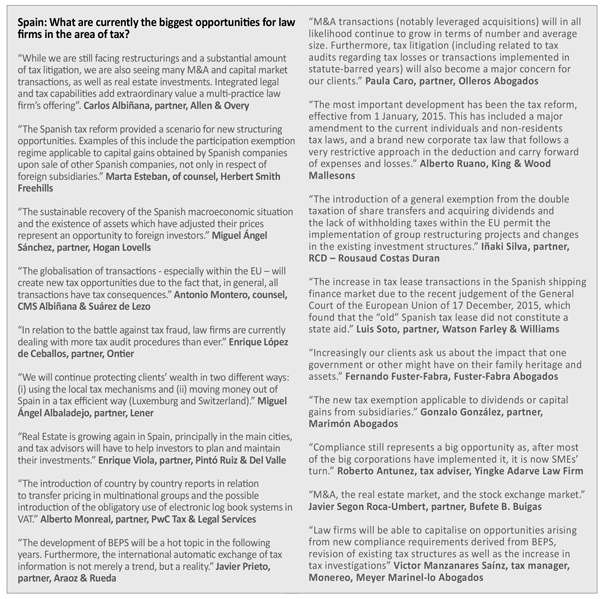

Further progress in relation to BEPS has been one of the key themes of the year, according to Freshfields Bruckhaus Deringer partner Silvia Paternain. BEPS aims to tackle company tax avoidance schemes by harmonising tax systems at an international level. “The global economy needs global rules,” says Paternain. “However, there are doubts about whether the US is serious about this – governments have agreed rules, but it now has to be implemented,” she adds. “Some countries are going to implement tough rules, but others may implement it on a ‘soft’ basis – something the European Union wants to deal with through a directive, to set a fair playing field.” Paternain believes that BEPS applies to all industry sectors in the same way, so “for some clients, it [BEPS] is huge”. Meanwhile, Paternain points out that, despite progress being made on BEPS, the UK government has stated its intention to remain committed to being the most competitive of the G20 countries from a tax perspective.

A big issue is the differing speeds at which countries are implementing BEPS, according to BDO tax director Eugenio García. “Some countries are keen to implement BEPS’ recommendations to tackle tax fraud and evasion, but not all countries will implement all recommendations or may not implement them at the same speed,” he adds. Deloitte partner Francisco Martín Barrios says it is uncertain how BEPS will affect competiveness at an international level.

BEPS is the result of a social change, specifically views on “what’s fair to pay”, according to Uría Menéndez partner Rafael Fuster. “This will have a big impact on large companies and how they manage their reputation – tax advice is now less technical and more about the impact it will have on the reputation of a business,” he adds. “Tax is now a matter for the board to analyse rather than just the tax director and this has had an impact on the way companies interact with their tax advisers.” Fuster adds that tax decisions made by companies are not only driven by tax efficiency and, consequently, “tax advising is less about planning and more about risk assessment and judgement”.

Pérez-Llorca partner Javier Fernández Cuenca says that it remains to be seen how the international community forces countries to adapt to the requirements of BEPS. He adds: “The level of responsibility is spreading; we will hopefully go to a world where tax is paid where it should be paid.” Aggressive tax planning is over, says Javier Vinuesa, partner at Gómez-Acebo & Pombo. “Big corporations are very cautious about it,” he continues. Vinuesa explains that corporations now know that if their tax arrangements are unpopular with the public, it could have a big impact on their revenue. Juan Alberto Urrengoechea, partner at Roca Junyent, agrees that the market is “facing the end of aggressive tax planning”.

Suspicious minds

Tax lawyers have traditionally been technical in their approach, but now they also have to act as risk managers, according to Cuatrecasas, Gonçalves Pereira partner Andrés Sánchez. BEPS has led to a change in mentality argues Linklaters’ Javier García-Pita: “It’s made some people overreact and has created a disproportionate atmosphere of suspicion – in big companies, directors now have to take charge of the policy.” He adds that the new corporate income tax law in Spain, as well as the country’s new general tax law, have also been significant developments in the last year.

