Linklaters guides Piscine´s €300m placement of Fluidra´s shares

Linklaters has advised Piscine Luxembourg Holdings, a fund controlled by Rhone Capital, on €300 million block trade sale of shares of Fluidra

Piscine Luxembourg Holdings, a fund controlled by Rhone Capital, decided to increase the placement of Spanish private limited company Fluidra’s shares to 9.6 million from 8.1 million shares (to 4.91% from 4.14% of its share capital). BofA Securities Europe SA has announced to the Spanish Securities Market Commission that once the accelerated bookbuild process directed to qualified investors conducted by BNP PARIBAS, BofA Securities Europe SA and Joh. Berenberg, Gossler & Co. KG (Joint Bookrunners) has been completed, the final terms of the placement have been determined. AZ Capital and STJ Advisors have acted as financial advisors to the seller (Piscine Luxembourg Holdings 1 S.à r.l.).

The number of Shares placed in the placement amounts to 9.6 million representing approximately 4.91% of the company’s share capital. The placement has amounted to a total of approximately €300.48 million, with the selling price being €31.30 per share.The company has repurchased 1,800,000 shares in the placement at the referred selling price per share.

Further to the completion of the placement, Piscine Luxembourg Holdings holds 32,428,788 ordinary shares of the company, representing approximately 16.58% of its issued share capital.

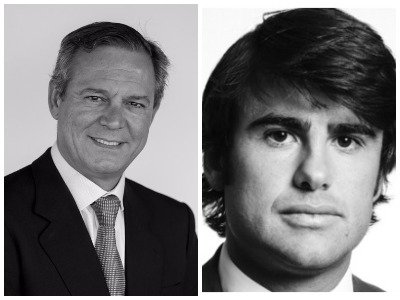

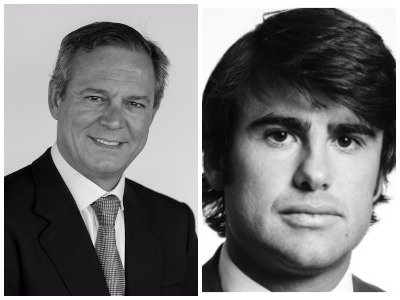

Linklaters´ team was led by partner Alejandro Ortiz (pictured left) and counsel Pablo Medina (pictured right).