Highlighting the effects of these new laws, Enrique Viola, partner at Pintó Ruiz & Del Valle says the new corporate income tax law has meant companies have had to conduct a review of their tax policies, while the general tax law has impacted on the tax planning on a significant proportion of tax payers.

The BEPS process will have a “structural impact”, according to Baker & McKenzie partner Rodrigo Ogea. “Clients are less interested in the short term, they are looking for strategic advice because that’s where they need more guidance,” he adds. “The rewards for short term planning are not that attractive.” Ogea says the UK is a very attractive proposition for companies and cites the example of Iberdrola’s decision to redirect investment away from Spain to the UK. However, he adds that there are also opportunities for Spain. Ogea continues: “Spain won’t compete on tax efficiency, but has competitive advantages for attracting the hospitality, leisure and logistics industries.”

Vinuesa says, in the future, “reputable tax advisers” will be financial intermediaries between the tax authorities and clients. “However, in order to achieve this, the relationship and the modus operandi of the Spanish tax authorities should change – some progress has been made, but more needs to be done,” he adds. Clifford Chance counsel Roberto Grau says that there is now a broad trend of ‘anti-abuse’ regulations. “We now have something in writing to show to the client,” he adds. “We now face the existence of more explicit tax principles and clients want to know how this will affect their business.” Fuster says BEPS reinforces the need for international networks and strong litigation practices: “Clients place a lot of value on litigation and BEPS will offer a lot of litigation opportunities.”

Paternain says that, in the international arena, the same principles will apply whether the client is Spanish, French, or from the US, for example, so tax lawyers will need to have an international mindset. “The value will be guiding clients at an international level and helping the board to set the tax policies,” she adds. “Clients have to understand that if you use certain tax advantages, they may be considered state aid – tax departments used to be partners to corporate and finance departments, but they now need to overlap with competition and litigation departments.”

The origin of BEPS is the digital economy, says García. There are a lot of opportunities for tax lawyers in relation to the “new businesses that will appear because of the transformation of the traditional business landscape into a digital environment”, he adds. “New operations are emerging in a fast moving environment – on the one hand, their tax treatment is wholly or partly not regulated, on the other hand, we have to change the way we work.”

Fernández Cuenca argues that there are not simply tax rules now as there is the risk that “someone will say that the use of the legally established limits is wrong, our role [as lawyers] is to bring common sense”.

Building trust

Building trust

There is considerable public scrutiny of how banks and large companies in Spain handle their tax affairs, Paternain says. “There is a perception that large companies and banks only pay five per cent tax, but it’s not true as they also pay taxes in other jurisdictions. The private sector has to stop being so defensive and stand up for itself. The public think Spanish companies have been abusive from a tax point of view, but the average tax rate paid by Spanish companies is quite high in international terms.”

García-Pita says there is now a feeling that “everyone is a tax evader unless they prove otherwise” when it comes to tax. “But the rules are in substance very similar, so we should still do the appropriate things that were done in the past, though we should be cautious about the new atmosphere,” he adds. Ogea says that when “pitching for strategic advice, it’s all about building trust”.

Now is a good time to be an outstanding tax lawyer, according to Fuster. “It’s a more dangerous profession and it’s easier than ever to make mistakes – I tell young lawyers never write anything that you wouldn’t want to see on the front page of El Mundo.” García says there is major competition in the Spanish legal market, but there is a “slow move” to increase fees. Martín Barrios says that on some occasions, legal fees are included in the budget for a project so there is a greater “ability to charge fees aligned with the real value provided to the client”. Strategic advice leads to “higher profitability” in terms of fees, according to Vinuesa.

Tax-related litigation will increase significantly, according to Fernández Cuenca. But he adds that clients want law firms to share the risk in such litigation in terms of whether it will be successful. Sánchez says there is a tension between sophisticated tax work and compliance work, for example. He adds: “Do firms want to be involved in transfer-pricing, for example? For this, you need a different type of experience or you need people to learn fast.”

Martín Barrios argues that there is now a greater need for tax lawyers to have partners in other jurisdictions where clients are doing business. He adds that this means law firms are under pressure to provide the same quality of service in all the jurisdictions in which their clients operate, but “you have to help clients to understand that depending on the jurisdictions involved, it could be challenging to provide the same level of quality in all those jurisdictions”.

Young tax lawyers have to create their own space in the market, according to Fuster. “Young lawyers have to get involved on the commercial side in order to see their careers flourish,” he adds. Urrengoechea says the outlook for young tax lawyers is promising: “There is a good relationship between market growth and professional careers and clients now require more [from tax lawyers].”

Don’t make mistakes

Don’t make mistakes

There will be opportunities for tax lawyers in a range of areas in the coming year, according to Martín Barrios. “There is BEPS, transfer-pricing, tax controversy, digitalisation, technology – there is an opportunity for law firms to leverage technology to expand their tax practices.” García says tax lawyers will need protection from liability claims: “There is no space for error – in specific cases, such as, for example, a delay in the provision of information in tax audits, tax authorities will start looking at who is liable, the client or the lawyer.” He adds that law firms also face the challenge of being more efficient and retaining talent.

The spread of liability to boards of directors means tax lawyers are getting more access to clients, according to Fernández Cuenca. “Tax lawyers play a more significant role in the life of clients,” he adds. Meanwhile, one partner says lawyers should collaborate more with the tax inspector as there is a “lack of trust.” Corporate governance will also present a big opportunity, according to Vinuesa. He continues. “We have to be global and we can be without having a network – we also have the opportunity to transform ourselves into fiscal intermediaries.”

Corporate governance for tax affairs will also present a big opportunity, according to Vinuesa. “The tax issues companies face are no longer local but rather global and therefore you need to have a comprehensive and global knowledge to advise your clients – we also have the opportunity to transform ourselves into fiscal intermediaries.”

Urrengoechea says BEPS is a big opportunity for tax lawyers, but he adds that the challenge is to maintain profitability. “Firms will have to adapt their internal structures,” he adds. Private clients could also potentially be a significant source of work, according to Fuster. Meanwhile, the review and assessment of tax policies will generate a lot of work for lawyers, according to Grau. “We need to know more than ever what our clients do.”

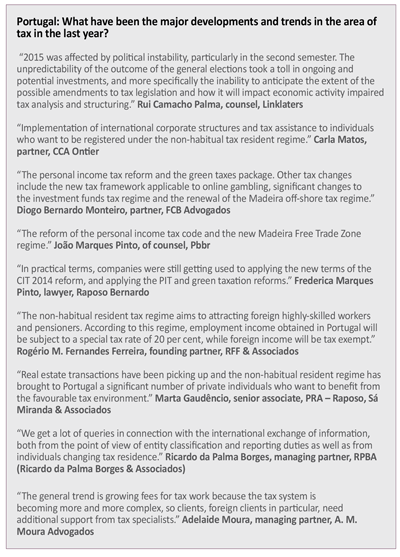

Portugal: Fighting tax avoidance

There were three key tax-related developments in Portugal during the last 12 months, according to MLGTS partner Francisco de Sousa da Câmara. “Firstly, there was the continuing consolidation of the corporate income tax reform, with the reduction of the corporate income tax rate to 21 per cent, which has created a more conducive environment for businesses,” he says. “Secondly, the changes introduced to the regime for investment funds, which make investment much more attractive – under the new regime, most of the income obtained by funds is exempt from corporate income tax (CIT) and non-resident investors may be exempt from Portuguese taxation in certain circumstances, or subject to low taxation.” The third major development, according to Sousa da Câmara, was the personal income tax reform, which has had a significant impact on both residents and non-residents.

Tax authorities have stepped up the fight against tax avoidance and tax assessments have aimed to “maximise collection”, which have led to significant levels of litigation, according to Sousa da Câmara. Meanwhile, the release of the final reports regarding 15 focus areas for BEPS was a key development in the last year, according to Vieira de Almeida partner Tiago Marreiros Moreira. He adds that, in general, tax has risen up the government agenda due to the “increasing burden on taxpayers”.

The biggest opportunities for tax lawyers, according to Marreiros Moreira, relate to the structuring of M&A transactions involving private equity firms and venture capital funds. In addition, he says tax planning related to real estate investments and major tax litigation and arbitrage cases will also generate considerable work for law firms. He continues: “There are also interesting opportunities in private wealth management and estate planning legal work for high-net-worth individuals.”

The considerable increase in the volume of tax litigation is one of the key trends identified by PLMJ partner João Magalhães Ramalho. However, he also identifies two key challenges facing law firms – firstly, maintaining the level of activity in relation to clients in Angola and Mozambique, two countries that are suffering due to the oil crisis and political instability, and secondly, staying ahead of the competition, in particular the major audit firms.

The trends evident in 2015 should continue in 2016, particularly the high demand for tax advice in relation to new investment opportunities in Portugal, according to Cuatrecasas, Gonçalves Pereira partner Diogo Ortigão Ramos. He adds: “An increase of both domestic and foreign investment is expected, calling for legal advice in particular regarding corporate and tax law.” In relation to personal income tax, Ortigão Ramos says the expectation is the “favourable non-habitual resident tax regime will continue to attract high-net-worth individuals”, which will lead to an increase in demand for estate planning, inheritance and family law advice. “In this regard, the ongoing public debate on the possible amendment of the stamp duty code regarding inheritances is also likely to give rise to demand from Portuguese families,” he adds.

Safe harbour

Abreu Advogados partner Pedro Pais de Almeida says Portugal is being considered as a safe harbour – with regard to individual income tax purposes – for high-net- worth individuals who decide to move their tax residency here under the non-habitual tax regime. He adds: “These high-net-worth individuals will be exempted in Portugal for their foreign source income – provided that some conditions are met – and their Portuguese-sourced income will be subject to a flat rate tax.” Pais de Almeida continues: “IRS value-added activities in Portugal shall be taxed at a 20 per cent rate and other types of income at a 28 per cent tax rate (that is, dividends, interest, capital gains from the sale of shares and rental income).”

According to Tiago Caiado Guerreiro, partner at Caiado Guerreiro, one of the biggest challenges law firms face in this area is the “interaction of different tax jurisdictions”. He adds: “Law firms experience challenges arising from the interpretation of different national tax rules that are simultaneously applicable to the same situation – indeed, the existence of double taxation agreements between countries contributes in theory to a clearer assessment, but in practice to complicated situations.”

Advising clients on how to adapt new international tax measures – such as the common reporting standards (CRS) and BEPS will be among the biggest challenges facing tax lawyers, according to Uría Menéndez-Proença de Carvalho partner Marta Pontes. She continues: “From a business perspective, considering how cost-sensitive clients have become in the recent years, one of the main challenges for law firms will be to keep rendering high quality services for competitive prices.”

The Portuguese real estate market has become increasingly attractive to foreign investors in 2015 and it currently represents one of the biggest opportunities for law firms, according to Linklaters counsel Rui Camacho Palma. “Additionally, the continuous need of both banks and corporates alike to clean their balance sheets will continue to drive M&A and assets deals in the years to come,” he adds.

However, Camacho Palma adds that one of the biggest challenges that the Portuguese market faces is “ensuring consistency between international and domestic tax advice”. In addition, multidisciplinary practices (MDPs) are expected to raise the level of competition in the Portuguese market. Camacho Palma concludes: “The ongoing discussion around the multidisciplinary firms, which are now increasingly accommodated in the Portuguese legal system, as well as possibility of certified accountants representing clients in administrative and judicial proceedings to a certain extent, may represent a relevant challenge in the near future.”